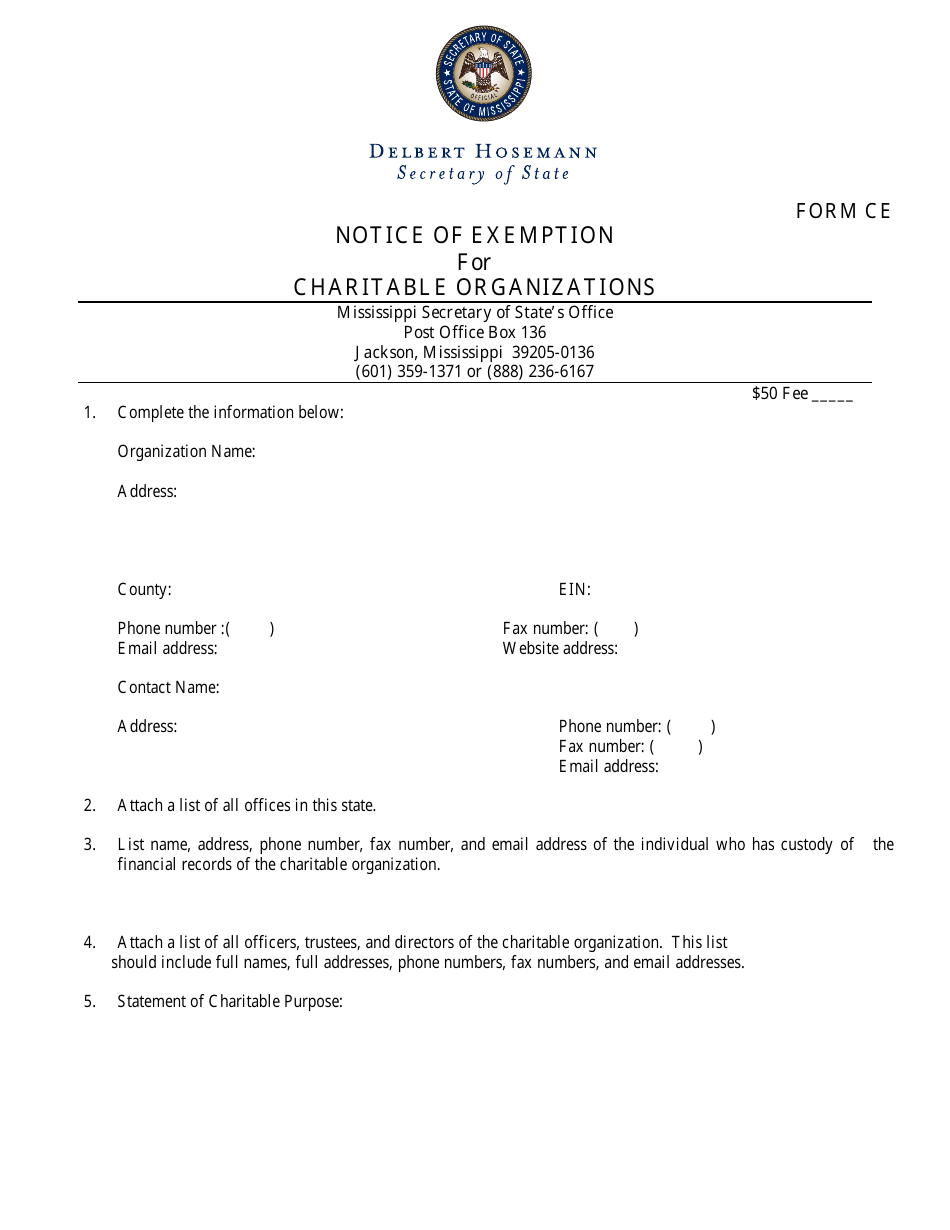

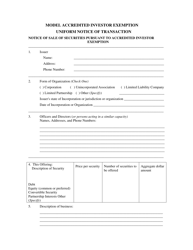

Form CE Notice of Exemption for Charitable Organizations - Mississippi

What Is Form CE?

This is a legal form that was released by the Mississippi Secretary of State - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a CE Notice of Exemption?

A: The CE Notice of Exemption is a form for charitable organizations in Mississippi to claim exemption from certain reporting requirements.

Q: Who can use the CE Notice of Exemption form?

A: Charitable organizations in Mississippi that meet certain criteria can use this form.

