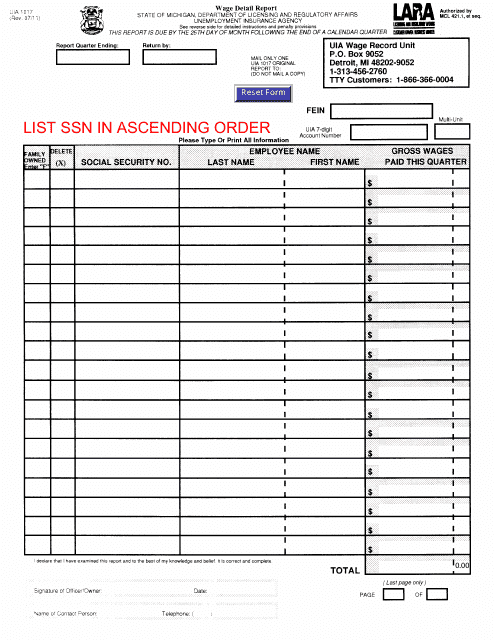

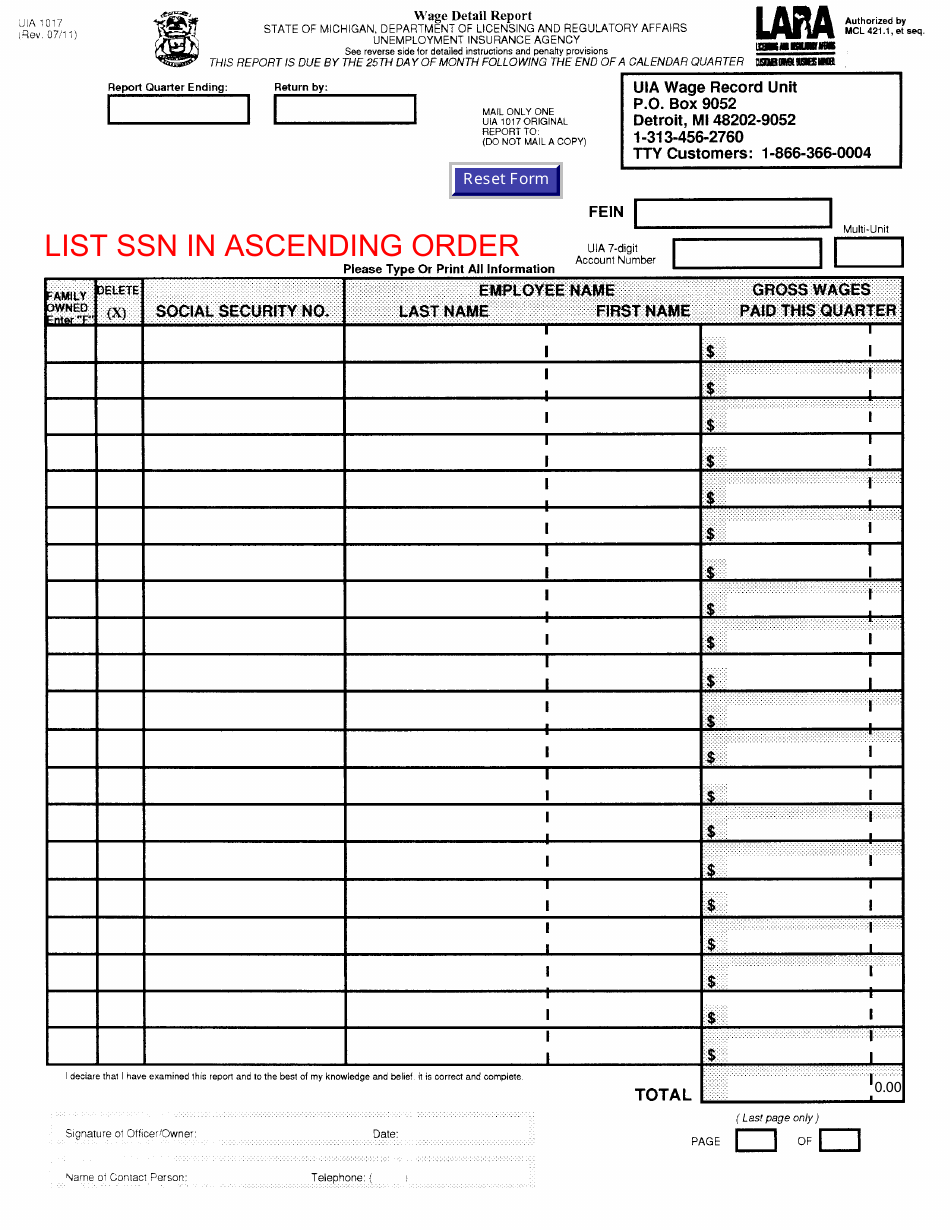

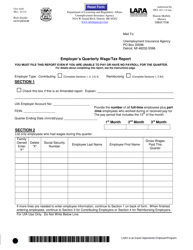

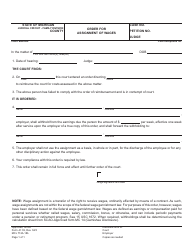

Form UIA1017 Wage Detail Report - Michigan

What Is Form UIA1017?

This is a legal form that was released by the Michigan Department of Licensing and Regulatory Affairs - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

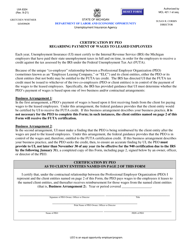

Q: What is the UIA1017 Wage Detail Report?

A: The UIA1017 Wage Detail Report is a form used in Michigan to report employee wages and tax information.

Q: Who is required to file the UIA1017 Wage Detail Report?

A: Employers in Michigan are required to file the UIA1017 Wage Detail Report.

Q: What information is required on the UIA1017 Wage Detail Report?

A: The UIA1017 Wage Detail Report requires information such as employee names, social security numbers, wages earned, and tax withholdings.

Q: When is the deadline for filing the UIA1017 Wage Detail Report?

A: The deadline for filing the UIA1017 Wage Detail Report is usually by the end of January each year.

Q: What happens if I don't file the UIA1017 Wage Detail Report?

A: Failure to file the UIA1017 Wage Detail Report may result in penalties and fines from the Michigan Department of Treasury.

Q: Is the UIA1017 Wage Detail Report different for employers in Canada?

A: Yes, the UIA1017 Wage Detail Report is specific to employers in Michigan and is not applicable to employers in Canada.

Form Details:

- Released on July 1, 2011;

- The latest edition provided by the Michigan Department of Licensing and Regulatory Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UIA1017 by clicking the link below or browse more documents and templates provided by the Michigan Department of Licensing and Regulatory Affairs.