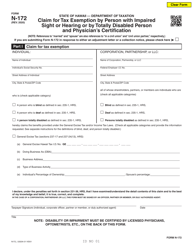

This version of the form is not currently in use and is provided for reference only. Download this version of

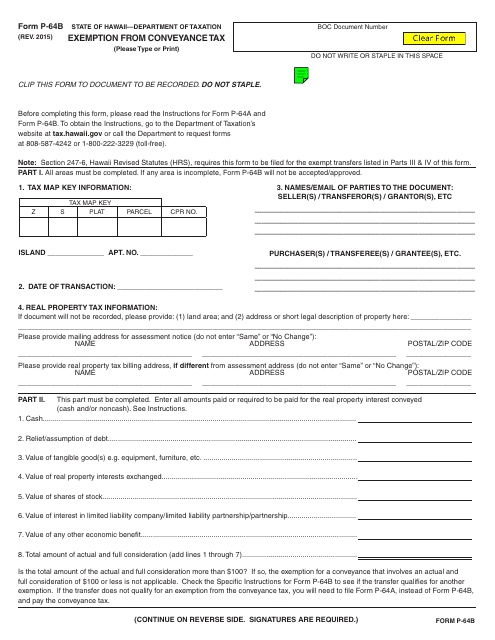

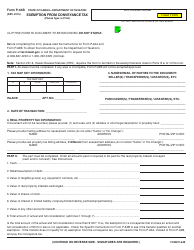

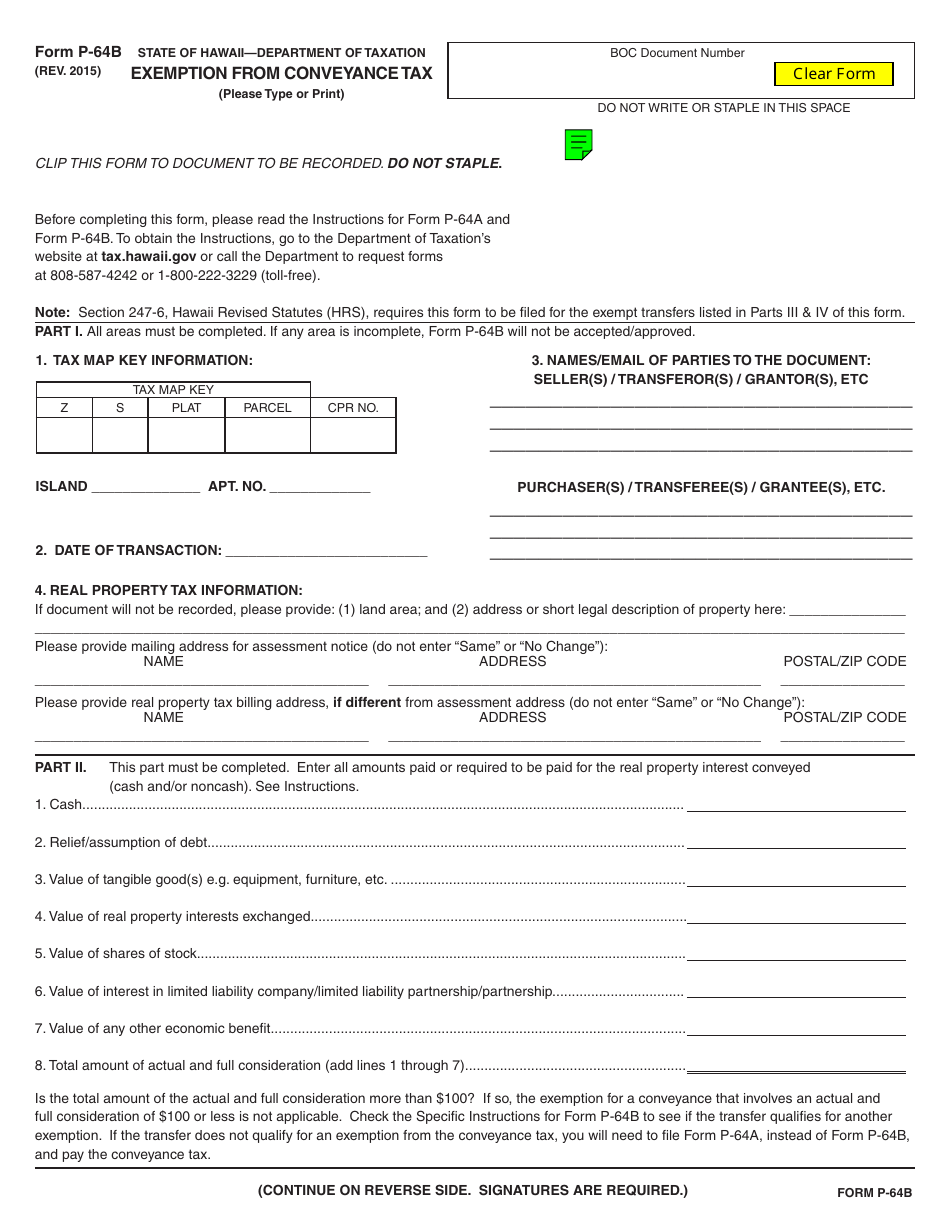

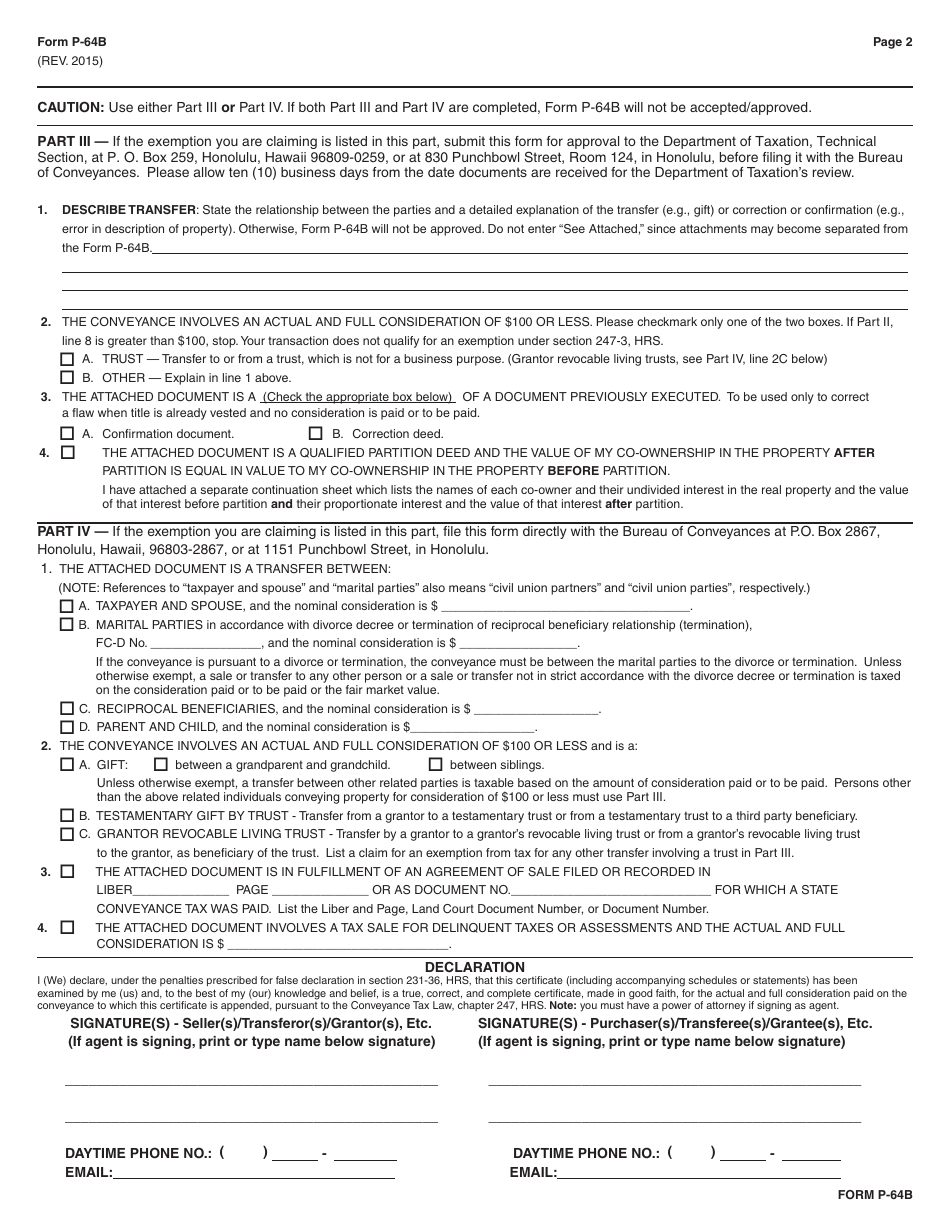

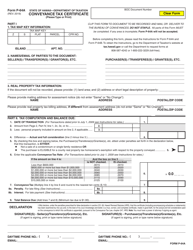

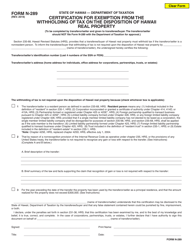

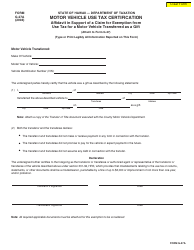

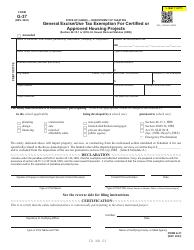

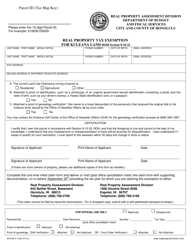

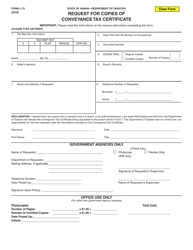

Form P-64B

for the current year.

Form P-64B Exemption From Conveyance Tax - Hawaii

What Is Form P-64B?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form P-64B?

A: Form P-64B is the form used to request exemption from conveyance tax in Hawaii.

