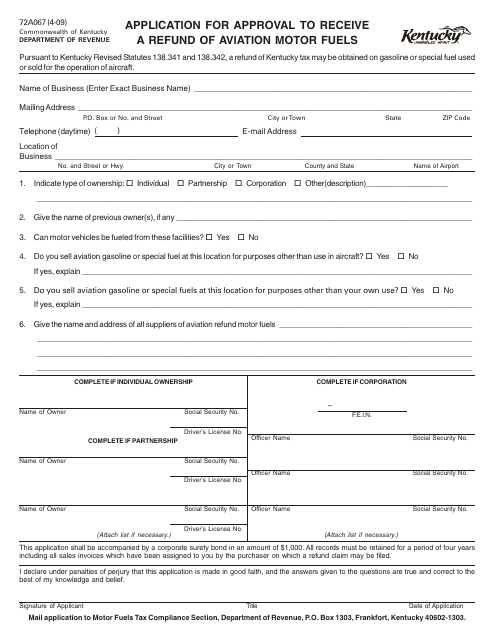

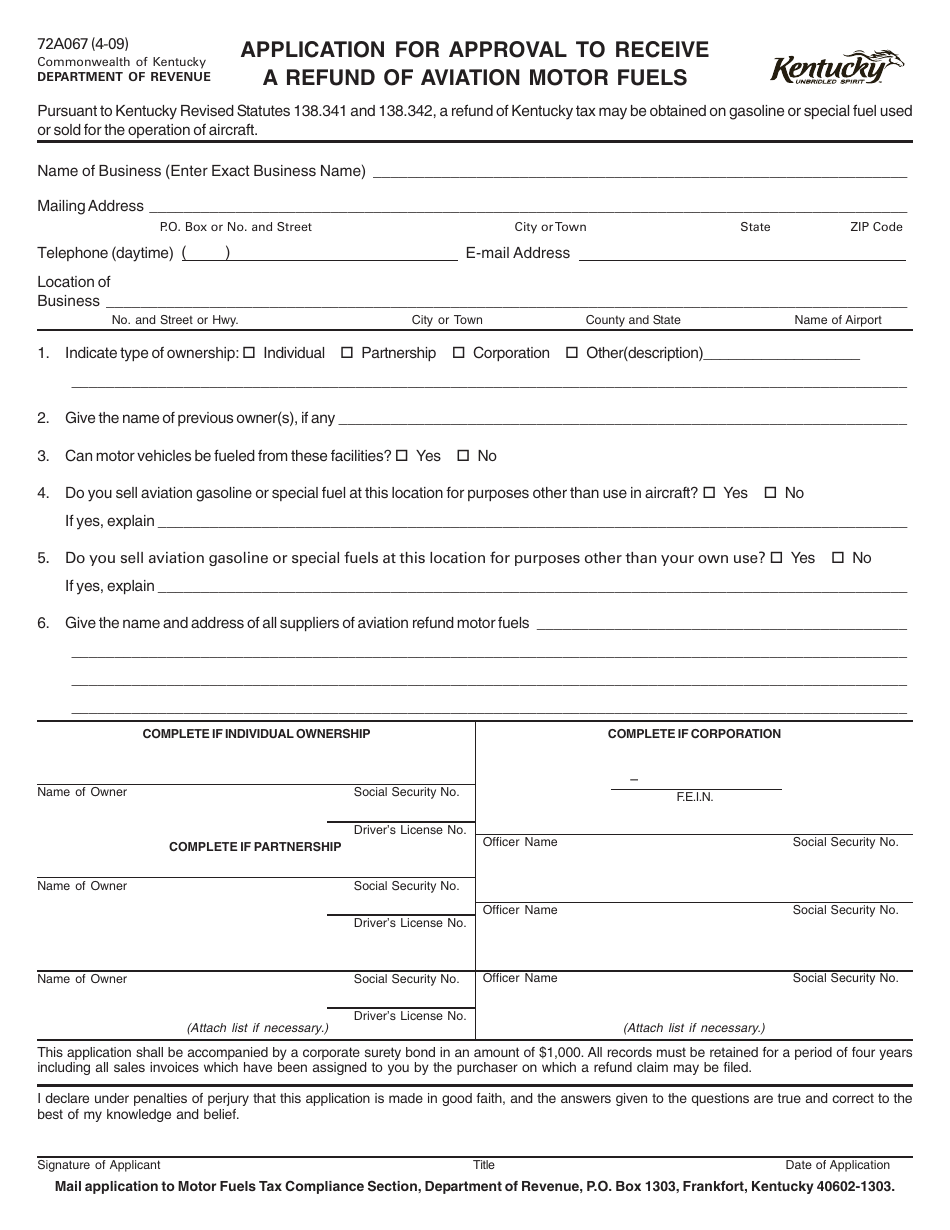

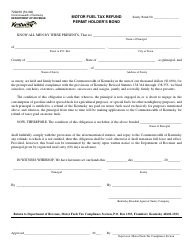

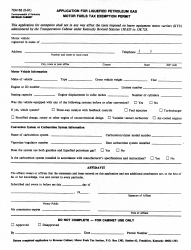

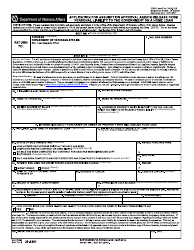

Form 72A067 Application for Approval to Receive a Refund of Aviation Motor Fuels - Kentucky

What Is Form 72A067?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A067?

A: Form 72A067 is an application for approval to receive a refund of aviation motor fuels in Kentucky.

Q: What is the purpose of Form 72A067?

A: The purpose of Form 72A067 is to apply for approval to receive a refund of aviation motor fuels in Kentucky.

Q: Who can use Form 72A067?

A: Any individual or entity that wants to receive a refund of aviation motor fuels in Kentucky can use Form 72A067.

Q: Are there any fees associated with Form 72A067?

A: No, there are no fees associated with Form 72A067.

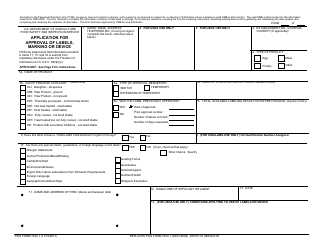

Q: What information do I need to provide on Form 72A067?

A: You need to provide information such as your name, address, tax account number, fuel supplier information, and details about the aviation motor fuel purchased.

Q: How do I submit Form 72A067?

A: You can submit Form 72A067 by mail or in person at the local revenue office.

Q: Is there a deadline to submit Form 72A067?

A: Yes, Form 72A067 must be filed within 3 years from the date of the fuel purchase.

Q: How long does it take to process Form 72A067?

A: The processing time for Form 72A067 can vary, but it usually takes a few weeks to receive a refund.

Q: Can I track the status of my Form 72A067?

A: Yes, you can contact the Kentucky Department of Revenue to track the status of your Form 72A067.

Form Details:

- Released on April 1, 2009;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A067 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.