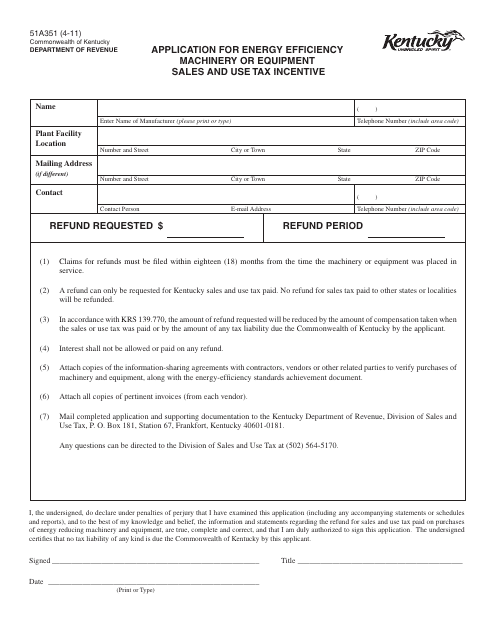

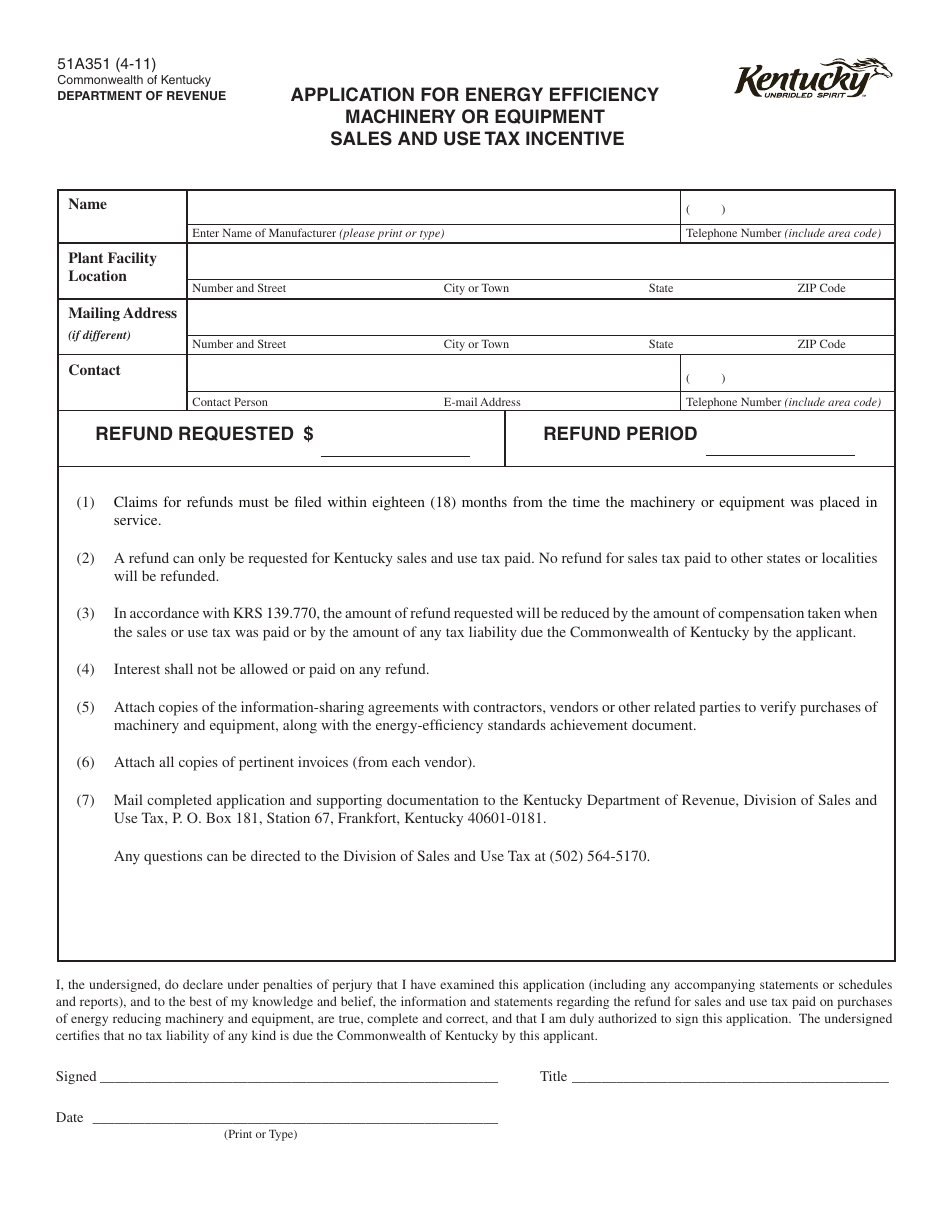

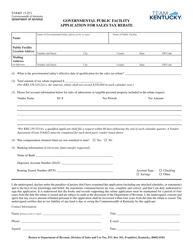

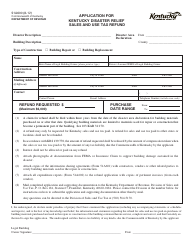

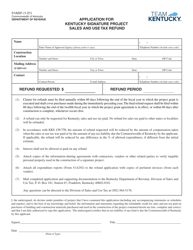

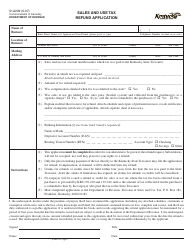

Form 51A351 Application for Energy Efficiency Machinery or Equipment Sales and Use Tax Incentive - Kentucky

What Is Form 51A351?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51A351?

A: Form 51A351 is the Application for Energy Efficiency Machinery or Equipment Sales and Use Tax Incentive in the state of Kentucky.

Q: What is the purpose of Form 51A351?

A: The purpose of Form 51A351 is to apply for the Energy Efficiency Machinery or Equipment Sales and Use Tax Incentive in Kentucky.

Q: What is the incentive for energy efficiency machinery or equipment in Kentucky?

A: The incentive allows for a sales and use tax refund for qualified energy efficiency machinery or equipment.

Q: Who is eligible for the incentive?

A: Manufacturing, mining, processing, and data centers may be eligible for the Energy Efficiency Machinery or Equipment Sales and Use Tax Incentive in Kentucky.

Form Details:

- Released on April 1, 2011;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A351 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.