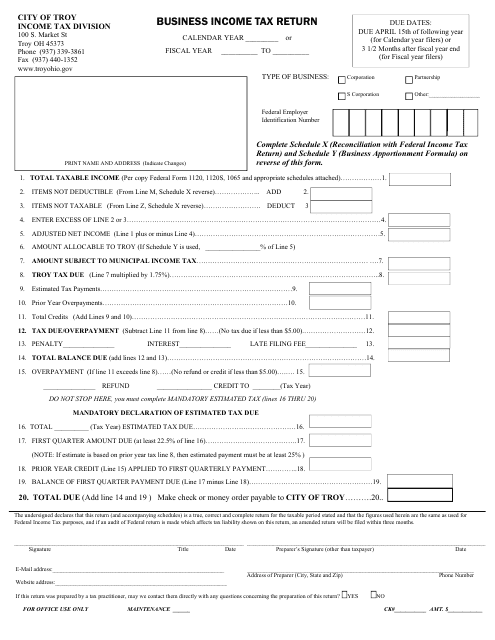

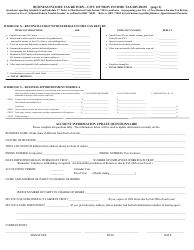

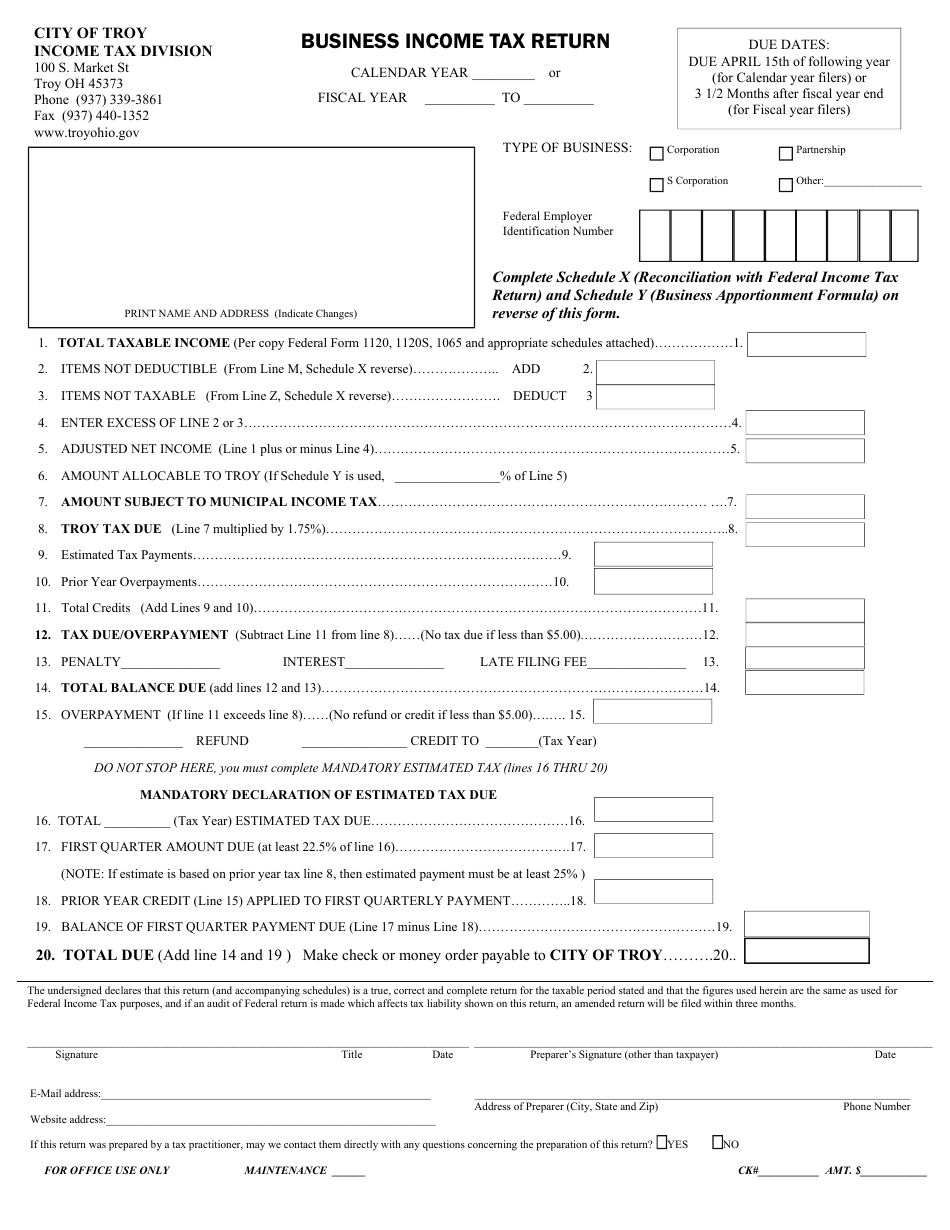

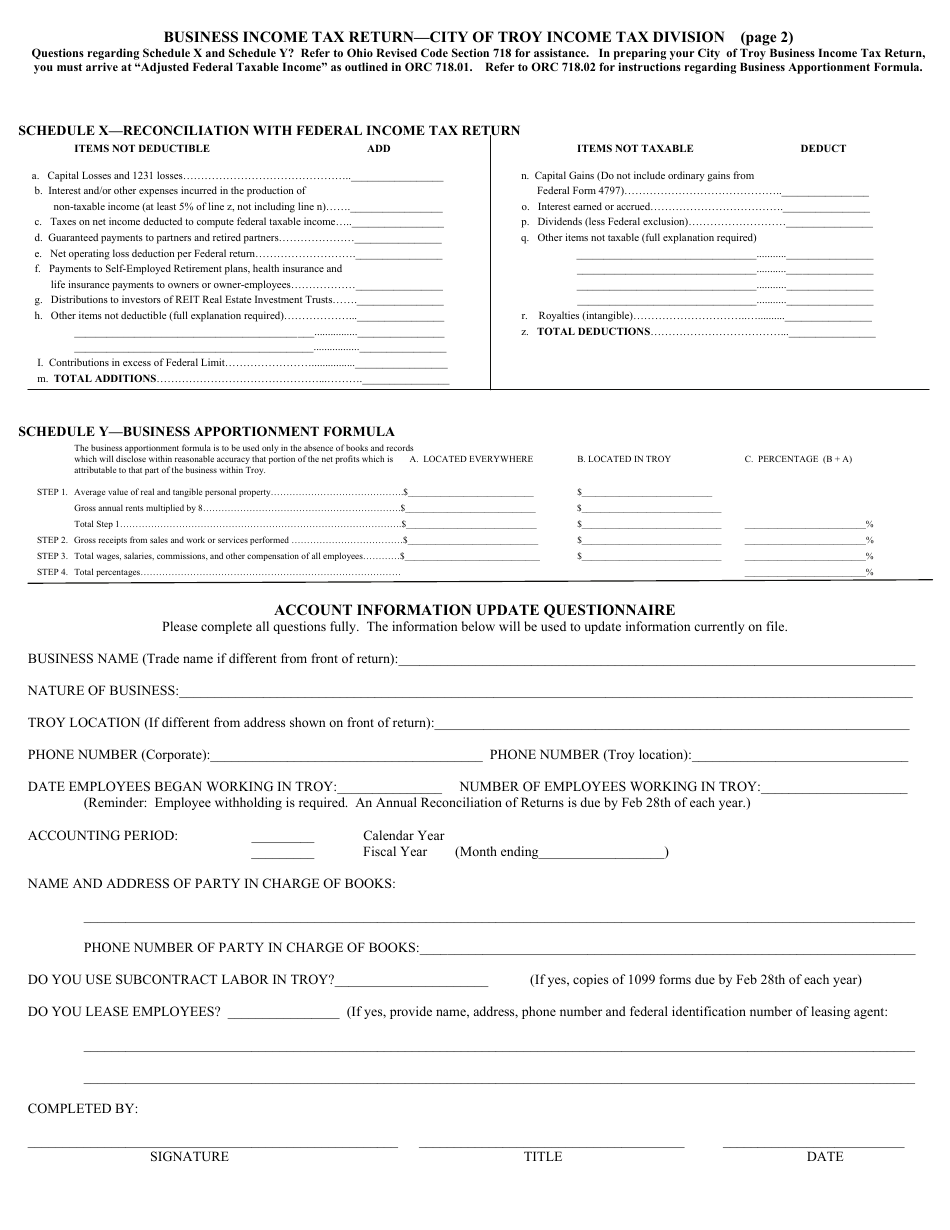

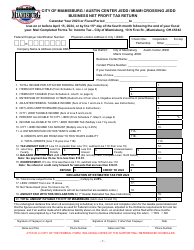

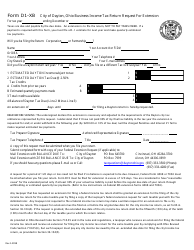

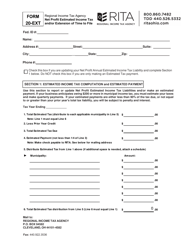

Business Income Tax Return - City of Troy, Ohio

Business Income Tax Return is a legal document that was released by the Income Tax Division - City of Troy, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Troy.

FAQ

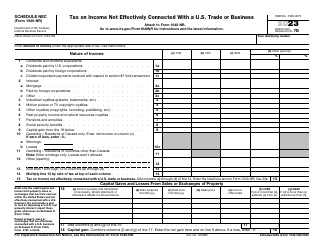

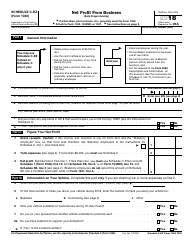

Q: What is a Business Income Tax Return?

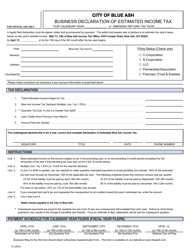

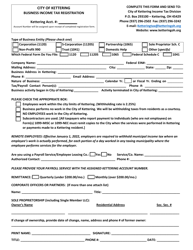

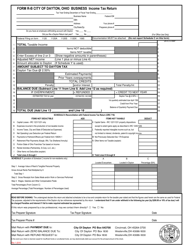

A: A Business Income Tax Return is a form that businesses in the City of Troy, Ohio must file to report their income and calculate the amount of tax they owe to the city.

Q: Who needs to file a Business Income Tax Return in Troy, Ohio?

