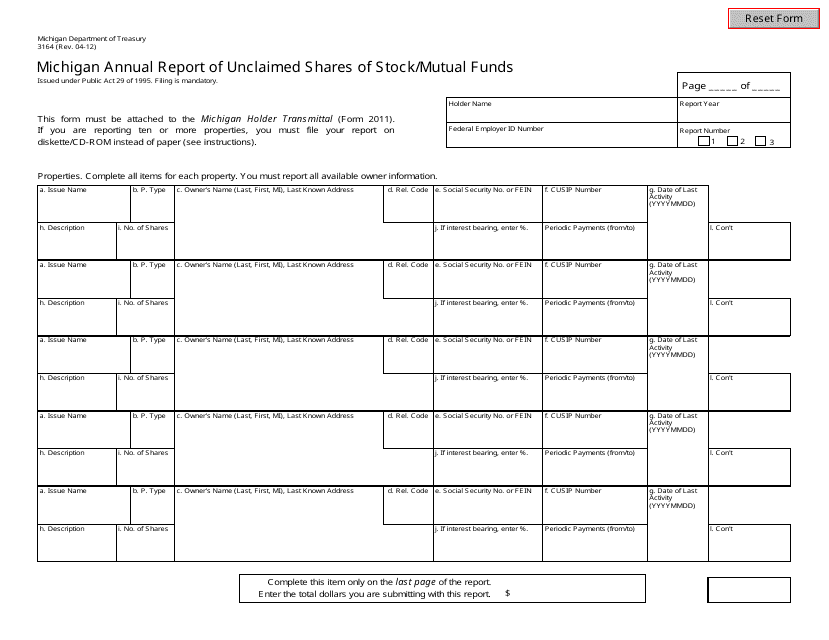

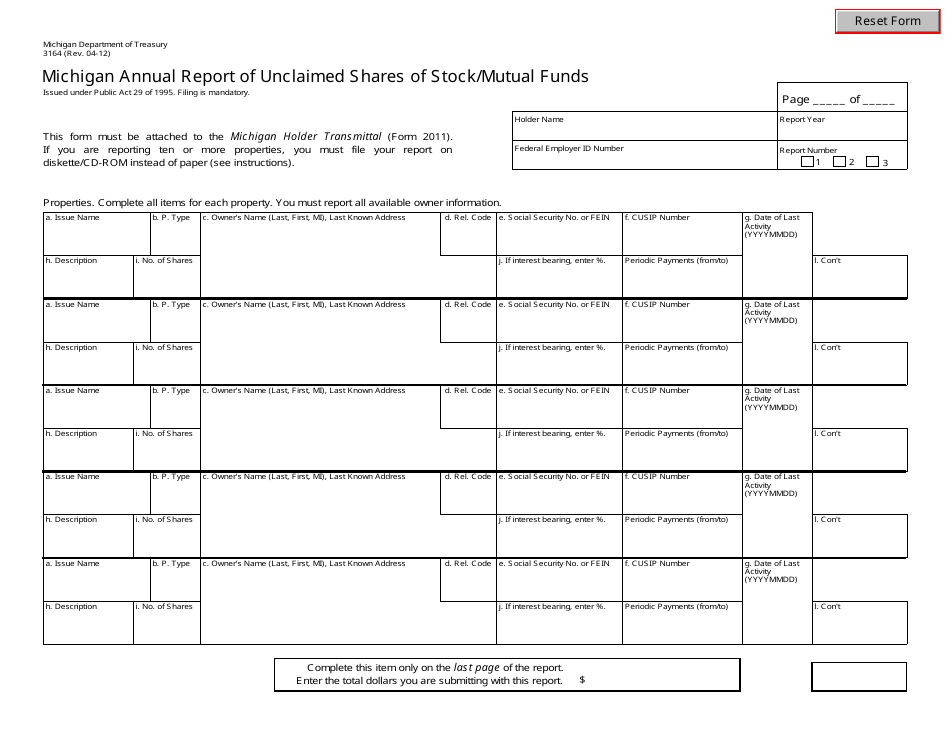

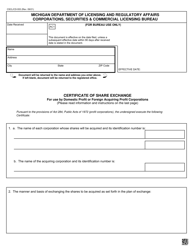

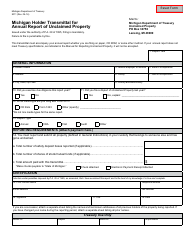

Form 3164 Michigan Annual Report of Unclaimed Shares of Stock / Mutual Funds - Michigan

What Is Form 3164?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3164?

A: Form 3164 is the Michigan Annual Report of Unclaimed Shares of Stock/Mutual Funds.

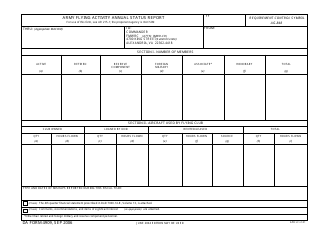

Q: What does the Form 3164 report?

A: Form 3164 reports unclaimed shares of stock/mutual funds.

Q: Who needs to file Form 3164?

A: Entities holding unclaimed shares of stock/mutual funds in Michigan need to file Form 3164.

Q: How often should Form 3164 be filed?

A: Form 3164 should be filed annually.

Q: Is there a fee to file Form 3164?

A: Yes, there is a fee to file Form 3164. The fee amount is specified on the form.

Q: What is the deadline for filing Form 3164?

A: The deadline for filing Form 3164 is specified on the form and typically falls in the spring.

Q: What happens if Form 3164 is not filed?

A: Failure to file Form 3164 may result in penalties or fines.

Q: Is Form 3164 only for Michigan residents?

A: No, Form 3164 is for entities holding unclaimed shares of stock/mutual funds in Michigan, regardless of residency.

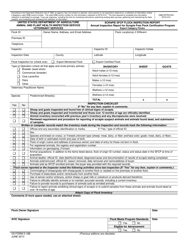

Q: Are there any exemptions to filing Form 3164?

A: Specific exemptions may apply. It is recommended to review the instructions on the form or consult with the Michigan Department of Treasury for guidance.

Form Details:

- Released on April 1, 2012;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3164 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.