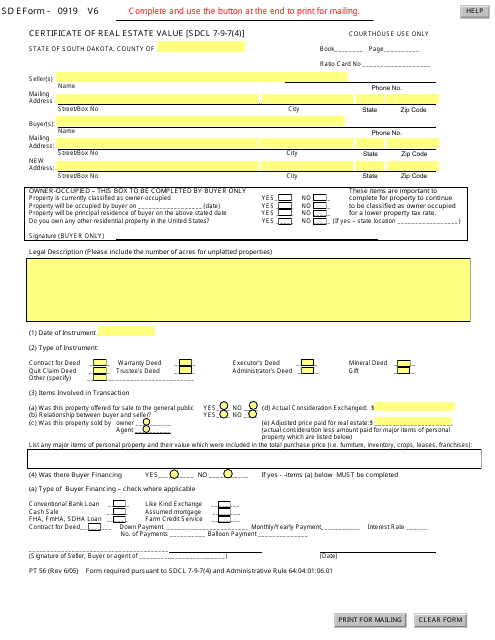

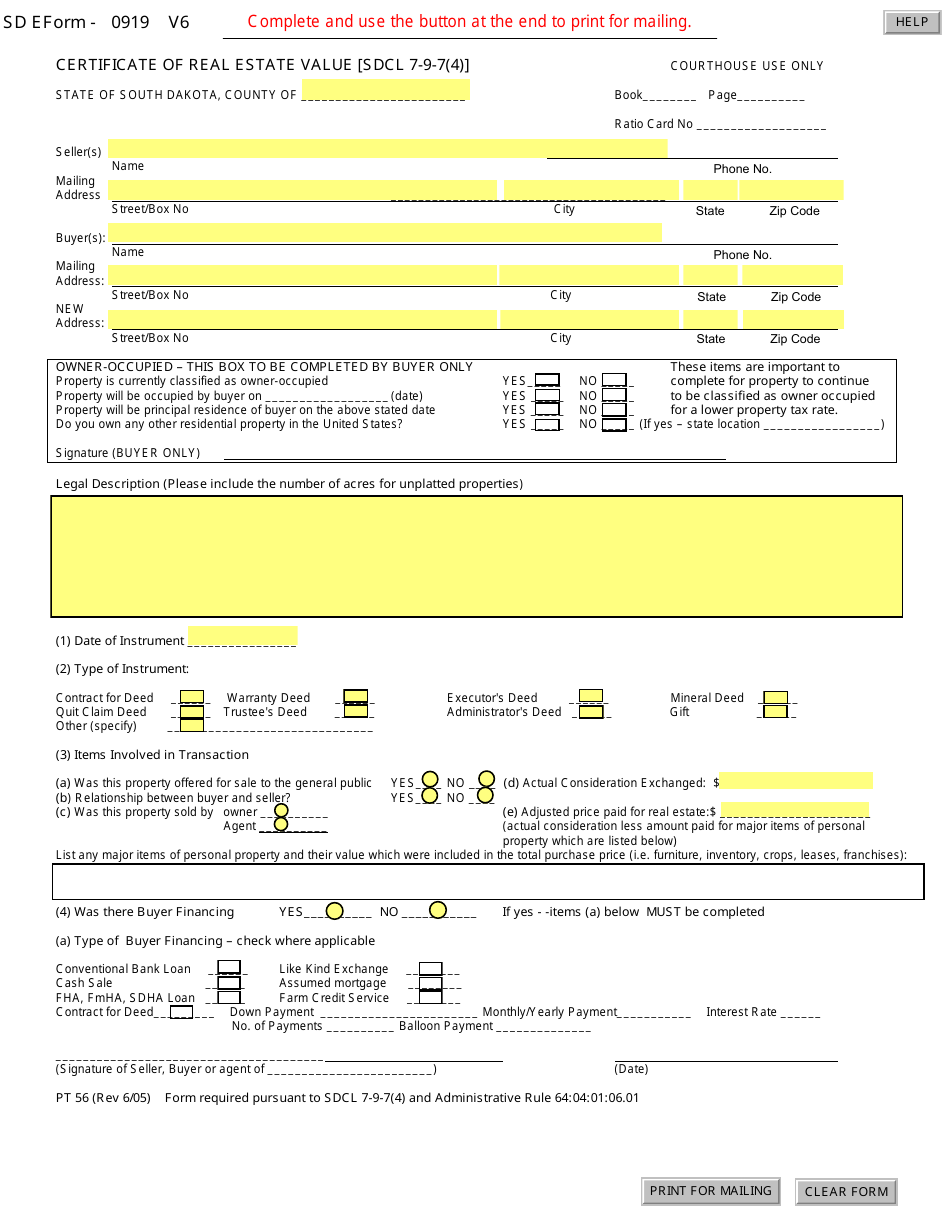

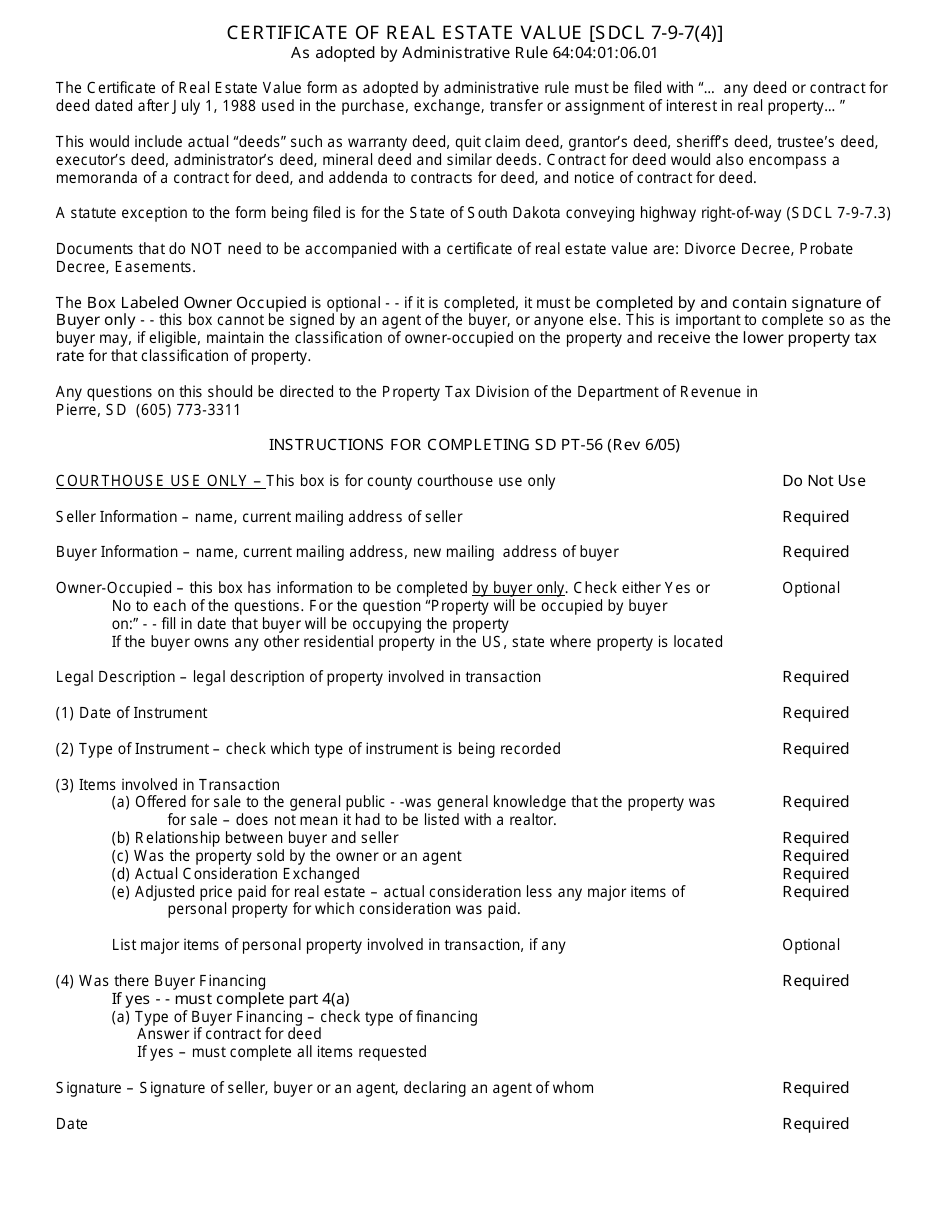

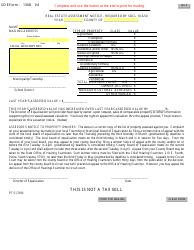

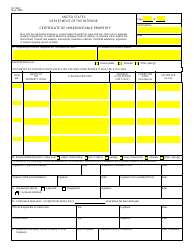

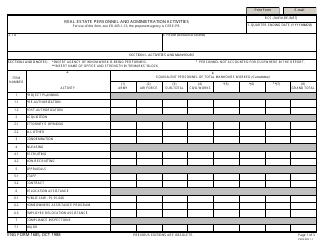

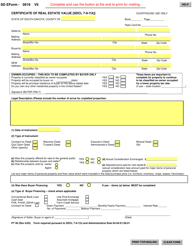

Form PT56 Certificate of Real Estate Value - South Dakota

What Is Form PT56?

This is a legal form that was released by the South Dakota Department of Revenue - a government authority operating within South Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT56 Certificate of Real Estate Value?

A: Form PT56 is a document used in South Dakota to report the sale or transfer of real estate and provide the necessary information for property valuation.

Q: Why is Form PT56 Certificate of Real Estate Value required?

A: Form PT56 is required to determine the fair market value of the property for tax purposes and to ensure accurate assessment and taxation.

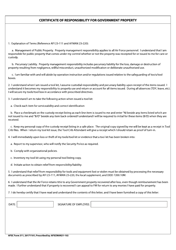

Q: Who needs to file Form PT56 Certificate of Real Estate Value?

A: The seller or the transferor of real estate in South Dakota is responsible for filing Form PT56.

Q: What information is required on Form PT56 Certificate of Real Estate Value?

A: Form PT56 requires information about the property being transferred, the parties involved, the sale price, and the reason for the transfer.

Q: When should Form PT56 Certificate of Real Estate Value be filed?

A: Form PT56 should be filed within 45 days of the sale or transfer of real estate.

Q: Are there any fees associated with filing Form PT56 Certificate of Real Estate Value?

A: There is no fee for filing Form PT56.

Q: What happens after filing Form PT56 Certificate of Real Estate Value?

A: After filing Form PT56, the county assessor will review the information and use it to determine the property's assessed value for tax purposes.

Form Details:

- Released on June 1, 2005;

- The latest edition provided by the South Dakota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PT56 by clicking the link below or browse more documents and templates provided by the South Dakota Department of Revenue.