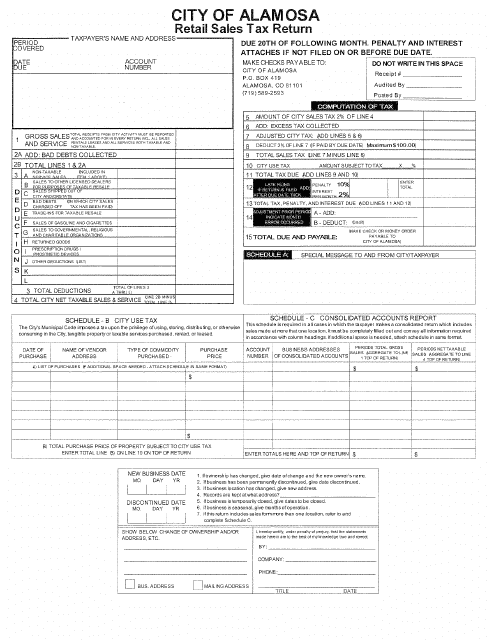

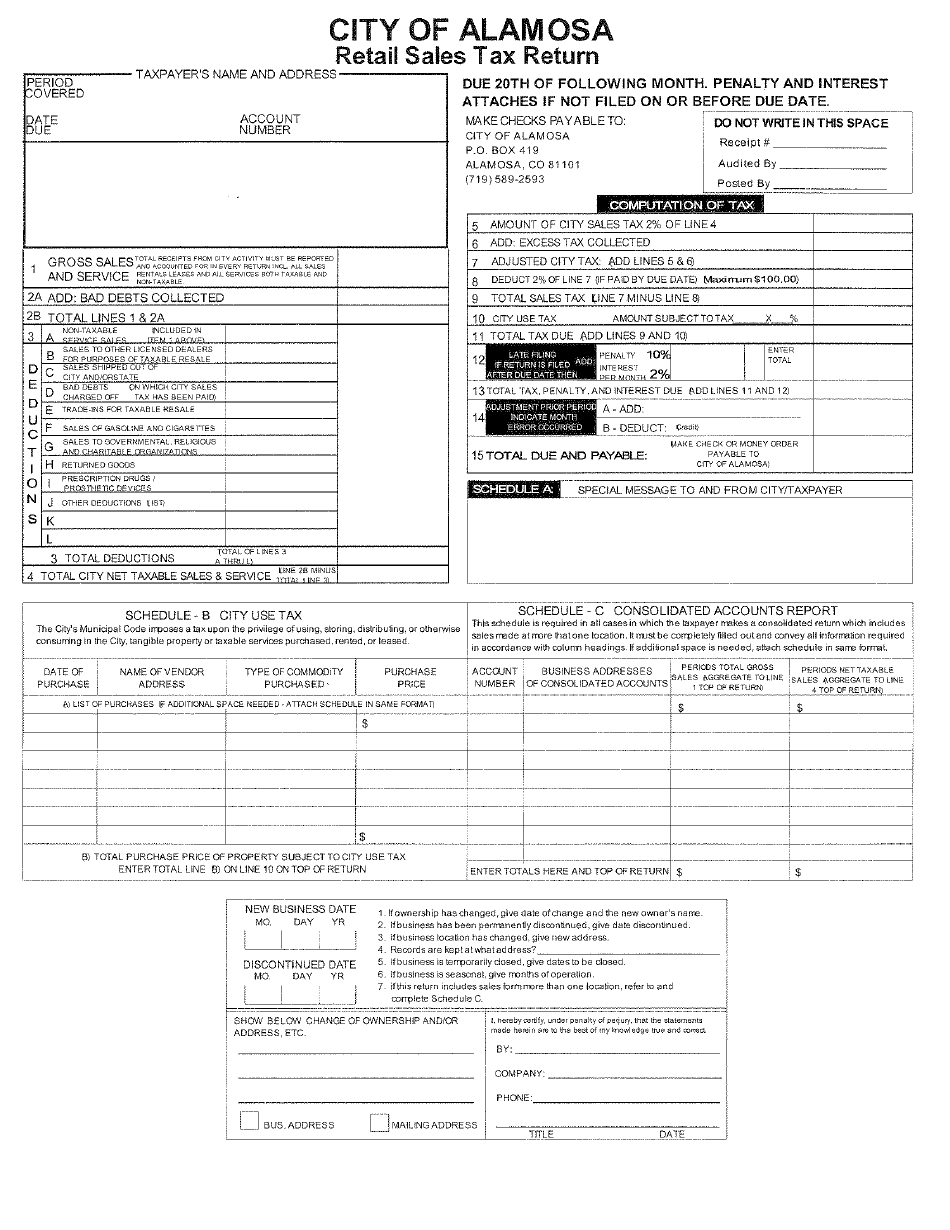

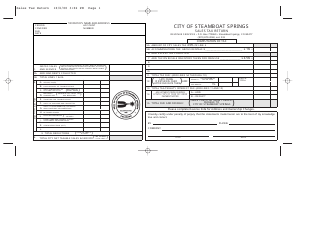

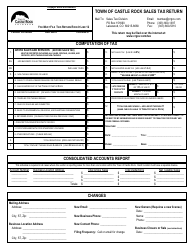

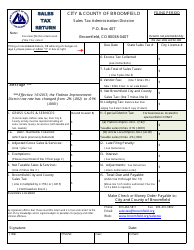

Retail Sales Tax Return - City of Alamosa, Colorado

Retail Sales Tax Return is a legal document that was released by the Colorado Department of Revenue - a government authority operating within Colorado. The form may be used strictly within City of Alamosa.

FAQ

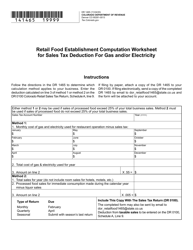

Q: What is the Retail Sales Tax Return?

A: The Retail Sales Tax Return is a form used to report and remit sales tax collected by businesses in the City of Alamosa, Colorado.

Q: Who needs to file the Retail Sales Tax Return?

A: Any business that sells taxable goods or services in the City of Alamosa, Colorado needs to file the Retail Sales Tax Return.

Q: How often do I need to file the Retail Sales Tax Return?

A: The frequency of filing depends on your sales volume. Most businesses are required to file on a monthly basis, but some may be eligible for quarterly or annual filing.

Q: What is the deadline for filing the Retail Sales Tax Return?

A: The deadline for filing the Retail Sales Tax Return is on or before the 20th day of the month following the reporting period.

Q: What if I am unable to file the Retail Sales Tax Return on time?

A: If you are unable to file the Retail Sales Tax Return on time, you may be subject to late filing penalties and interest charges.

Q: Are there any exemptions or deductions available on the Retail Sales Tax Return?

A: Yes, there may be exemptions or deductions available for certain types of sales. It is recommended to consult the City of Alamosa's Sales Tax Department for more information.

Q: What happens if I fail to file the Retail Sales Tax Return?

A: Failure to file the Retail Sales Tax Return may result in penalties and interest charges, and the City of Alamosa may take legal action to collect the unpaid taxes.

Q: Can I amend the Retail Sales Tax Return if I made a mistake?

A: Yes, you can file an amended Retail Sales Tax Return if you made a mistake. However, it is important to correct the mistake as soon as possible.

Form Details:

- The latest edition currently provided by the Colorado Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.