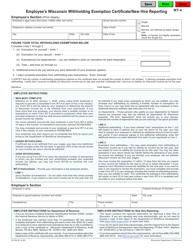

This version of the form is not currently in use and is provided for reference only. Download this version of

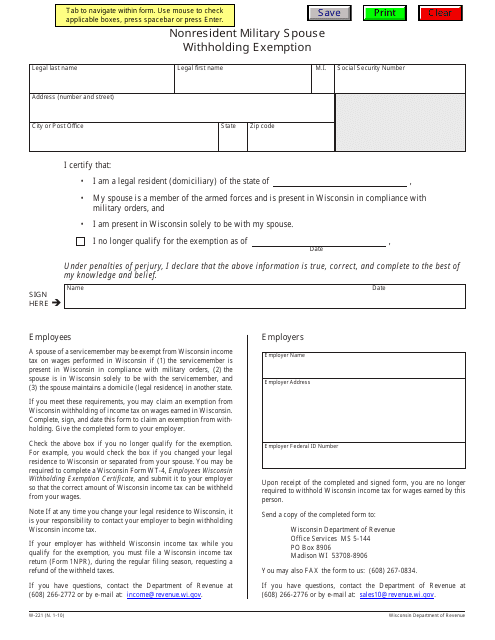

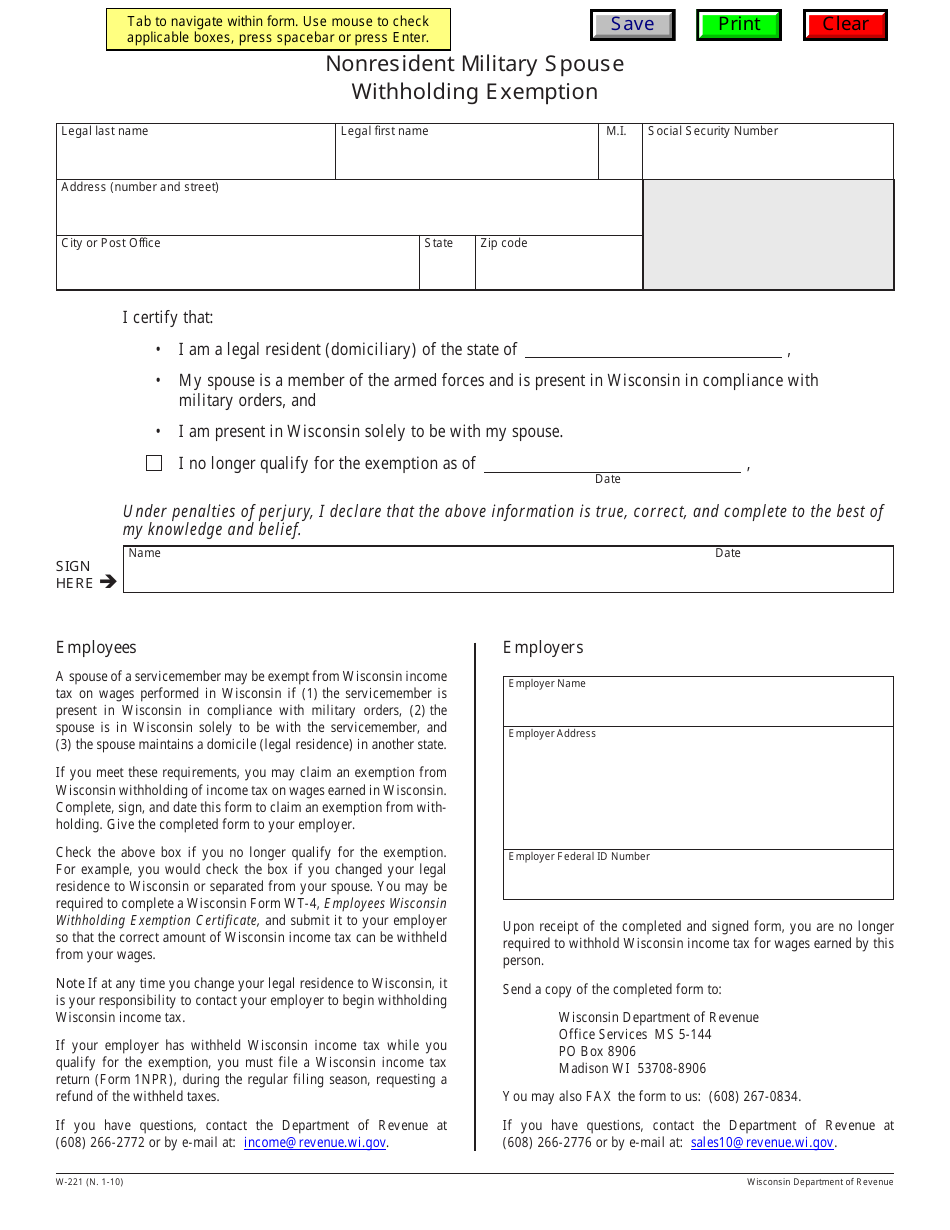

Form W-221

for the current year.

Form W-221 Nonresident Military Spouse Withholding Exemption - Wisconsin

What Is Form W-221?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-221?

A: Form W-221 is a form used for nonresident military spouses to claim withholding exemption in Wisconsin.

Q: Who can use Form W-221?

A: Nonresident military spouses can use Form W-221.

Q: What is the purpose of Form W-221?

A: The purpose of Form W-221 is to allow nonresident military spouses to claim withholding exemption in Wisconsin.

Q: Is Form W-221 only for Wisconsin residents?

A: No, Form W-221 is specifically for nonresident military spouses who reside in states outside of Wisconsin.

Q: What information do I need to complete Form W-221?

A: To complete Form W-221, you will need your personal information, the active duty military member's information, and any other required documentation.

Q: Can Form W-221 be filed electronically?

A: Yes, Form W-221 can be filed electronically.

Q: Are there any filing deadlines for Form W-221?

A: Yes, Form W-221 must be filed by the due date of your tax return.

Q: What should I do if I have additional questions about Form W-221?

A: If you have additional questions about Form W-221, you should contact the Wisconsin Department of Revenue for assistance.

Form Details:

- Released on January 1, 2010;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-221 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.