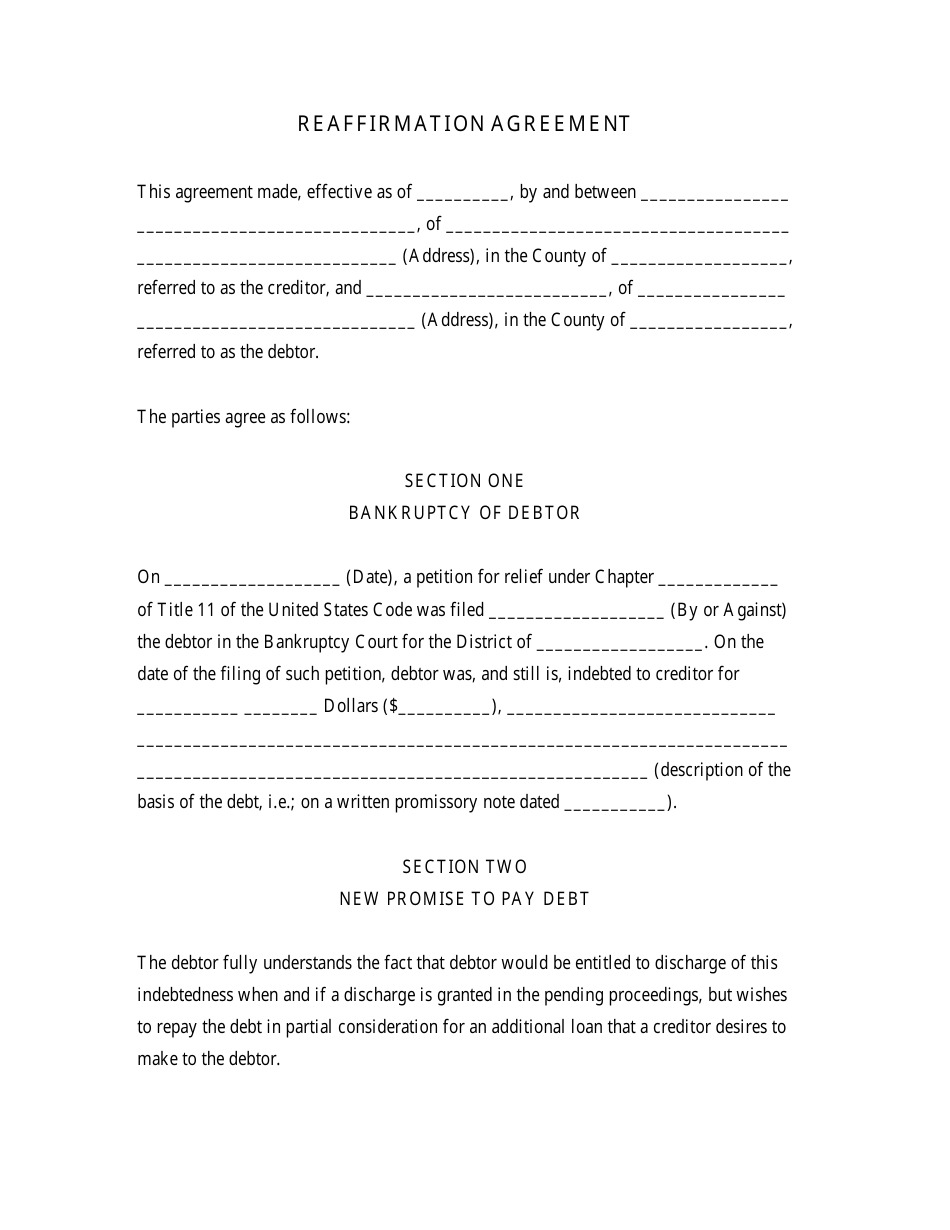

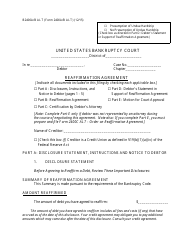

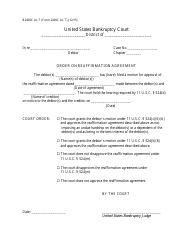

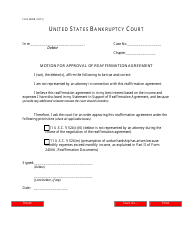

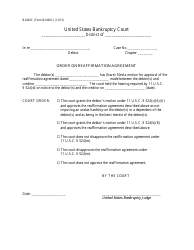

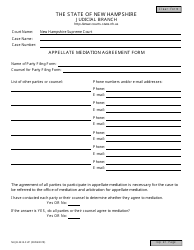

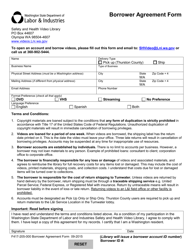

Reaffirmation Agreement Form

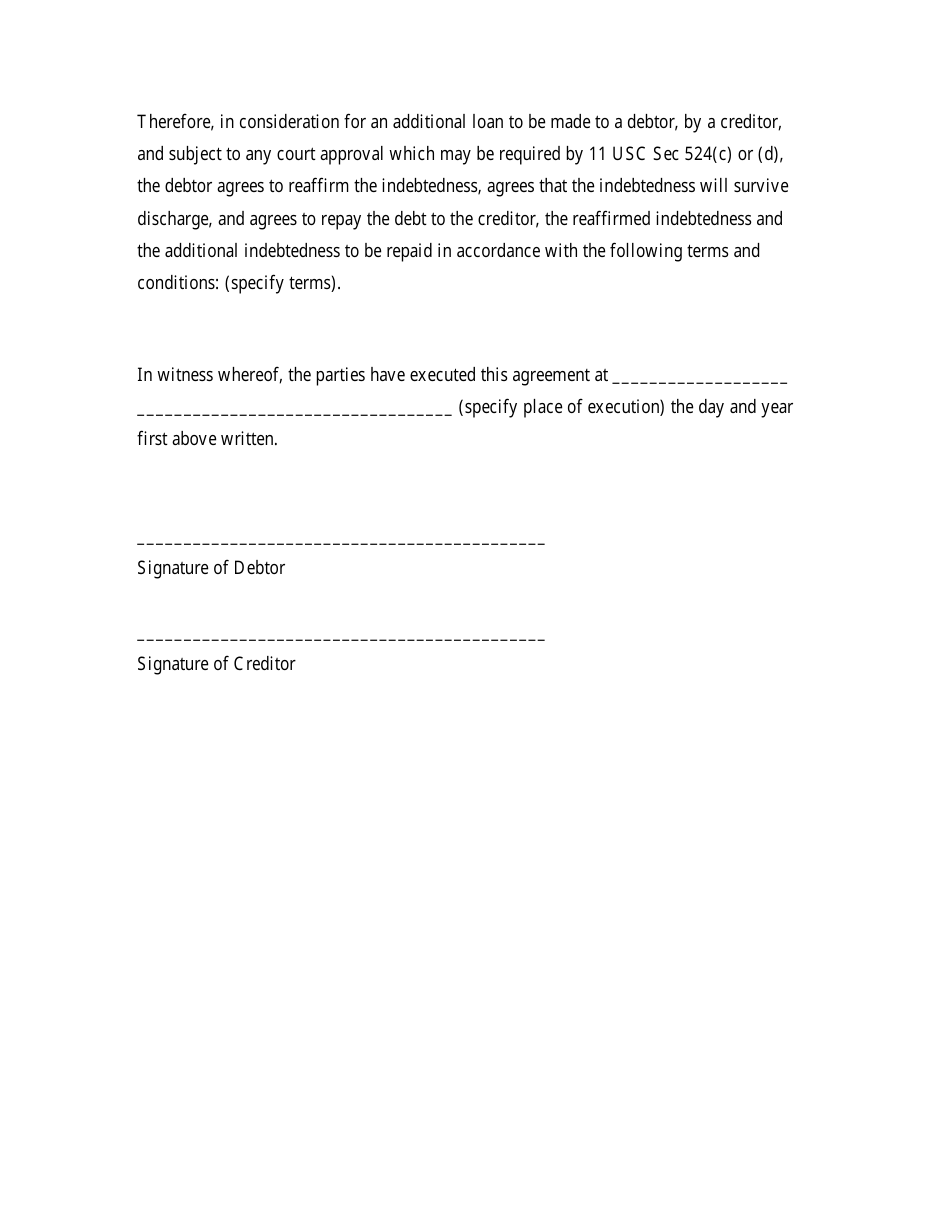

A reaffirmation agreement form is used in bankruptcy cases to allow a debtor to keep a particular debt, such as a car loan or a mortgage, even though they have filed for bankruptcy. It essentially makes the debtor responsible for repaying the debt despite the bankruptcy filing.

The reaffirmation agreement form is typically filed by the debtor in bankruptcy cases.

FAQ

Q: What is a reaffirmation agreement form?

A: A reaffirmation agreement form is a legal document that allows a borrower to reaffirm their commitment to repay a debt after filing for bankruptcy.

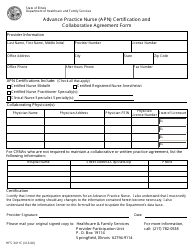

Q: Why would someone need to use a reaffirmation agreement form?

A: Someone may need to use a reaffirmation agreement form to keep certain assets, such as a car or a home, that are secured by a debt from being repossessed or foreclosed upon.

Q: What happens if someone does not sign a reaffirmation agreement form?

A: If someone does not sign a reaffirmation agreement form, their debt may be discharged in bankruptcy and the creditor may be prohibited from collecting the debt.

Q: Is a reaffirmation agreement form required in bankruptcy?

A: No, a reaffirmation agreement form is not required in bankruptcy. It is optional and usually only used when a borrower wants to keep certain assets.

Q: Can a reaffirmation agreement form be cancelled?

A: Yes, a reaffirmation agreement form can be cancelled within a certain time period after it is signed, typically before the bankruptcy court issues a discharge order.