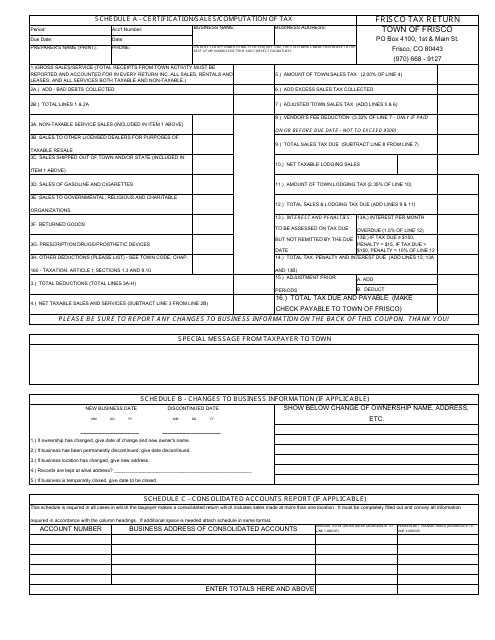

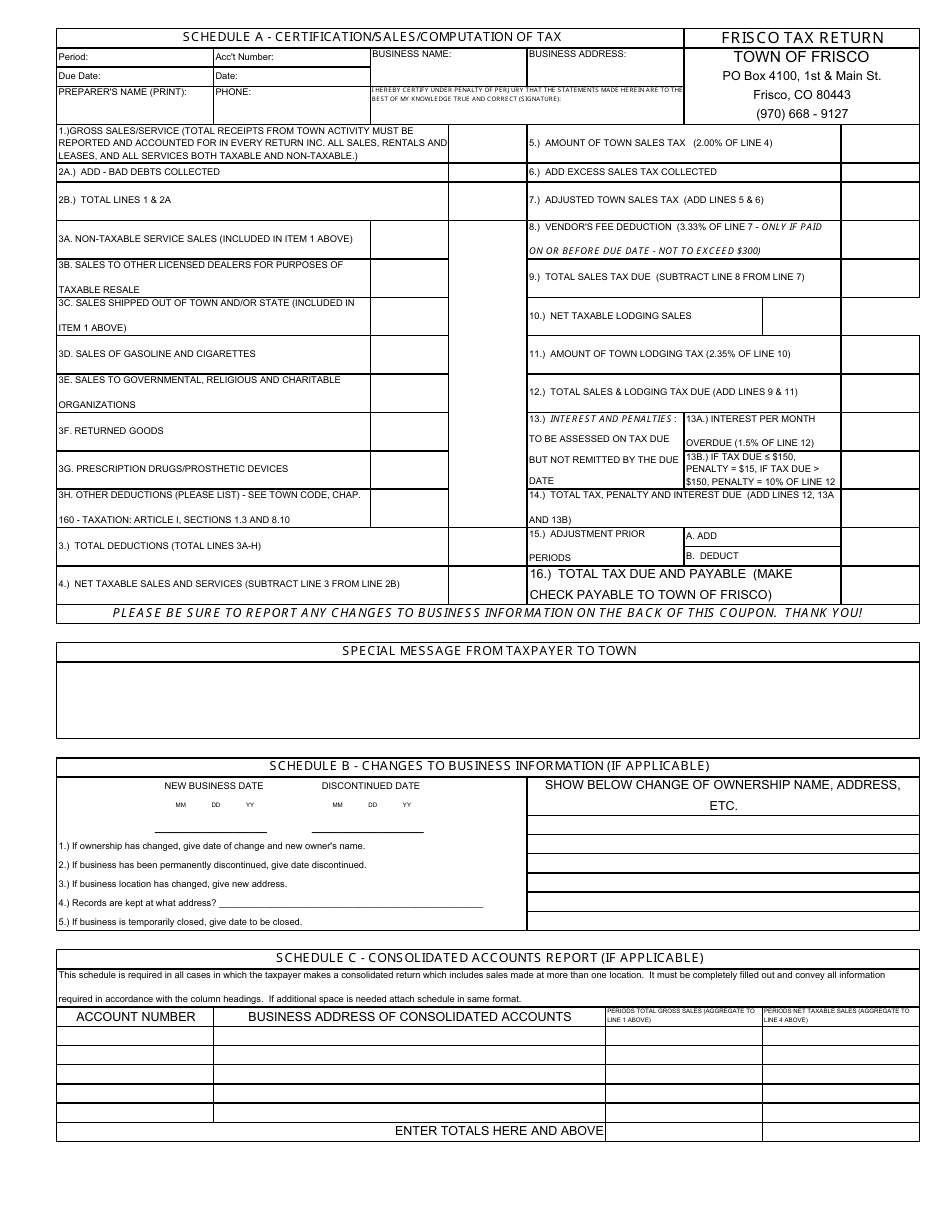

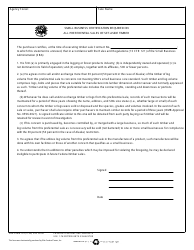

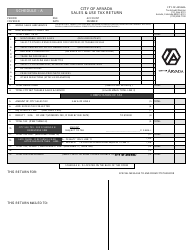

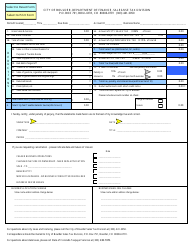

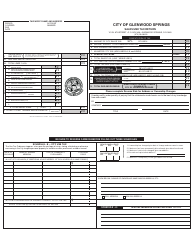

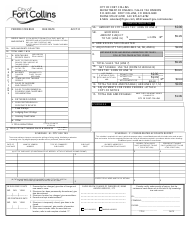

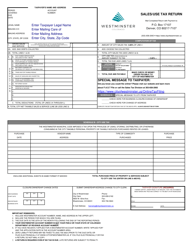

Schedule A Certification / Sales / Computation of Tax Frisco Tax Return - Town of Frisco, Colorado

What Is Schedule A?

This is a legal form that was released by the Department of Finance - Town of Frisco, Colorado - a government authority operating within Colorado. The form may be used strictly within Town of Frisco. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule A Certification?

A: Schedule A Certification is a part of the Frisco Tax Return process in the Town of Frisco, Colorado.

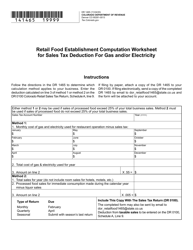

Q: What does the Sales category refer to?

A: The Sales category on the Frisco Tax Return form includes the total amount of taxable sales made within the Town of Frisco.

Q: What is Computation of Tax?

A: Computation of Tax refers to the calculation of the amount of tax owed based on the taxable sales and the applicable tax rate in the Town of Frisco.

Q: What is the Town of Frisco, Colorado?

A: The Town of Frisco, Colorado is a municipality in Colorado that requires residents and businesses to file a Frisco Tax Return.

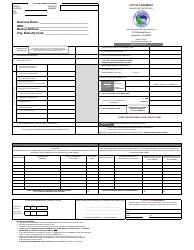

Q: What is the purpose of the Frisco Tax Return?

A: The purpose of the Frisco Tax Return is to report and pay the appropriate amount of tax owed to the Town of Frisco based on taxable sales.

Q: Are there any specific requirements for filing a Frisco Tax Return?

A: Yes, you may need to include Schedule A Certification and provide accurate information regarding sales and computation of tax.

Form Details:

- The latest edition provided by the Department of Finance - Town of Frisco, Colorado;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule A by clicking the link below or browse more documents and templates provided by the Department of Finance - Town of Frisco, Colorado.