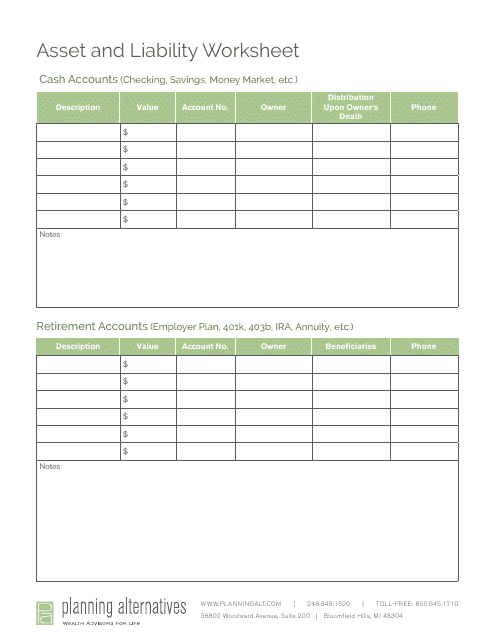

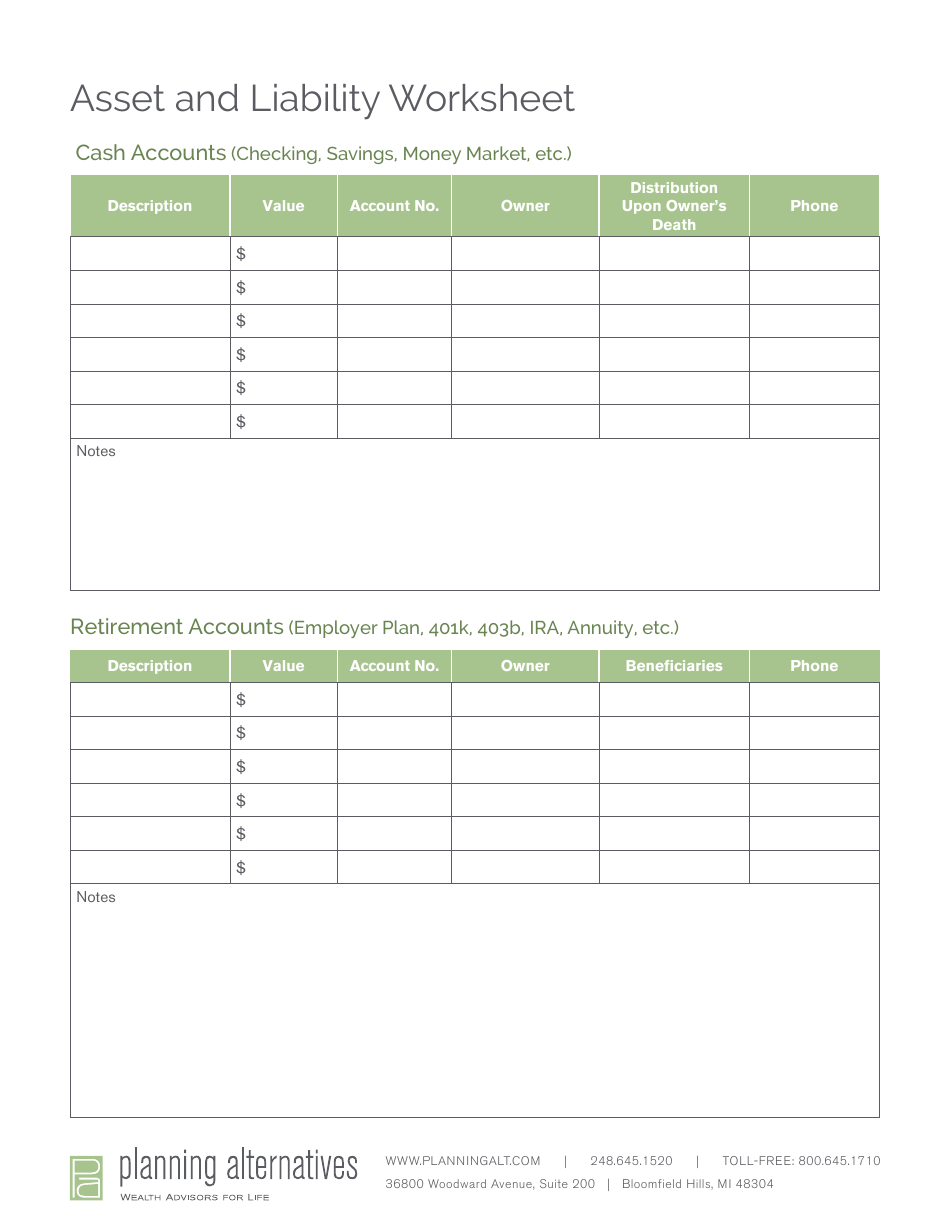

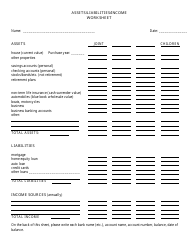

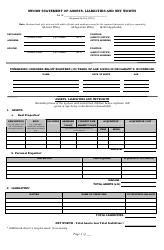

Asset and Liability Worksheet Template - Planning Alternatives

The Asset and Liability Worksheet Template - Planning Alternatives is used to help individuals or businesses plan and assess their financial situation. It helps in organizing and evaluating assets (things you own) and liabilities (things you owe) to make informed decisions about financial planning and management.

FAQ

Q: What is an asset and liability worksheet?

A: An asset and liability worksheet is a template used for organizing and tracking a person's assets and liabilities.

Q: Why is it important to use an asset and liability worksheet?

A: Using an asset and liability worksheet helps individuals understand their financial standing and make informed decisions about their finances.

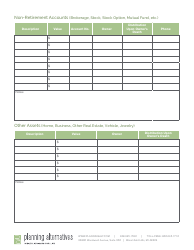

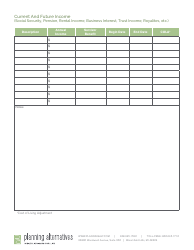

Q: What should be included in an asset and liability worksheet?

