This version of the form is not currently in use and is provided for reference only. Download this version of

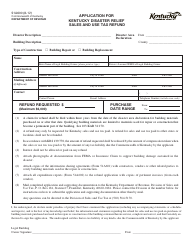

Form 51A401

for the current year.

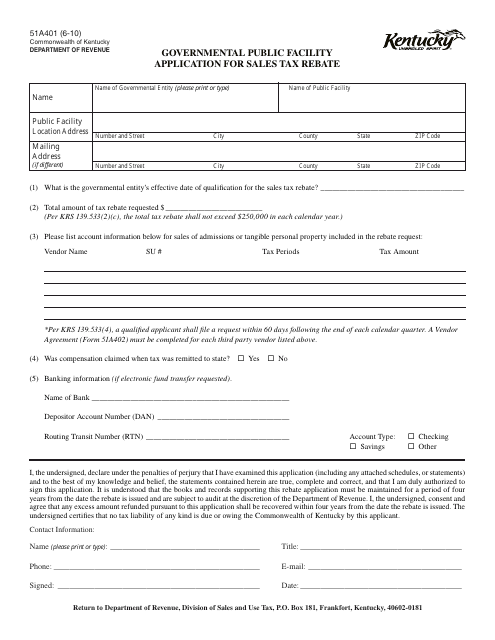

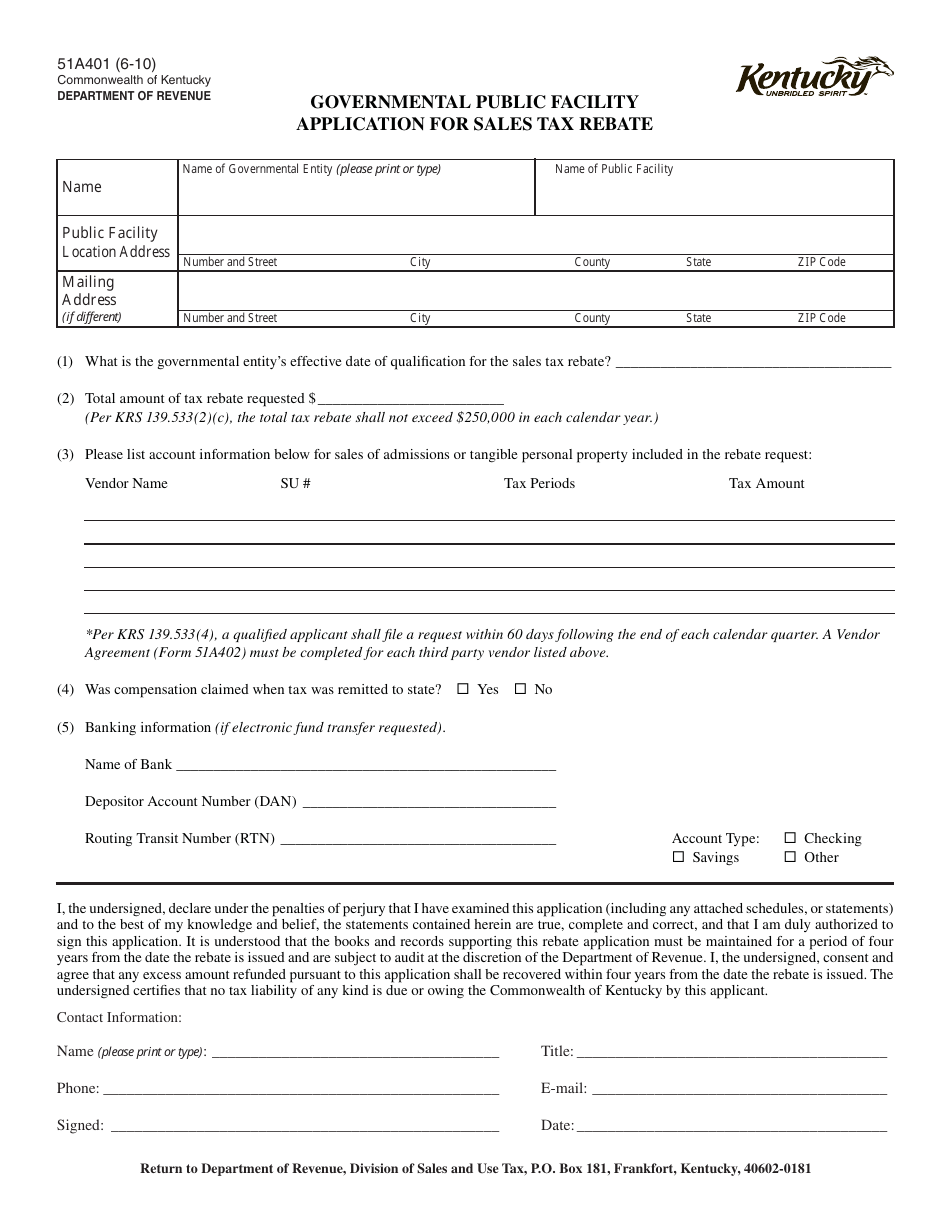

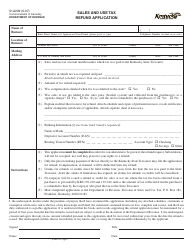

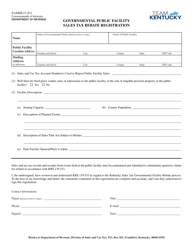

Form 51A401 Governmental Public Facility Application for Sales Tax Rebate - Kentucky

What Is Form 51A401?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

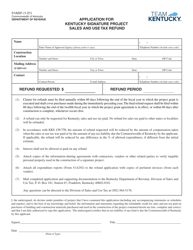

Q: What is Form 51A401?

A: Form 51A401 is the Governmental Public Facility Application for Sales Tax Rebate in Kentucky.

Q: What is the purpose of Form 51A401?

A: The purpose of Form 51A401 is to apply for a sales tax rebate on eligible purchases made for a government-owned public facility.

Q: What is a sales tax rebate?

A: A sales tax rebate is a refund or reduction of the sales tax paid on eligible purchases.

Q: Who should fill out Form 51A401?

A: Form 51A401 should be filled out by the government agency that owns the public facility.

Q: What kind of purchases are eligible for the sales tax rebate?

A: Purchases of tangible personal property, construction materials, or services directly used in the construction or improvement of the public facility are eligible for the sales tax rebate.

Q: Do I need to attach supporting documentation with Form 51A401?

A: Yes, you need to attach detailed invoices, receipts, and contracts to support your claim for the sales tax rebate.

Q: What is the deadline for submitting Form 51A401?

A: Form 51A401 should be submitted within 12 months after the completion of the project.

Q: Is there a fee for filing Form 51A401?

A: No, there is no fee for filing Form 51A401.

Form Details:

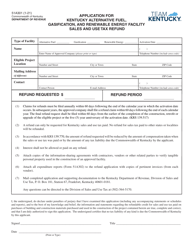

- Released on June 1, 2010;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A401 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.