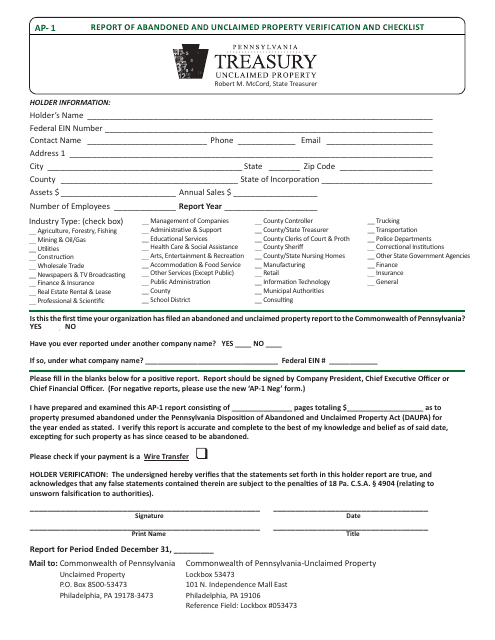

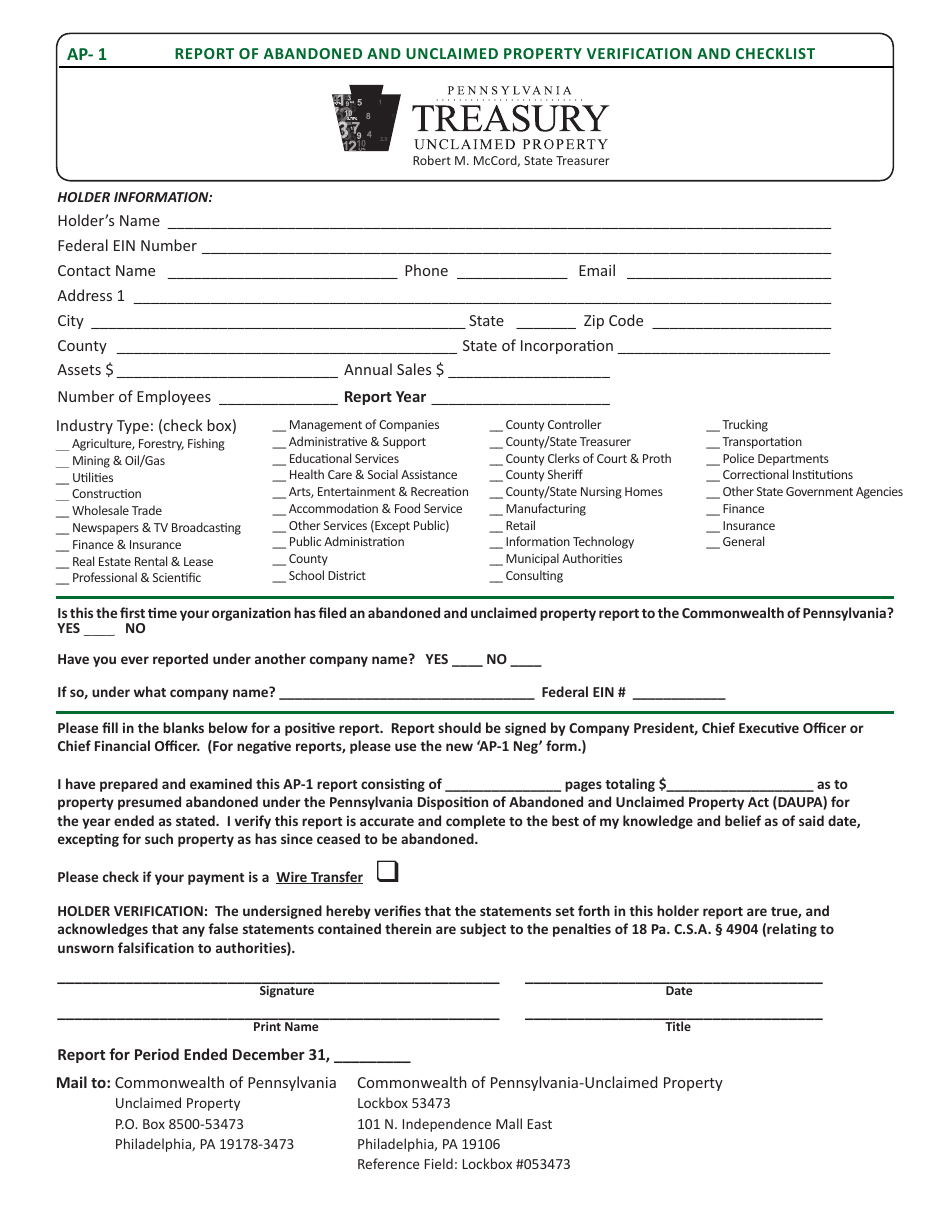

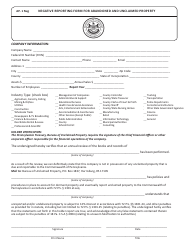

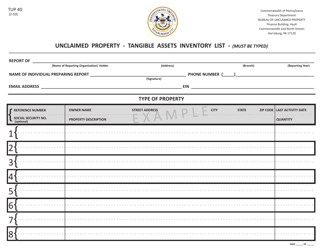

Form AP-1 Report of Abandoned and Unclaimed Property - Verification and Checklist - Pennsylvania

What Is Form AP-1?

This is a legal form that was released by the Pennsylvania Treasury - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AP-1?

A: Form AP-1 is a report used in Pennsylvania to report abandoned and unclaimed property.

Q: Who needs to file Form AP-1?

A: Any holder of abandoned or unclaimed property in Pennsylvania needs to file Form AP-1.

Q: What is considered abandoned or unclaimed property?

A: Abandoned or unclaimed property refers to assets that have been left unclaimed by their owners for a certain period of time.

Q: What information is required on Form AP-1?

A: Form AP-1 requires information such as the property owner's name, last known address, and a description of the property.

Q: When is Form AP-1 due?

A: Form AP-1 is due on or before April 15th of each year.

Q: Is there a filing fee for Form AP-1?

A: No, there is no filing fee for Form AP-1 in Pennsylvania.

Q: What happens if I don't file Form AP-1?

A: Failure to file Form AP-1 can result in penalties and interest charges.

Q: Can I file Form AP-1 electronically?

A: Yes, Pennsylvania allows electronic filing of Form AP-1.

Q: Are there any exemptions to filing Form AP-1?

A: Yes, certain types of property and entities may be exempt from filing Form AP-1. It is best to consult the Pennsylvania Treasury Department for specific exemptions.

Form Details:

- The latest edition provided by the Pennsylvania Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AP-1 by clicking the link below or browse more documents and templates provided by the Pennsylvania Treasury.