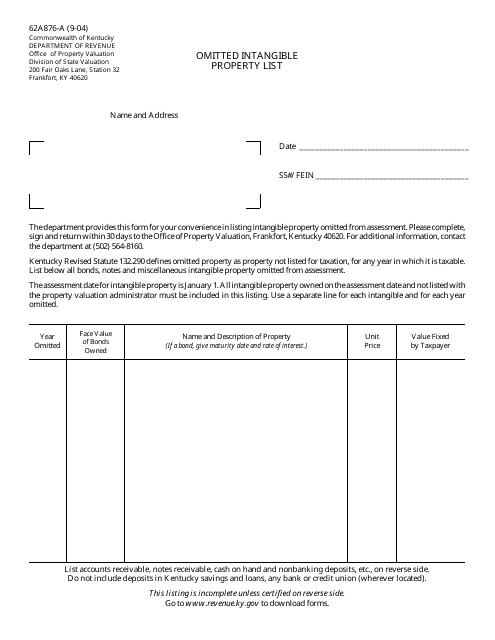

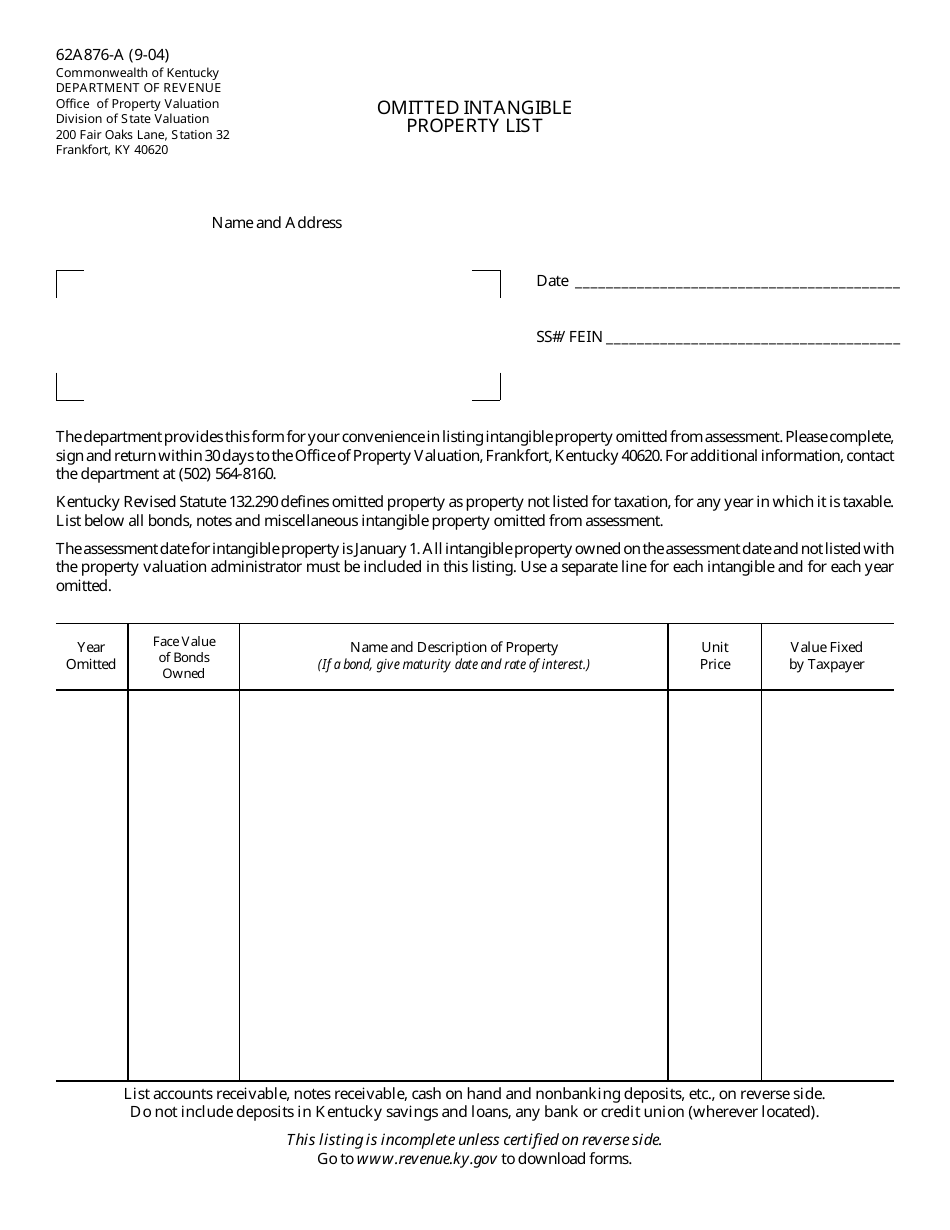

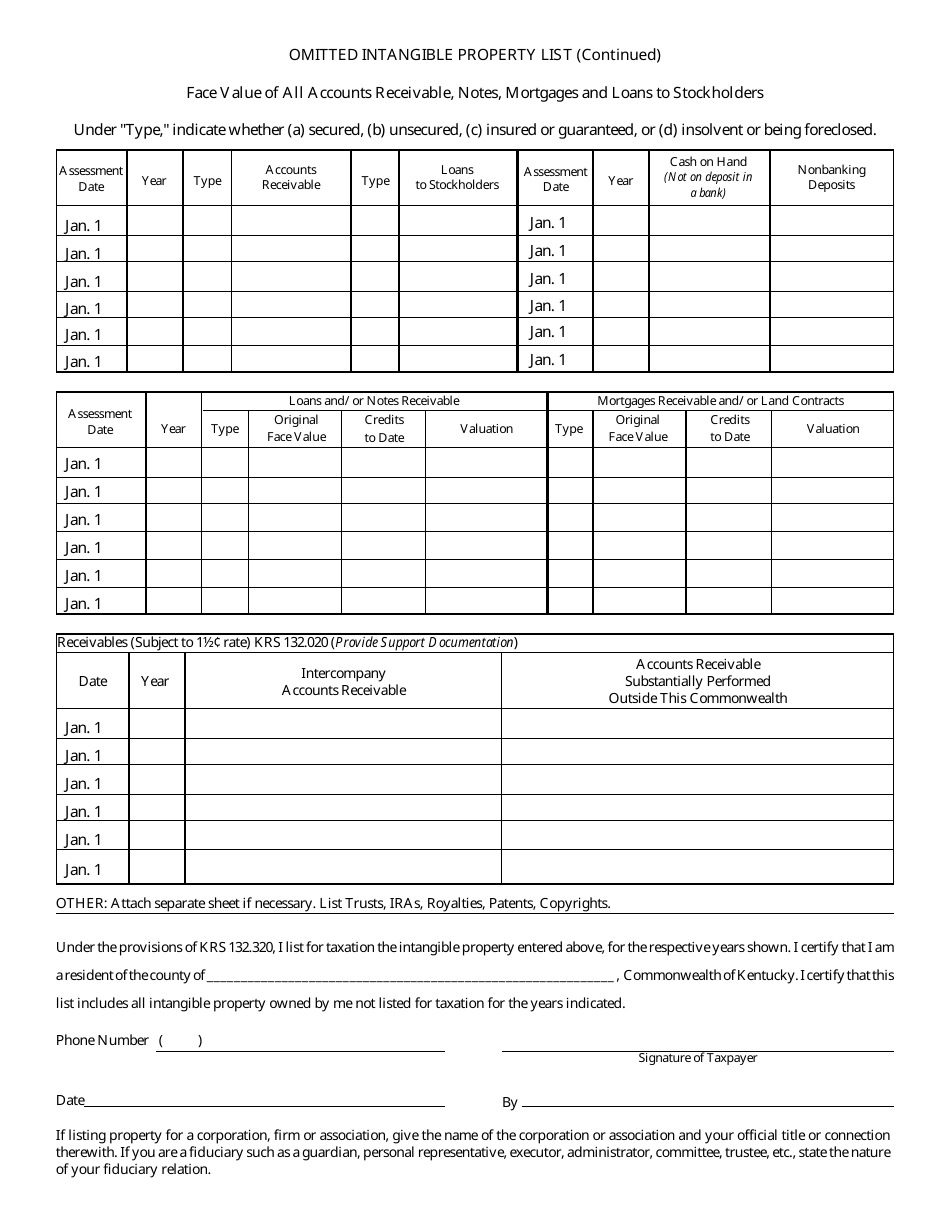

Form 62A876-A Omitted Intangible Property List - Kentucky

What Is Form 62A876-A?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 62A876-A?

A: Form 62A876-A is the Omitted Intangible Property List for Kentucky.

Q: What is the purpose of Form 62A876-A?

A: The purpose of Form 62A876-A is to report any omitted intangible property in Kentucky.

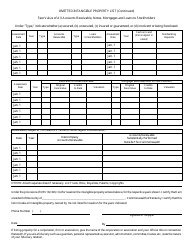

Q: Who is required to file Form 62A876-A?

A: Anyone who has omitted intangible property in Kentucky is required to file Form 62A876-A.

Q: What is considered intangible property?

A: Intangible property refers to assets that have value but do not have a physical form, such as patents, copyrights, and stocks.

Q: When is Form 62A876-A due?

A: Form 62A876-A is due on April 15th of each year.

Q: Are there any penalties for not filing Form 62A876-A?

A: Yes, there are penalties for not filing Form 62A876-A, including interest charges and potential legal actions.

Form Details:

- Released on September 1, 2004;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 62A876-A by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.