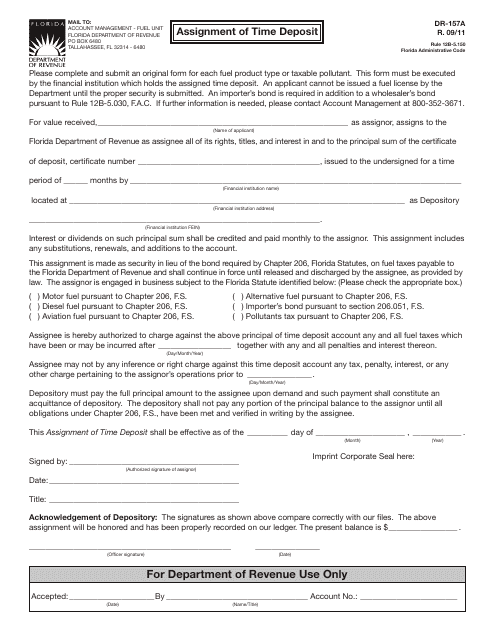

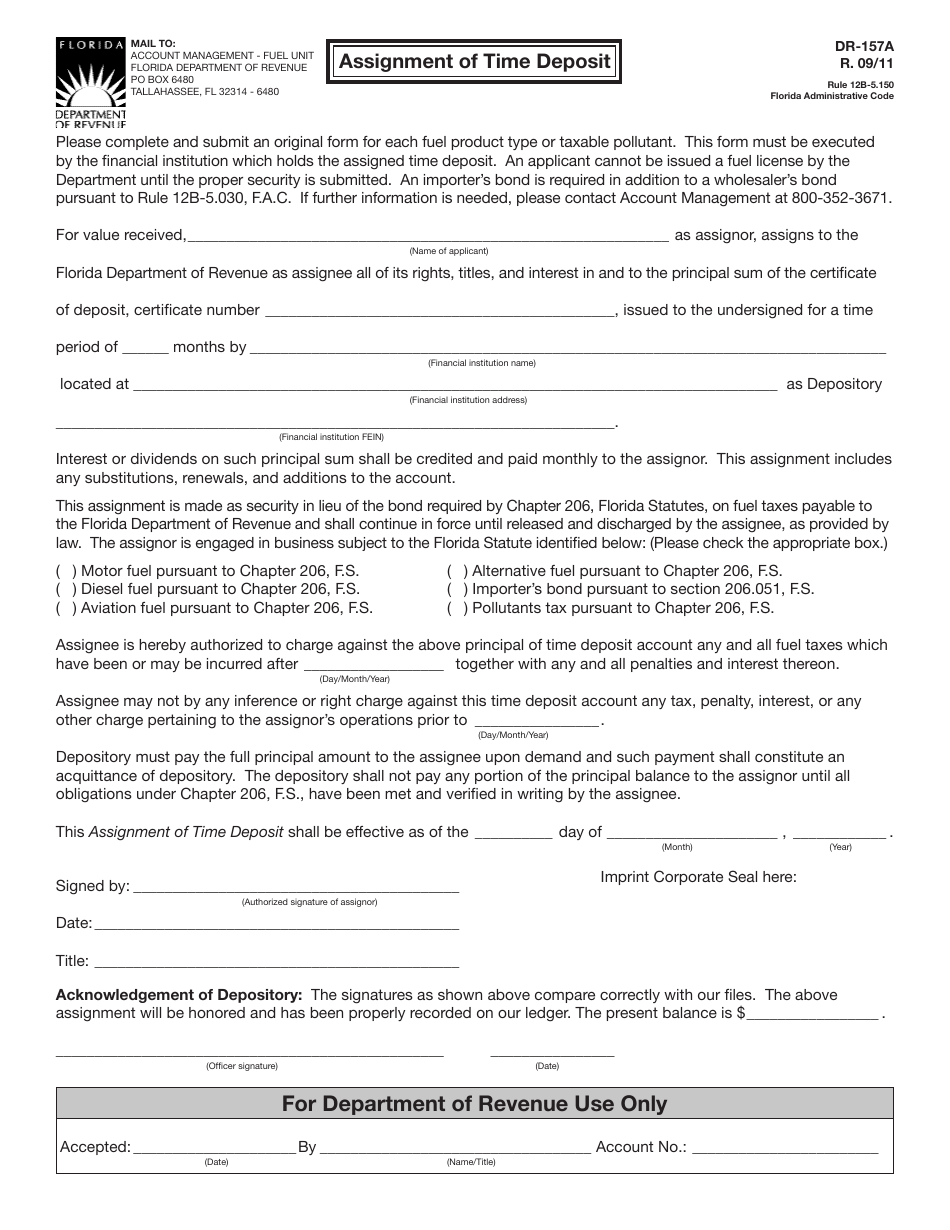

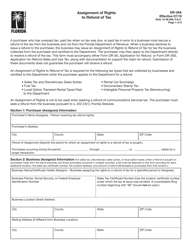

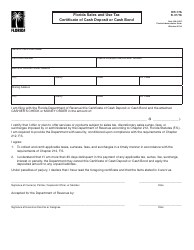

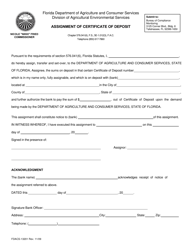

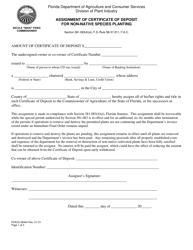

Form DR-157A Assignment of Time Deposit - Florida

What Is Form DR-157A?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

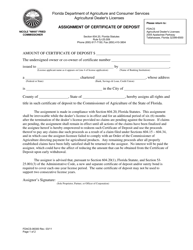

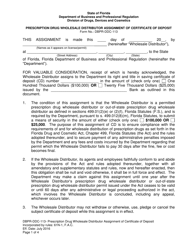

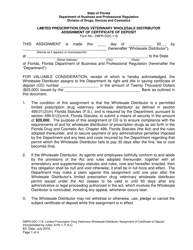

Q: What is Form DR-157A?

A: Form DR-157A is the Assignment of Time Deposit form for the state of Florida.

Q: What is the purpose of Form DR-157A?

A: The purpose of Form DR-157A is to assign or transfer rights to a time deposit account.

Q: Who should use Form DR-157A?

A: Form DR-157A should be used by individuals or entities who want to assign or transfer their rights to a time deposit account in Florida.

Q: Is there a fee to file Form DR-157A?

A: There is no fee to file Form DR-157A.

Q: Are there any specific requirements for completing Form DR-157A?

A: Yes, you must provide information about the assignor, the assignee, and the time deposit account being assigned.

Q: Can Form DR-157A be filed electronically?

A: Yes, Form DR-157A can be filed electronically.

Q: What should I do after completing Form DR-157A?

A: After completing Form DR-157A, you should submit it to the Florida Department of Revenue.

Q: Are there any time limits for filing Form DR-157A?

A: There are no specific time limits mentioned for filing Form DR-157A.

Q: Can I make changes to Form DR-157A after submitting it?

A: No, once Form DR-157A is submitted, you cannot make changes to it. It is important to review the form for accuracy before submitting it.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-157A by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.