Q: What is conveyance tax?

A: Conveyance tax is a tax imposed on the transfer of real property in Hawaii.

Q: Who is eligible for exemption from conveyance tax?

A: Certain types of transfers, such as transfers between spouses, parent and child, grandparent and grandchild, and transfers to or from non-profit organizations, may be exempt from conveyance tax.

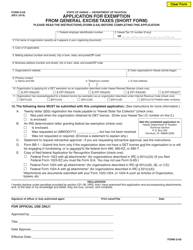

Q: How do I apply for exemption from conveyance tax?

A: To apply for exemption from conveyance tax, you need to complete and submit Form P-64B to the Hawaii Department of Taxation.

Q: Is there a deadline for submitting Form P-64B?

A: Yes, Form P-64B must be submitted within 30 days from the date of the conveyance.

Q: Are there any fees associated with applying for exemption from conveyance tax?

A: There is no fee for submitting Form P-64B.

Q: How long does it take to process a request for exemption from conveyance tax?

A: The processing time for a request for exemption from conveyance tax varies, but it typically takes several weeks.

Q: What happens if my request for exemption from conveyance tax is approved?

A: If your request for exemption from conveyance tax is approved, you will not have to pay conveyance tax on the transfer of the property.

Q: What happens if my request for exemption from conveyance tax is denied?

A: If your request for exemption from conveyance tax is denied, you may be required to pay conveyance tax on the transfer of the property.

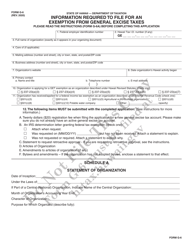

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form P-64B by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.