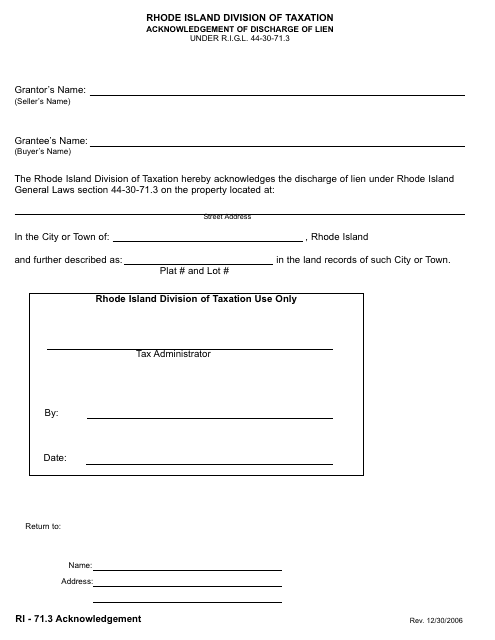

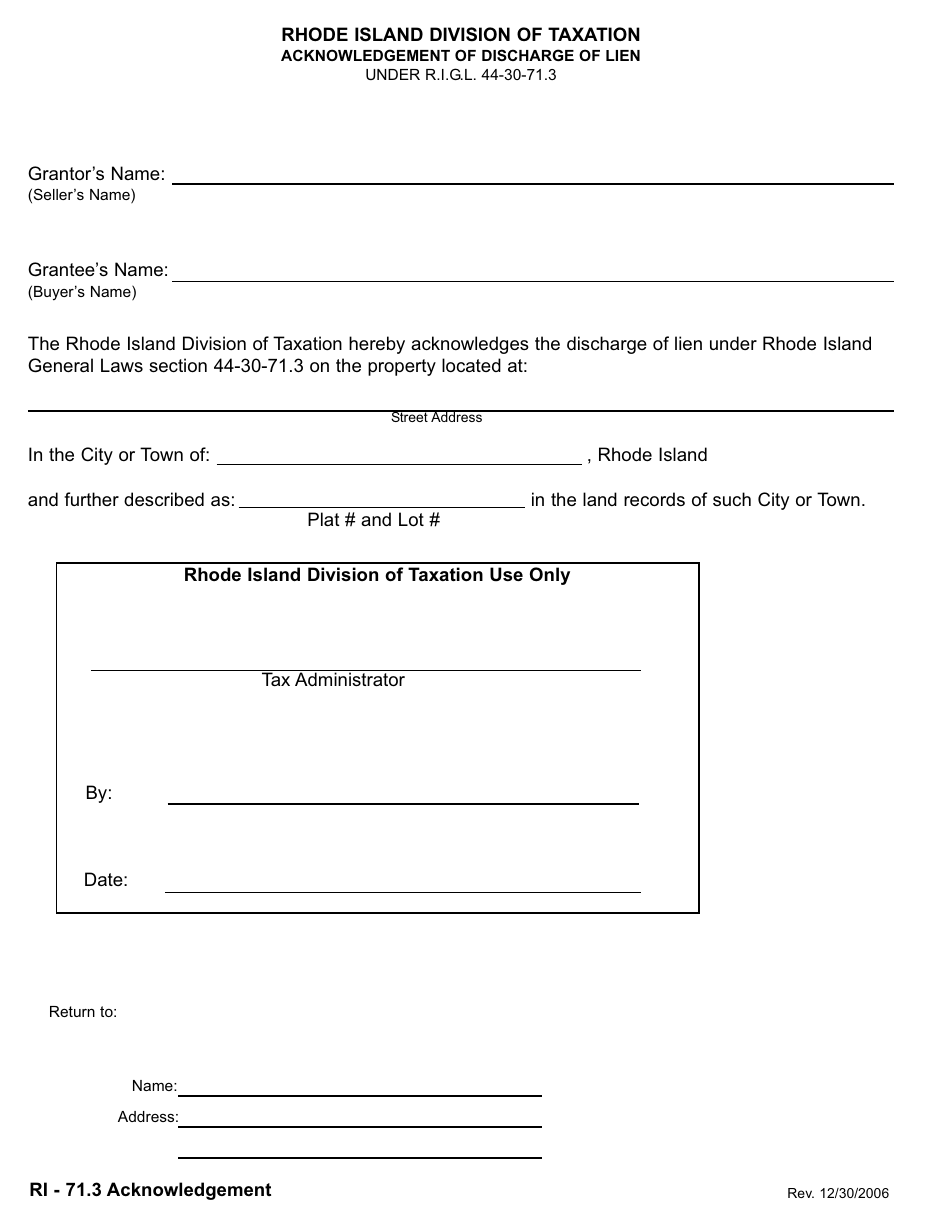

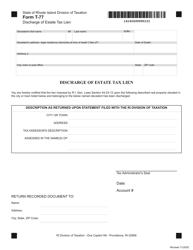

Acknowledgement of Discharge of Lien - Rhode Island

Acknowledgement of Discharge of Lien is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is an Acknowledgment of Discharge of Lien?

A: An Acknowledgment of Discharge of Lien is a legal document that releases a previously recorded lien on a property.

Q: What is a lien?

A: A lien is a legal claim or hold on a property or asset to secure the payment of a debt or obligation.

Q: Why would a lien be discharged?

A: A lien may be discharged when the debt or obligation secured by the lien has been paid off or otherwise satisfied.

Q: Is an Acknowledgment of Discharge of Lien required in Rhode Island?

A: Yes, an Acknowledgment of Discharge of Lien is required in Rhode Island to formally release a lien from a property.

Q: Who can provide an Acknowledgement of Discharge of Lien in Rhode Island?

A: The lienholder or their representative can provide an Acknowledgment of Discharge of Lien in Rhode Island.

Q: What information is typically included in an Acknowledgment of Discharge of Lien?

A: An Acknowledgment of Discharge of Lien typically includes the property owner's name, property description, lienholder information, and details of the discharged lien.

Q: How is an Acknowledgment of Discharge of Lien recorded in Rhode Island?

A: An Acknowledgment of Discharge of Lien is typically recorded with the City or Town Clerk's office in the jurisdiction where the property is located.

Form Details:

- Released on December 30, 2006;

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.