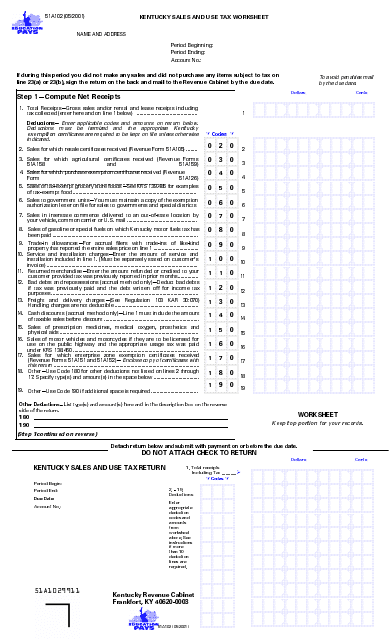

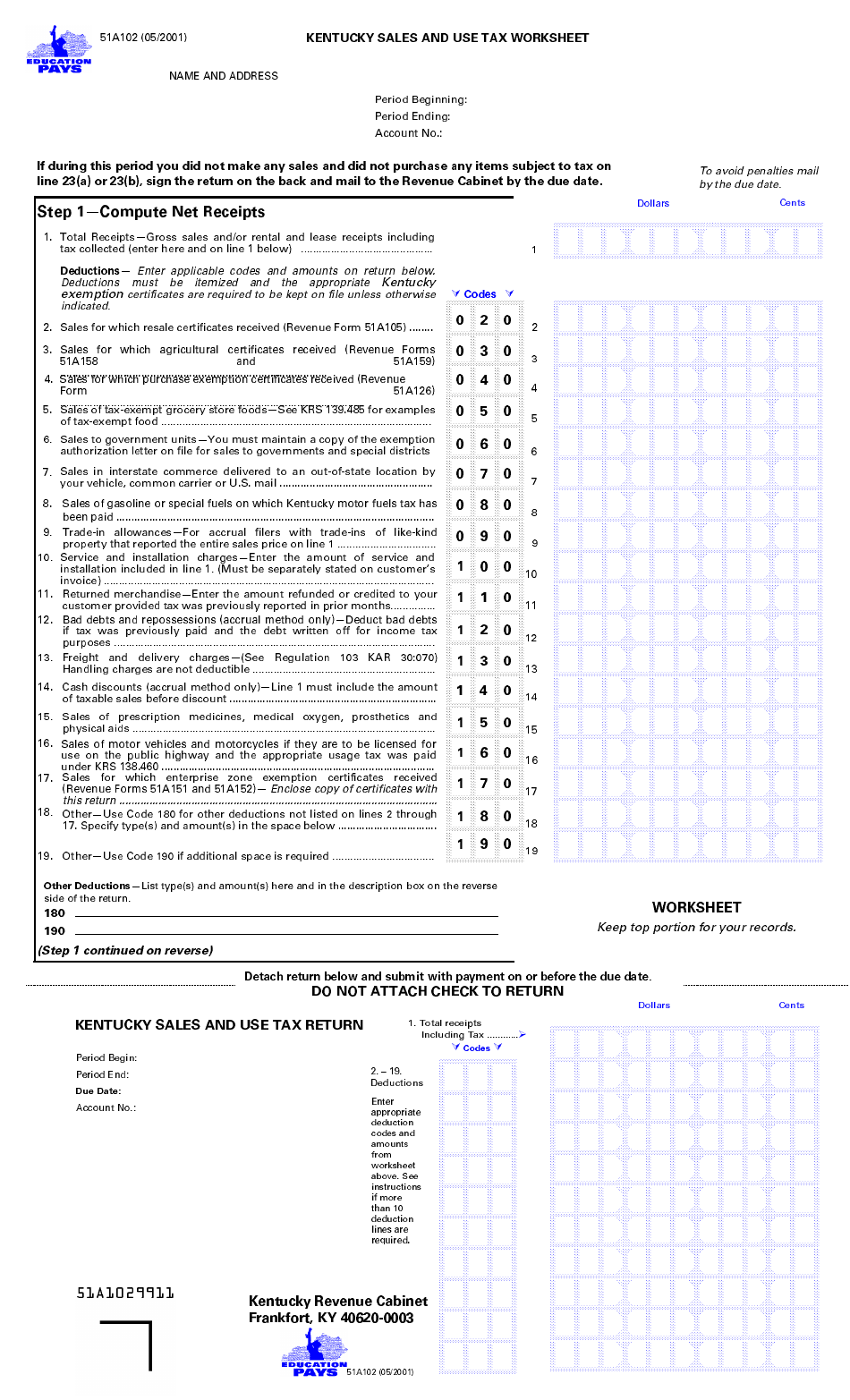

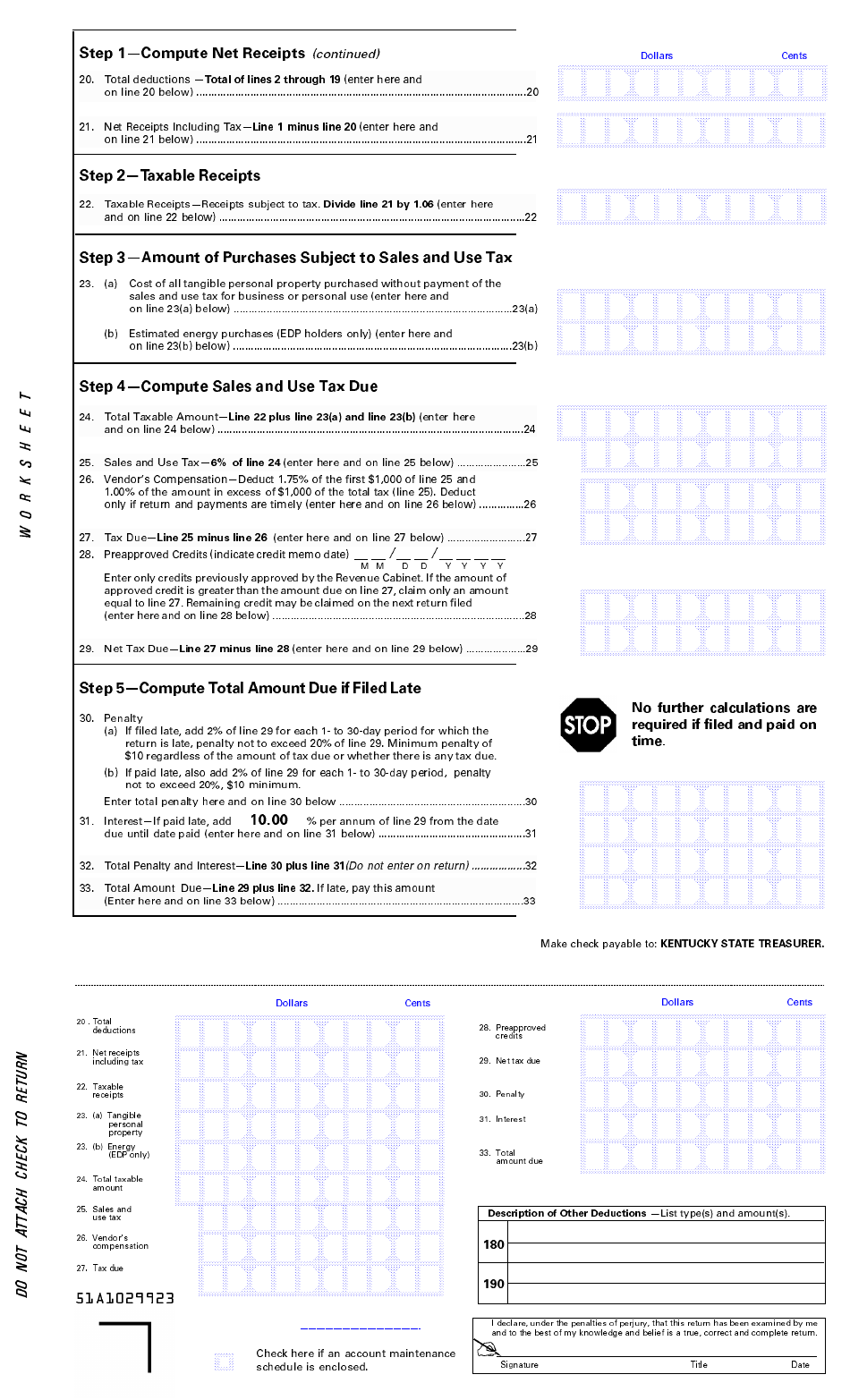

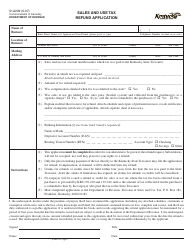

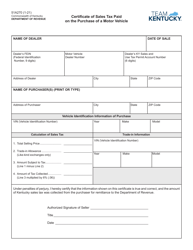

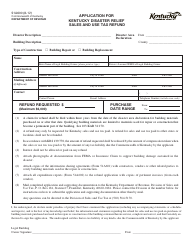

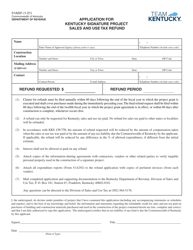

Form 51A102 Sales and Use Tax Worksheet - Kentucky

What Is Form 51A102?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51A102?

A: Form 51A102 is the Sales and Use Tax Worksheet used in Kentucky.

Q: What is the purpose of Form 51A102?

A: Form 51A102 is used to calculate the amount of sales and use tax due in Kentucky.

Q: Who needs to file Form 51A102?

A: Individuals and businesses that are required to pay sales and use tax in Kentucky need to file Form 51A102.

Q: How often do you need to file Form 51A102?

A: Form 51A102 is typically filed on a monthly basis, although some businesses may be required to file on a quarterly basis.

Q: What information do I need to complete Form 51A102?

A: You will need to provide information about your sales and purchases, as well as any exemptions or deductions that apply.

Q: What happens if I don't file Form 51A102?

A: Failure to file Form 51A102 or pay the required sales and use tax can result in penalties and interest charges.

Form Details:

- Released on May 1, 2001;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A102 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.