This version of the form is not currently in use and is provided for reference only. Download this version of

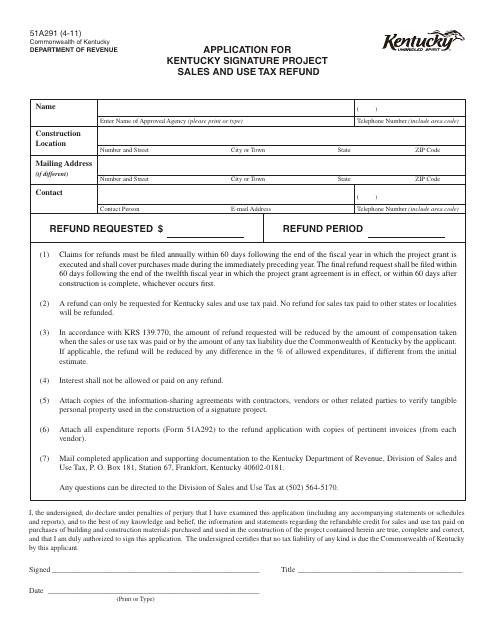

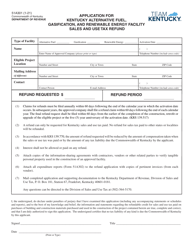

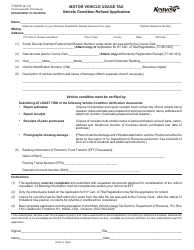

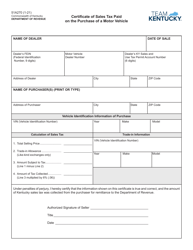

Form 51A291

for the current year.

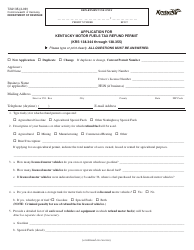

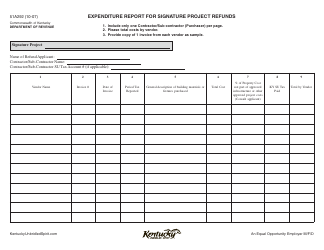

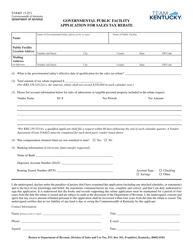

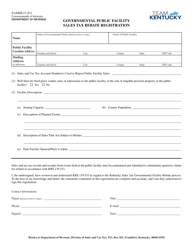

Form 51A291 Application for Kentucky Signature Project Sales and Use Tax Refund - Kentucky

What Is Form 51A291?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51A291?

A: Form 51A291 is an application for the Kentucky Signature Project Sales and Use Tax Refund.

Q: What is the purpose of Form 51A291?

A: The purpose of Form 51A291 is to apply for a sales and use tax refund under the Kentucky Signature Project.

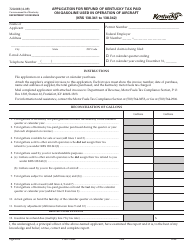

Q: Who should use Form 51A291?

A: Individuals or businesses who have made qualifying purchases under the Kentucky Signature Project may use Form 51A291 to apply for a tax refund.

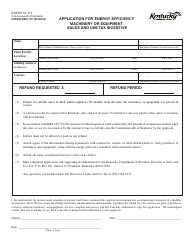

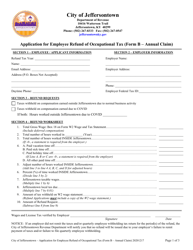

Q: What is the Kentucky Signature Project?

A: The Kentucky Signature Project is a program that provides tax incentives for certain businesses, especially those involved in research and development.

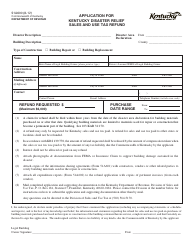

Q: Is there a deadline for submitting Form 51A291?

A: Yes, Form 51A291 must be submitted within three years from the date of purchase for which the refund is being requested.

Q: What supporting documents are required with Form 51A291?

A: Supporting documents such as invoices, receipts, and other proof of purchase must be included with Form 51A291.

Form Details:

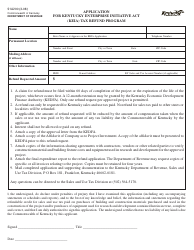

- Released on April 1, 2011;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A291 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.