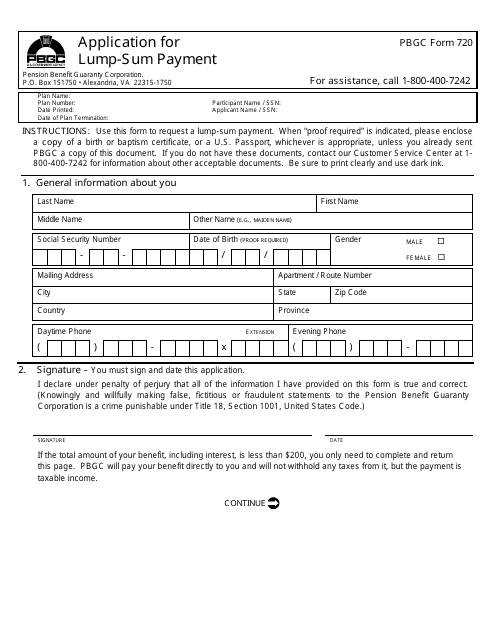

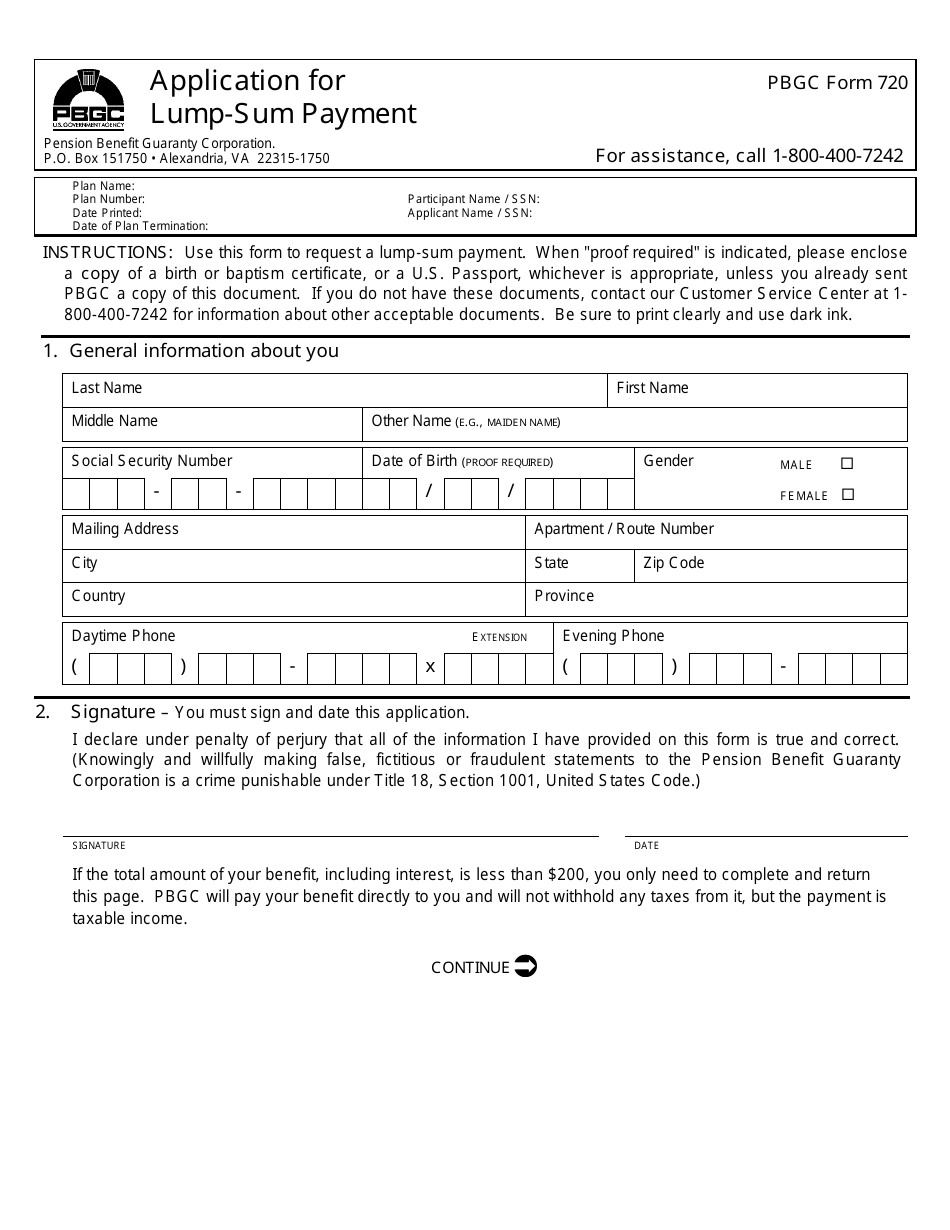

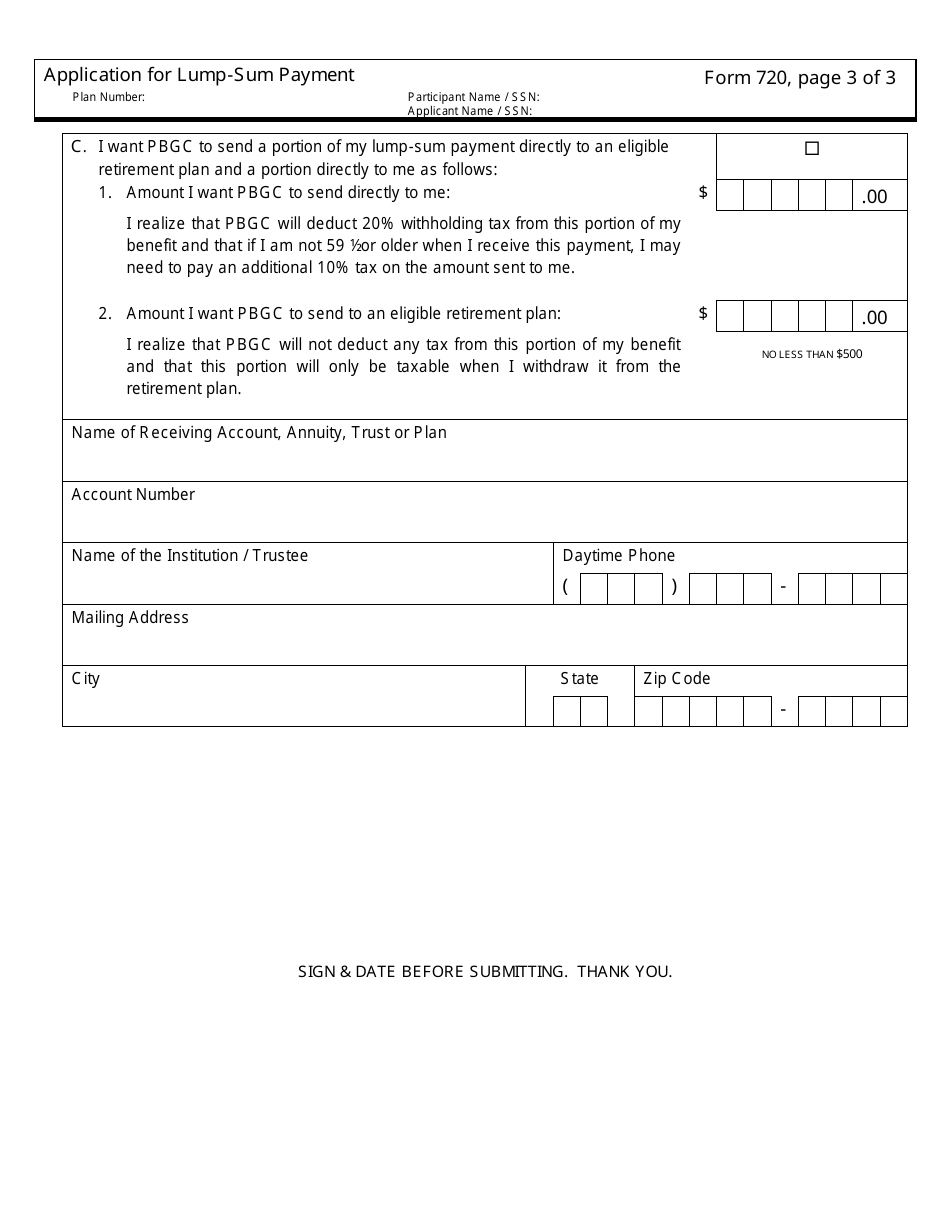

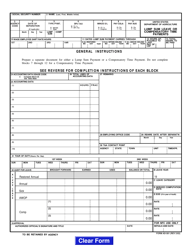

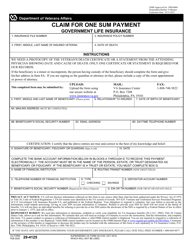

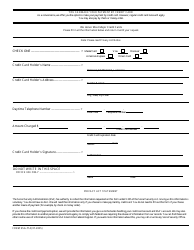

PBGC Form 720 Application for Lump-Sum Payment

What Is PBGC Form 720?

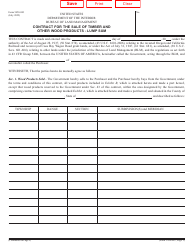

This is a legal form that was released by the U.S. Pension Benefit Guaranty Corporation and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PBGC Form 720?

A: PBGC Form 720 is an application for a lump-sum payment from the Pension Benefit Guaranty Corporation.

Q: Who should fill out PBGC Form 720?

A: This form should be filled out by individuals who are eligible for a lump-sum payment from the PBGC.