A: Any business that operates within the City of Troy, Ohio, whether it is a sole proprietorship, partnership, limited liability company (LLC), or corporation, may be required to file a Business Income Tax Return.

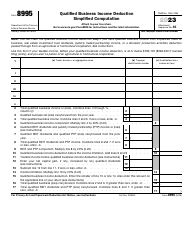

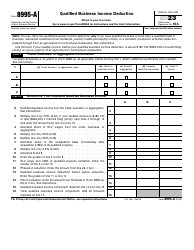

Q: What information is required to complete a Business Income Tax Return in Troy, Ohio?

A: The specific information required can vary depending on the type of business, but generally you will need to provide details about your business income, expenses, deductions, and any credits you may be eligible for.

Q: When is the deadline for filing a Business Income Tax Return in Troy, Ohio?

A: The deadline for filing a Business Income Tax Return in Troy, Ohio is typically April 15th of the following calendar year, unless an extension has been granted.

Q: How do I file a Business Income Tax Return in Troy, Ohio?

A: You can file a Business Income Tax Return in Troy, Ohio by completing the necessary forms and submitting them to the City of Troy Income Tax Department either by mail or electronically.

Q: Are there any penalties for late or non-filing of a Business Income Tax Return in Troy, Ohio?

A: Yes, there are penalties for late or non-filing of a Business Income Tax Return in Troy, Ohio. The exact penalties can vary depending on the amount of tax owed and the length of the delay, but they can include monetary fines and interest charges.

Q: Are there any deductions or credits available for businesses filing a Business Income Tax Return in Troy, Ohio?

A: Yes, there may be deductions and credits available for businesses filing a Business Income Tax Return in Troy, Ohio. Some common deductions and credits include business expenses, employee wages, and credits for investments in certain areas.

Form Details:

- The latest edition currently provided by the Income Tax Division - City of Troy, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Income Tax Division - City of Troy, Ohio.