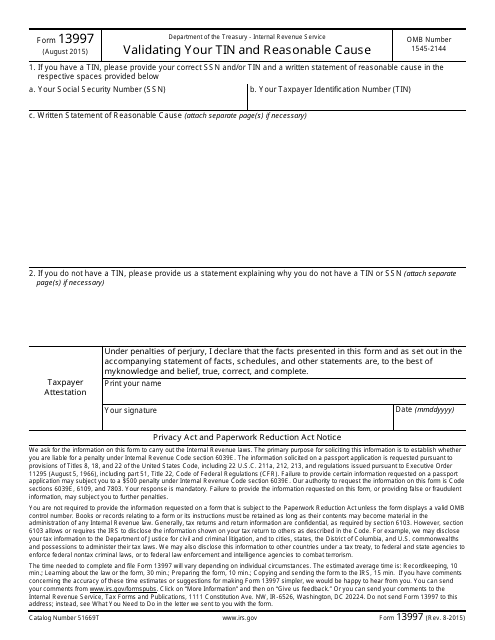

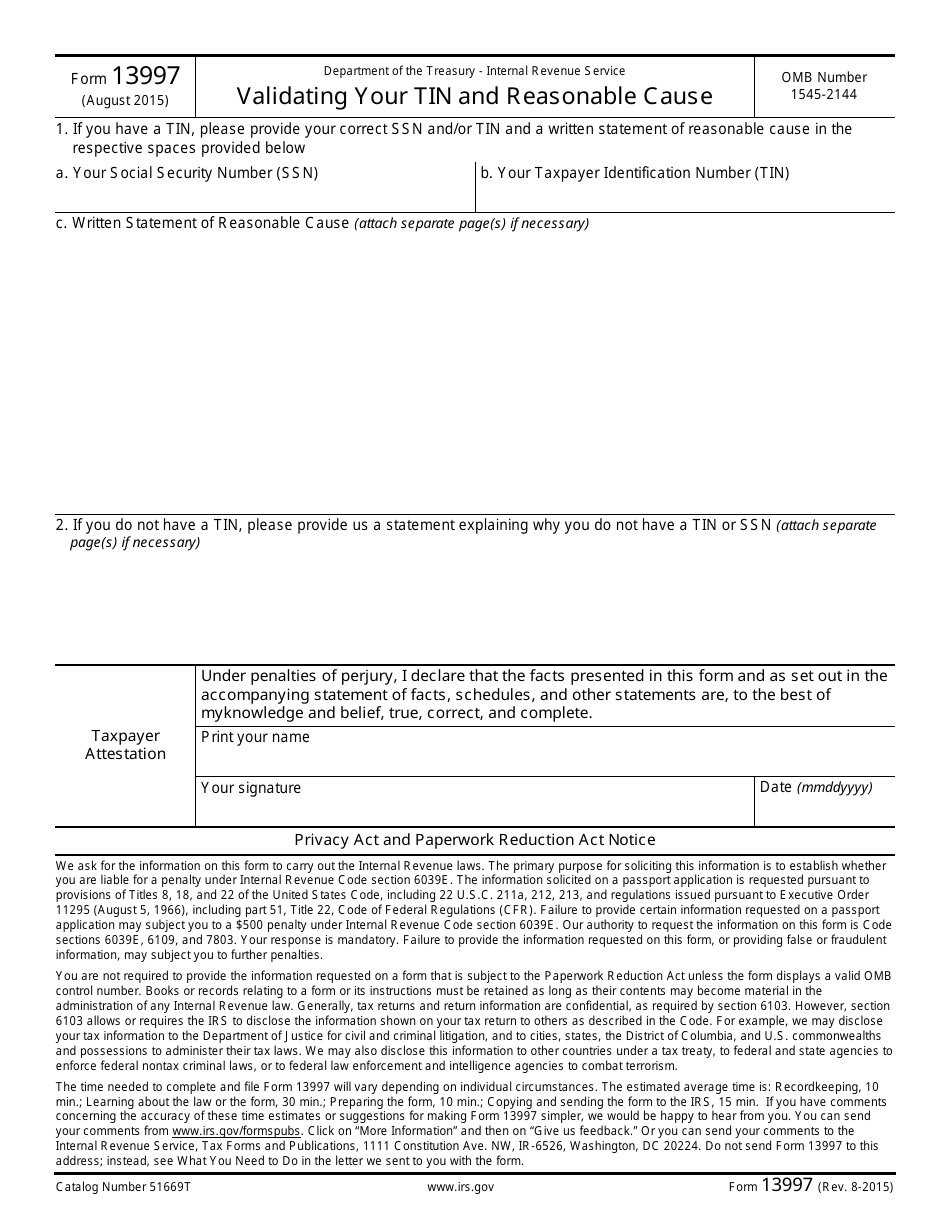

IRS Form 13997 Validating Your Tin and Reasonable Cause

What Is IRS Form 13997?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on August 1, 2015. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 13997?

A: IRS Form 13997 is used to validate your Taxpayer Identification Number (TIN) and to provide reasonable cause for certain errors on your tax return.

Q: Why do I need to validate my TIN?

A: Validating your TIN ensures that the IRS has accurate information about your tax filing status and helps prevent any issues or delays with your tax return.

Q: What is reasonable cause?

A: Reasonable cause refers to a valid explanation or justification for a mistake or omission on your tax return.

Q: When should I use IRS Form 13997?

A: You should use IRS Form 13997 when you need to validate your TIN and provide reasonable cause for errors on your tax return, as requested by the IRS.

Q: How do I fill out IRS Form 13997?

A: You will need to follow the instructions provided with the form and provide accurate information about your TIN, the errors on your tax return, and the reasonable cause for those errors.

Q: What happens after I submit IRS Form 13997?

A: The IRS will review your form and the information you provided. They may request additional documentation or contact you for further clarification if needed.

Q: Can I e-file IRS Form 13997?

A: No, currently IRS Form 13997 is not available for e-filing. You will need to submit a paper copy of the form by mail.

Q: Is IRS Form 13997 applicable to both the US and Canada?

A: No, IRS Form 13997 is specific to the United States. Canadians may have different forms and procedures for validating their TIN and providing reasonable cause.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13997 through the link below or browse more documents in our library of IRS Forms.