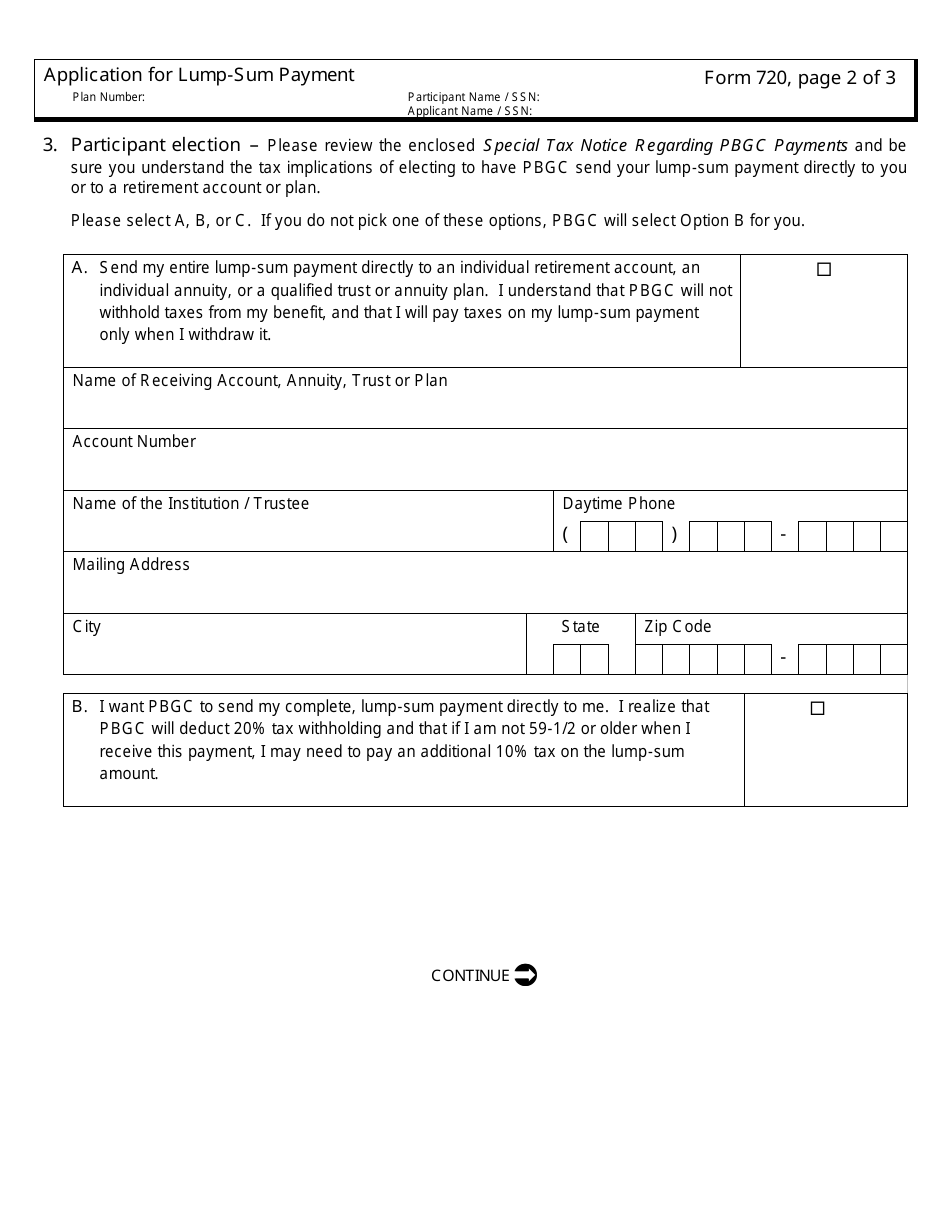

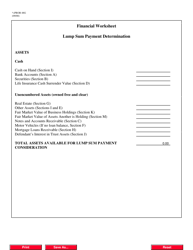

Q: What is a lump-sum payment?

A: A lump-sum payment is a one-time payment of a pension benefit instead of receiving it as a monthly annuity.

Q: How do I apply for a lump-sum payment?

A: You can apply for a lump-sum payment by filling out the PBGC Form 720 and submitting it to the PBGC.

Q: Are there any eligibility requirements for a lump-sum payment?

A: Yes, there are eligibility requirements for a lump-sum payment. You must meet certain criteria specified by the PBGC.

Q: What happens after I submit PBGC Form 720?

A: After submitting PBGC Form 720, the PBGC will review your application and determine if you are eligible for a lump-sum payment.

Q: How long does it take to receive a lump-sum payment?

A: The processing time for a lump-sum payment can vary, but it typically takes several weeks.

Q: Can I choose to receive a monthly annuity instead of a lump-sum payment?

A: Yes, you have the option to receive your pension benefit as a monthly annuity instead of a lump-sum payment.

Q: Are lump-sum payments taxable?

A: Yes, lump-sum payments are generally taxable. You may need to consult with a tax professional for specific advice.

Form Details:

- The latest available edition released by the U.S. Pension Benefit Guaranty Corporation;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of PBGC Form 720 by clicking the link below or browse more documents and templates provided by the U.S. Pension Benefit Guaranty Corporation.