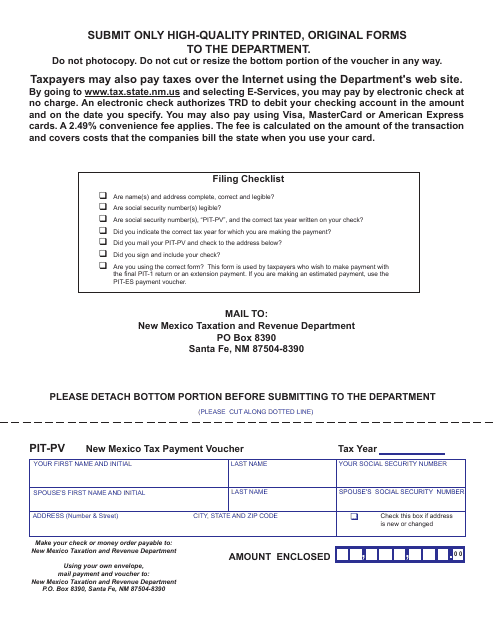

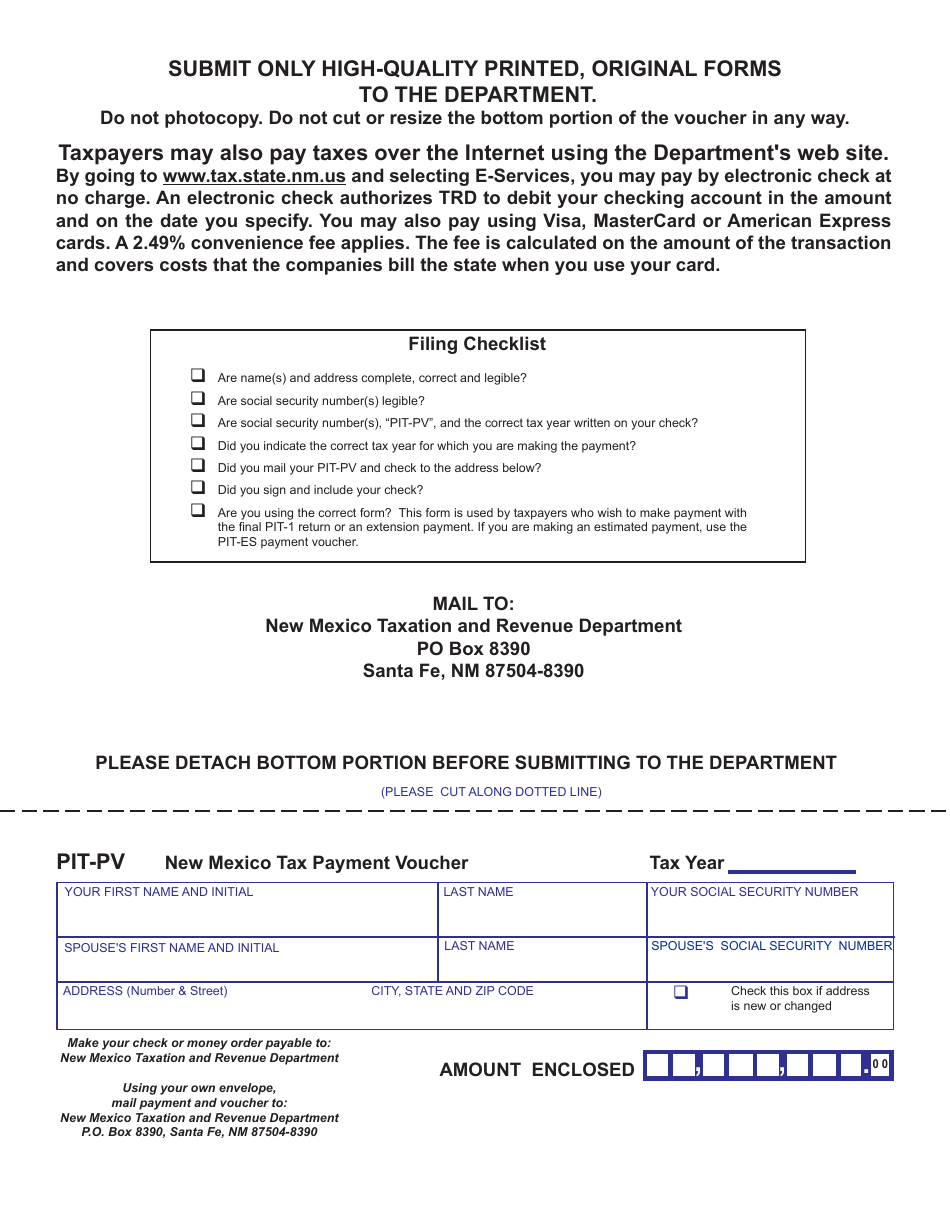

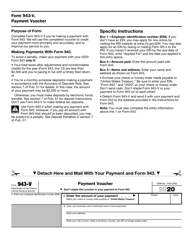

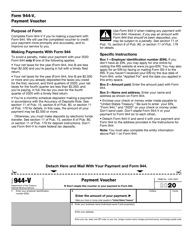

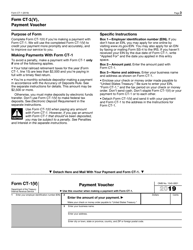

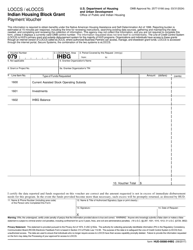

Form PIT-PV New Mexico Tax Payment Voucher - New Mexico

What Is Form PIT-PV?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form PIT-PV?

A: Form PIT-PV is the New Mexico Tax Payment Voucher.

Q: What is the purpose of Form PIT-PV?

A: The purpose of Form PIT-PV is to make payments for New Mexico state taxes.

Q: Who needs to use Form PIT-PV?

A: Any individual or business making a payment for New Mexico state taxes needs to use Form PIT-PV.

Q: Can I file Form PIT-PV electronically?

A: No, Form PIT-PV cannot be filed electronically. It must be submitted by mail or in-person.

Q: What information is required on Form PIT-PV?

A: Form PIT-PV requires the taxpayer's name, address, Social Security number or business identification number, tax year, and the amount being paid.

Q: When is the deadline to submit Form PIT-PV?

A: The deadline to submit Form PIT-PV is determined by the New Mexico Taxation and Revenue Department and may vary depending on the tax year.

Q: Are there any penalties for late payment of New Mexico state taxes?

A: Yes, late payments of New Mexico state taxes may result in penalties and interest charges. It is important to submit Form PIT-PV and pay your taxes on time.

Form Details:

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PIT-PV by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.