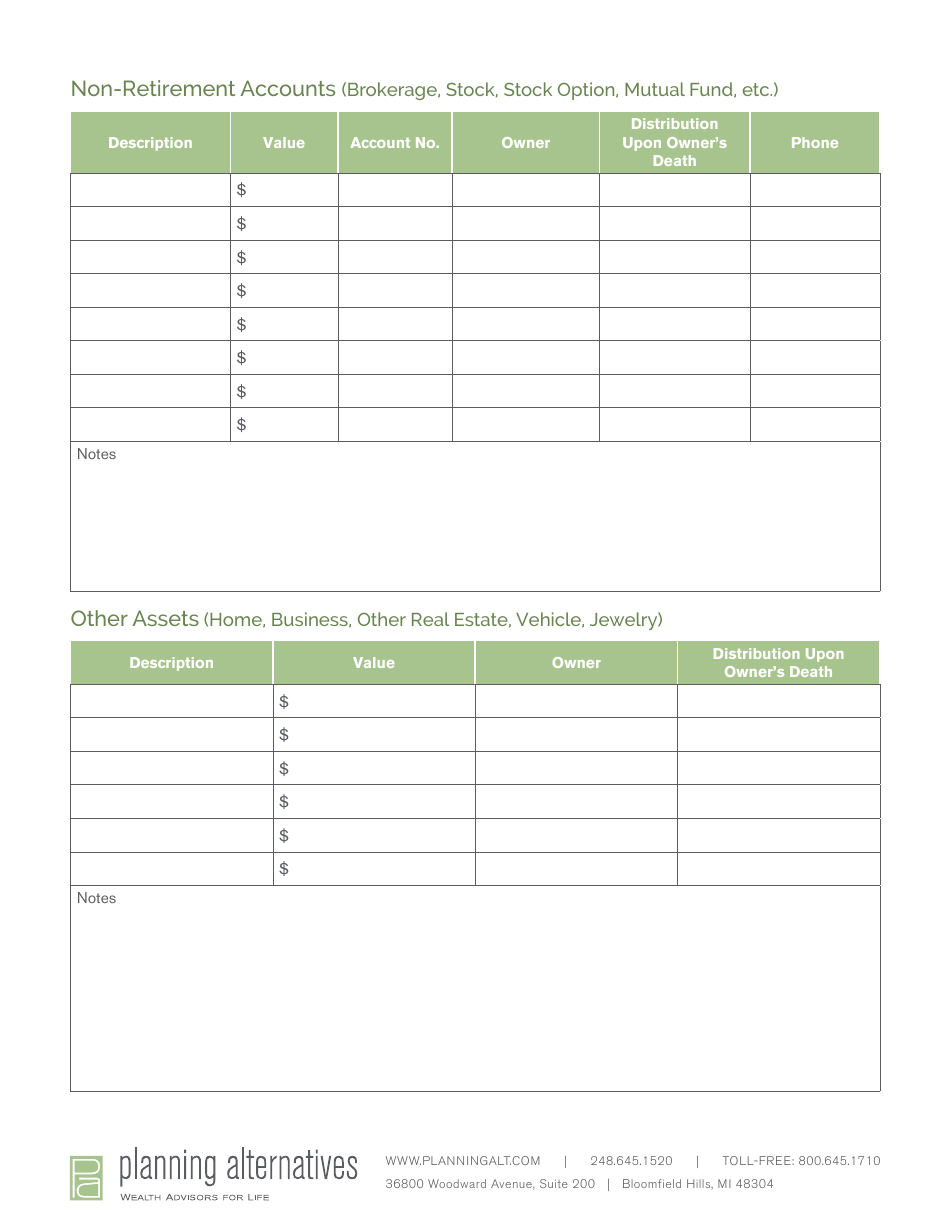

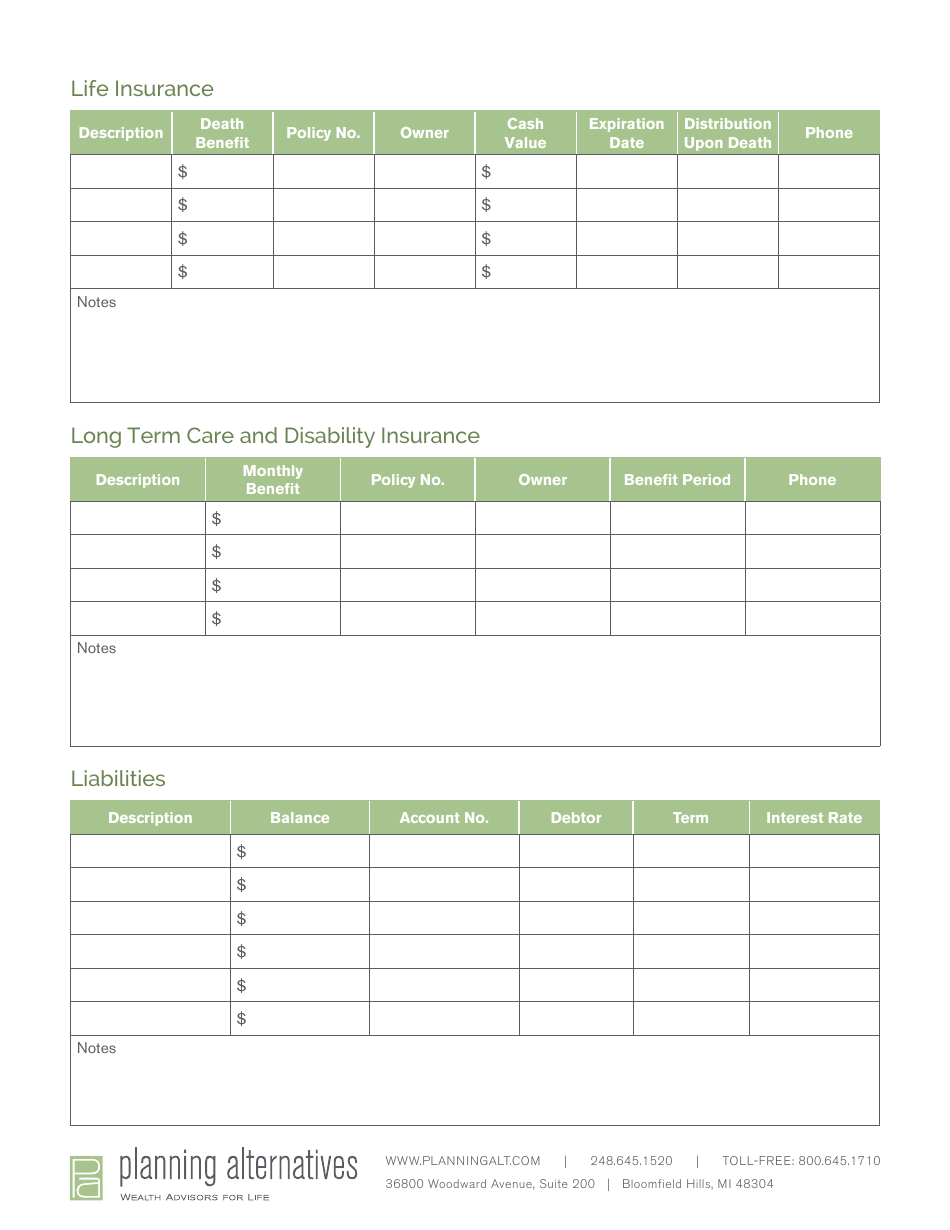

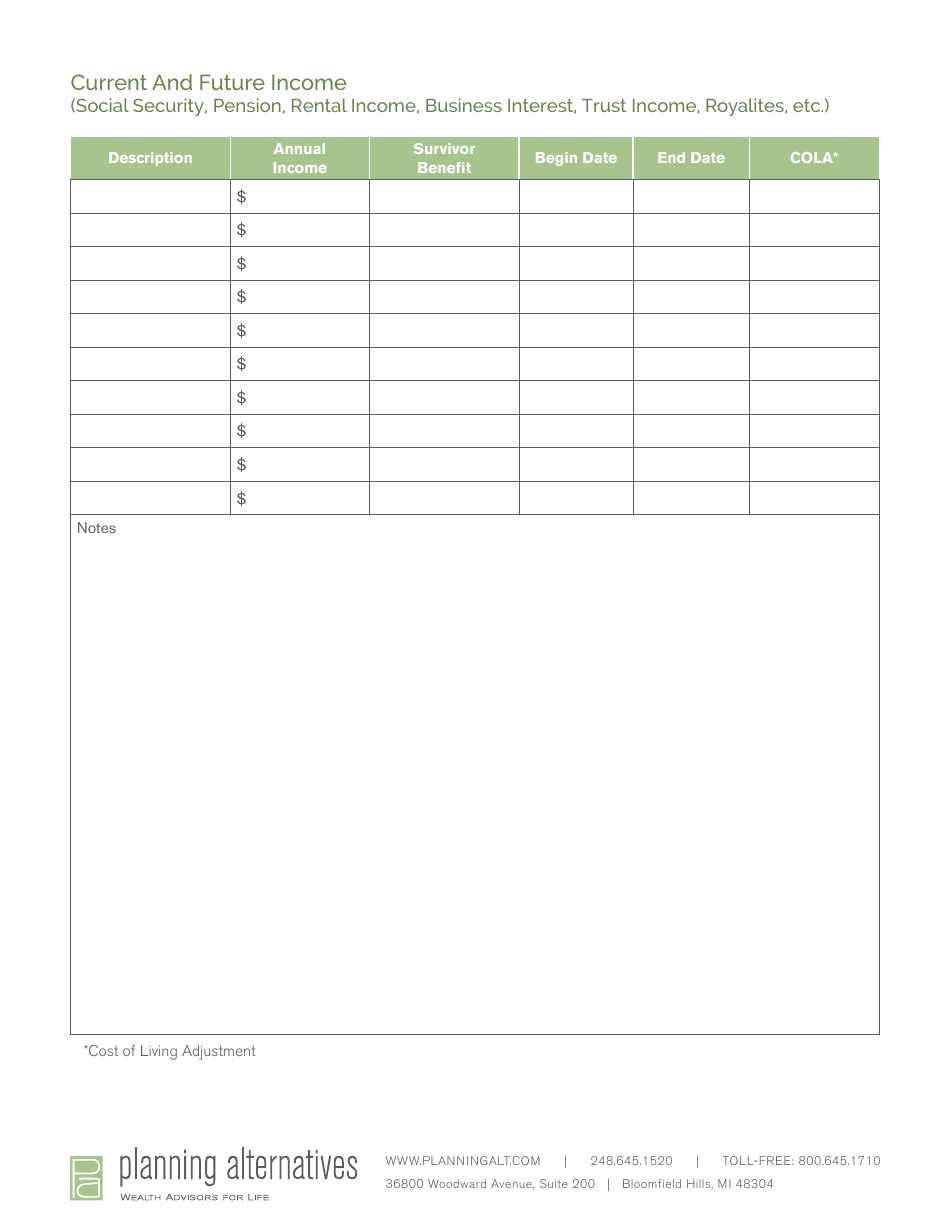

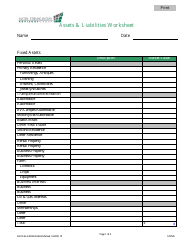

A: An asset and liability worksheet should include a list of all assets, such as bank accounts and investments, and liabilities, such as loans and debts.

Q: How can I use an asset and liability worksheet?

A: To use an asset and liability worksheet, start by listing all your assets and their values, then list all your liabilities and their amounts. Finally, calculate your net worth by subtracting your total liabilities from your total assets.

Q: Can I customize an asset and liability worksheet template?

A: Yes, you can customize an asset and liability worksheet template to fit your specific financial situation and goals.

Q: How often should I update my asset and liability worksheet?

A: It is recommended to update your asset and liability worksheet regularly, such as monthly or annually, to accurately track changes in your financial position.

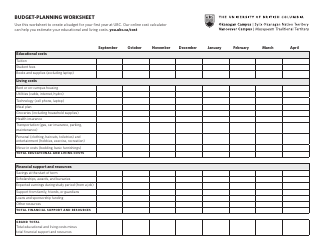

Q: What are some alternative planning methods?

A: Alternative planning methods include budgeting, investment planning, retirement planning, and estate planning.

Q: Why should I consider alternative planning methods?

A: Considering alternative planning methods can help you achieve specific financial goals, such as saving for retirement or paying off debt.