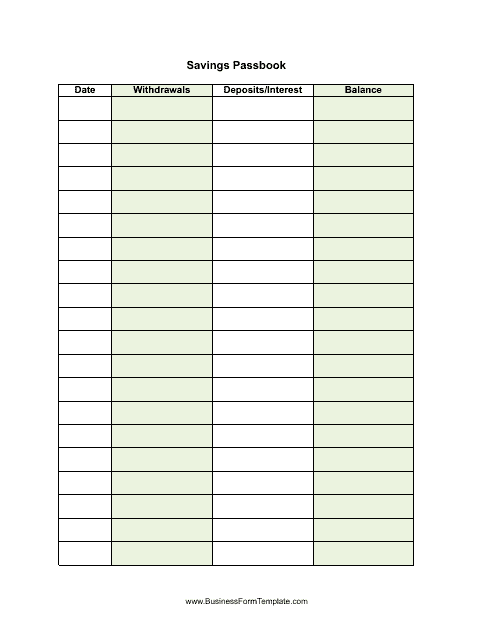

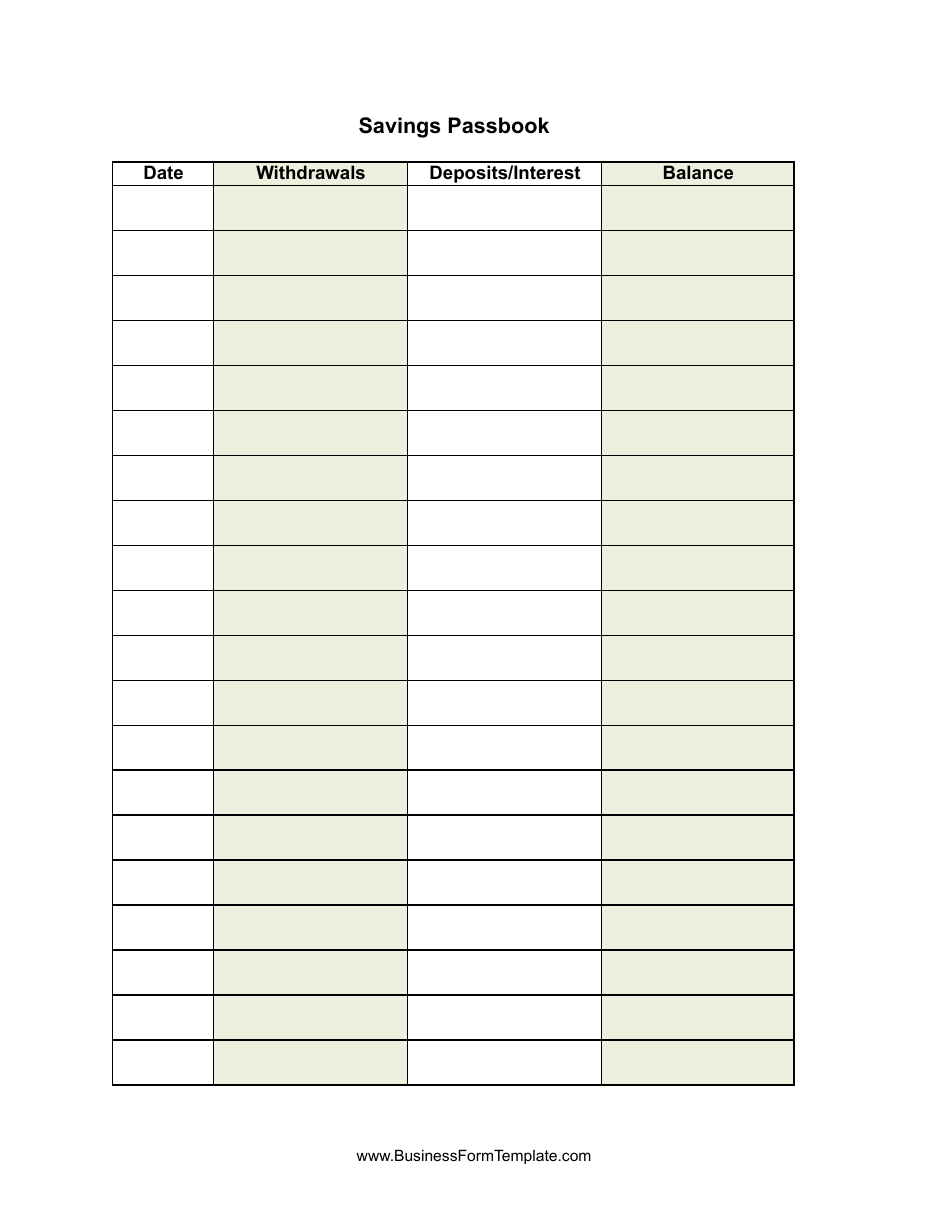

Savings Passbook Template

A Savings Passbook Template is a document used by banks to record transactions and balances for a savings account. It helps account holders keep track of their savings and provides a history of their transactions.

The savings passbook template is typically filed by the individual or account holder at their bank or financial institution.

FAQ

Q: What is a savings passbook?

A: A savings passbook is a document issued by a bank to account holders to record their savings transactions.

Q: How do I get a savings passbook?

A: You can get a savings passbook by opening a savings account at a bank that offers passbook accounts.

Q: What is the purpose of a savings passbook?

A: The purpose of a savings passbook is to keep a record of deposits, withdrawals, and interest earned on a savings account.

Q: What information is typically included in a savings passbook?

A: A savings passbook usually includes the account holder's name, account number, transaction dates, transaction amounts, and the current balance.

Q: Can I use a savings passbook to make withdrawals?

A: Yes, you can use a savings passbook to make withdrawals at the bank counter or through an ATM, depending on the bank's policies.

Q: What should I do if my savings passbook is lost or stolen?

A: If your savings passbook is lost or stolen, you should immediately contact your bank to report the loss and request a replacement passbook.

Q: Can I have multiple savings passbooks?

A: Yes, some banks allow customers to have multiple savings passbooks for different savings accounts or purposes.

Q: Are there any fees associated with using a savings passbook?

A: Fees for savings passbooks vary by bank. Some banks may charge a fee for issuing or replacing a passbook, while others may offer it as a free service.