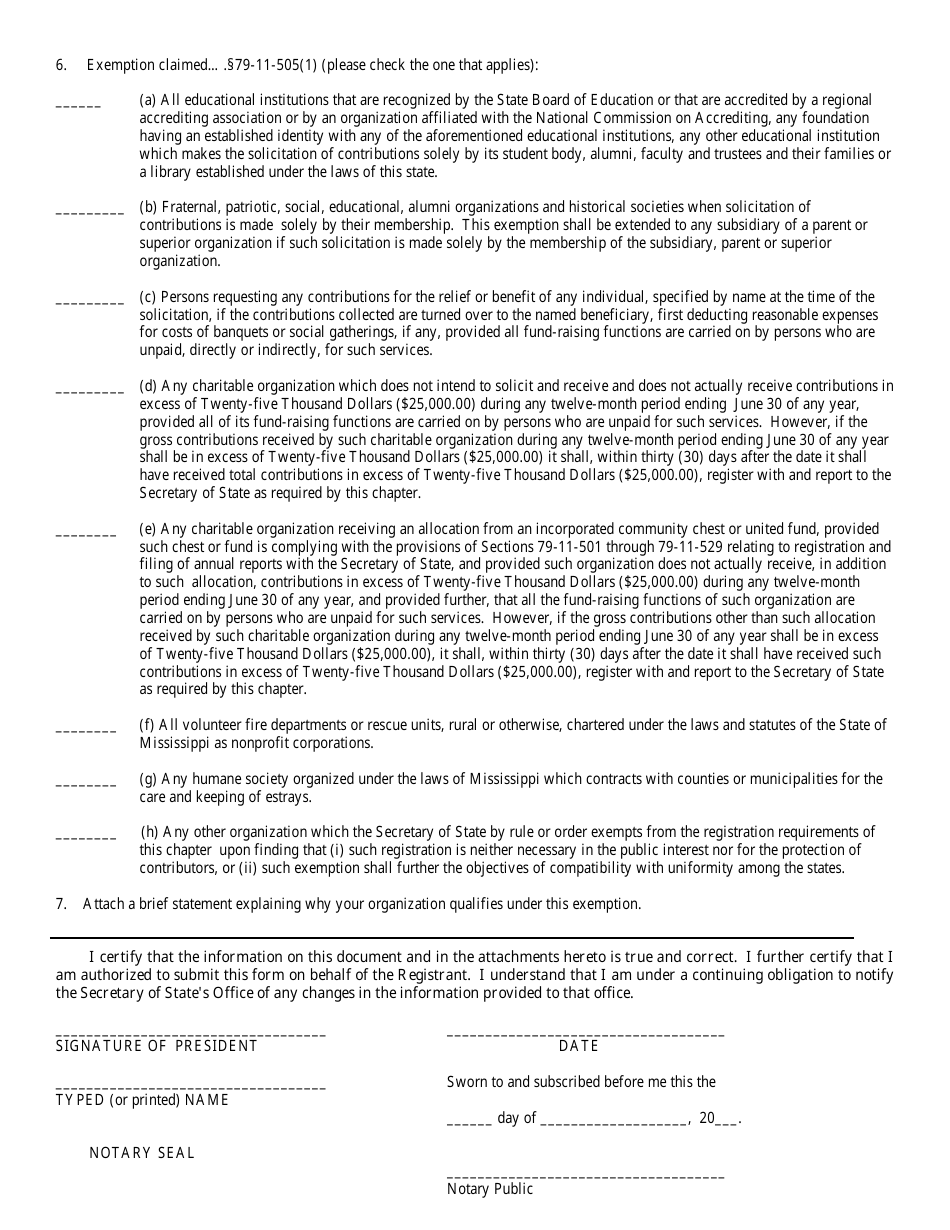

Q: What does the CE Notice of Exemption exempt organizations from?

A: This form exempts organizations from certain reporting requirements, such as the annual registration statement and financial report.

Q: How do I qualify for exemption?

A: To qualify, your organization must have gross contributions of less than $25,000 in the most recent fiscal year and not anticipate contributions of more than $50,000 in the current fiscal year.

Q: Is there a deadline to submit the CE Notice of Exemption?

A: Yes, the form must be filed with the Secretary of State's Office within 60 days of the end of your organization's fiscal year.

Q: Are there any fees associated with filing the CE Notice of Exemption?

A: No, there are no fees for filing this form.

Q: What happens after I submit the CE Notice of Exemption?

A: Once the form is approved, your organization will be exempt from certain reporting requirements for the current fiscal year.

Q: Do I need to renew the exemption every year?

A: No, the exemption is valid for one fiscal year, but you will need to file a new CE Notice of Exemption each year if your organization continues to meet the criteria.

Form Details:

- The latest edition provided by the Mississippi Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CE by clicking the link below or browse more documents and templates provided by the Mississippi Secretary of State.