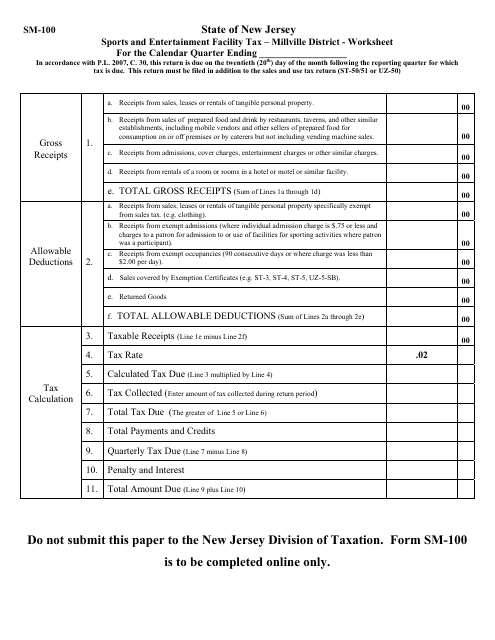

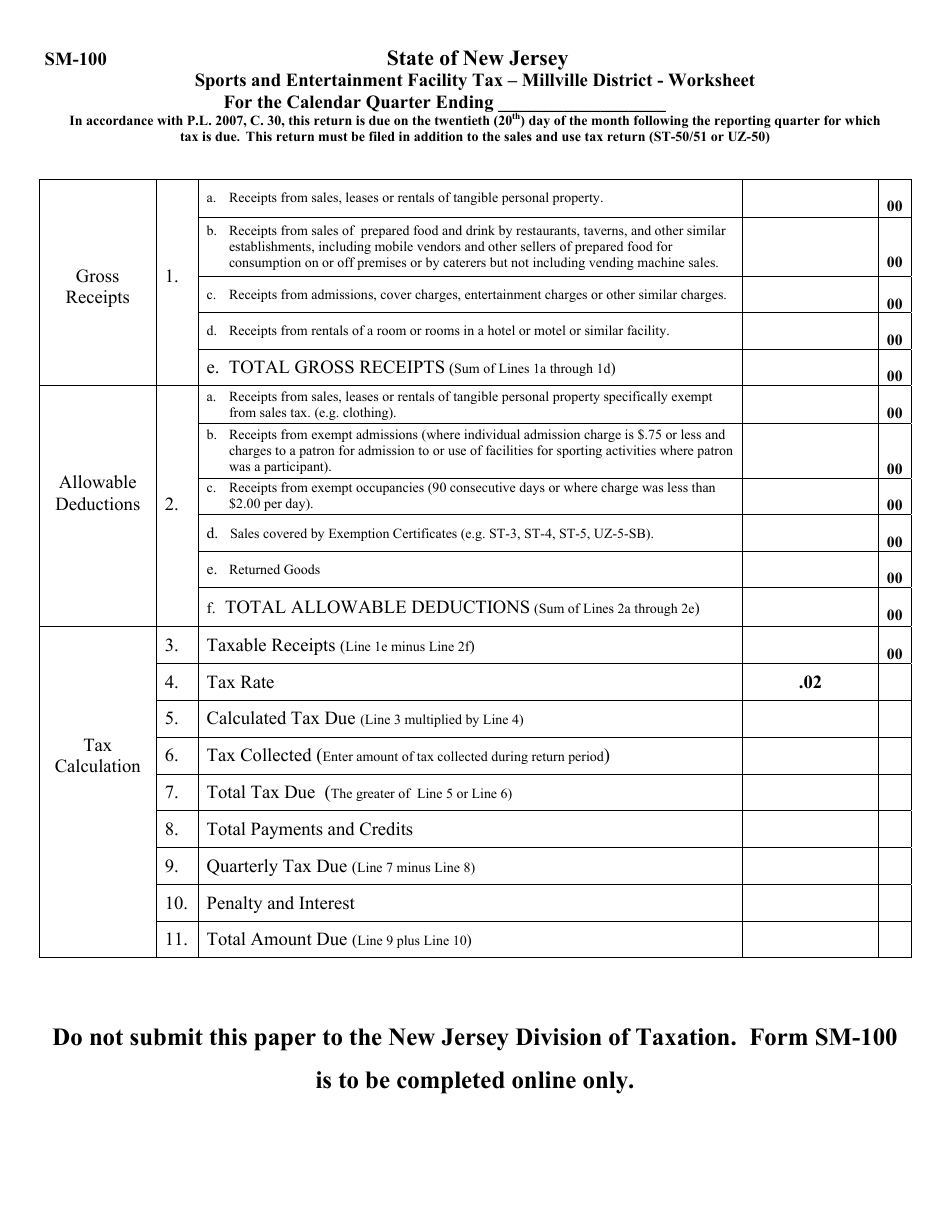

Form SM-100 Sports and Entertainment Facility Tax " Millville District - Worksheet - New Jersey

What Is Form SM-100?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form SM-100 Sports and Entertainment Facility Tax?

A: Form SM-100 is a tax form related to sports and entertainment facilities in Millville District, New Jersey.

Q: Who needs to fill out Form SM-100?

A: Owners and operators of sports and entertainment facilities in the Millville District of New Jersey need to fill out Form SM-100.

Q: What is the purpose of Form SM-100?

A: The purpose of Form SM-100 is to report and pay the Sports and Entertainment Facility Tax in Millville District, New Jersey.

Q: When is the deadline for filing Form SM-100?

A: The deadline for filing Form SM-100 is typically on or before the last day of the month following the end of the tax quarter.

Q: What happens if I don't file Form SM-100?

A: Failure to file Form SM-100 or late filing may result in penalties and interest.

Q: How do I fill out Form SM-100?

A: You need to provide information about your sports and entertainment facility, gross receipts, and calculate the tax due according to the instructions provided on the form.

Q: Is Form SM-100 applicable to all sports and entertainment facilities in New Jersey?

A: No, Form SM-100 is specific to sports and entertainment facilities in the Millville District of New Jersey.

Q: Can I e-file Form SM-100?

A: As of now, electronic filing is not available for Form SM-100. You need to file a paper copy.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SM-100 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.