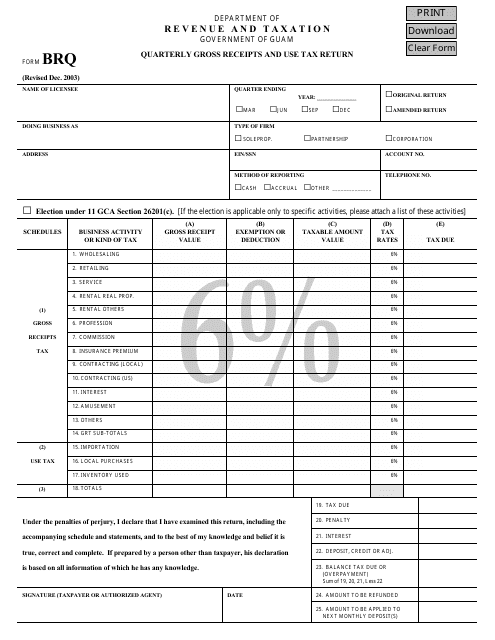

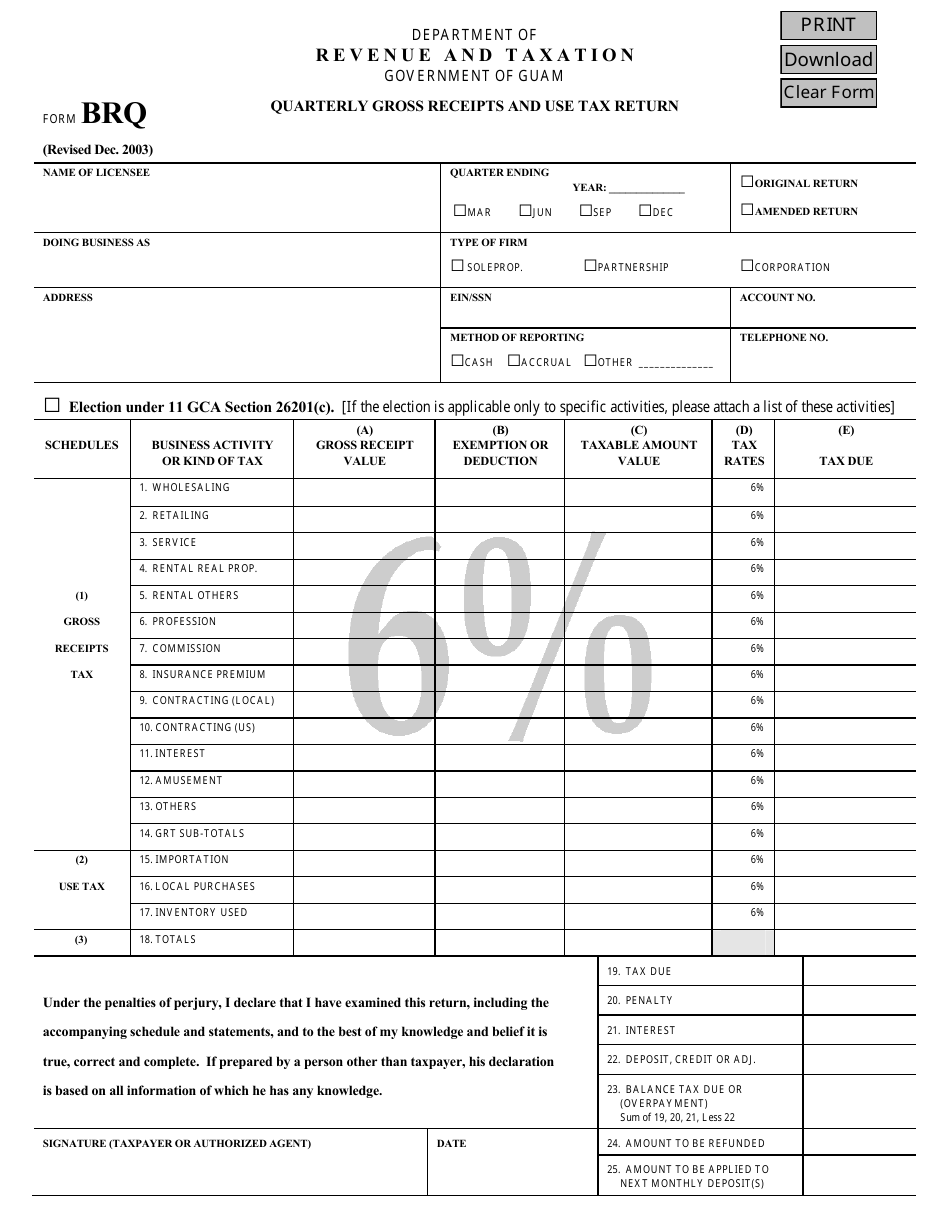

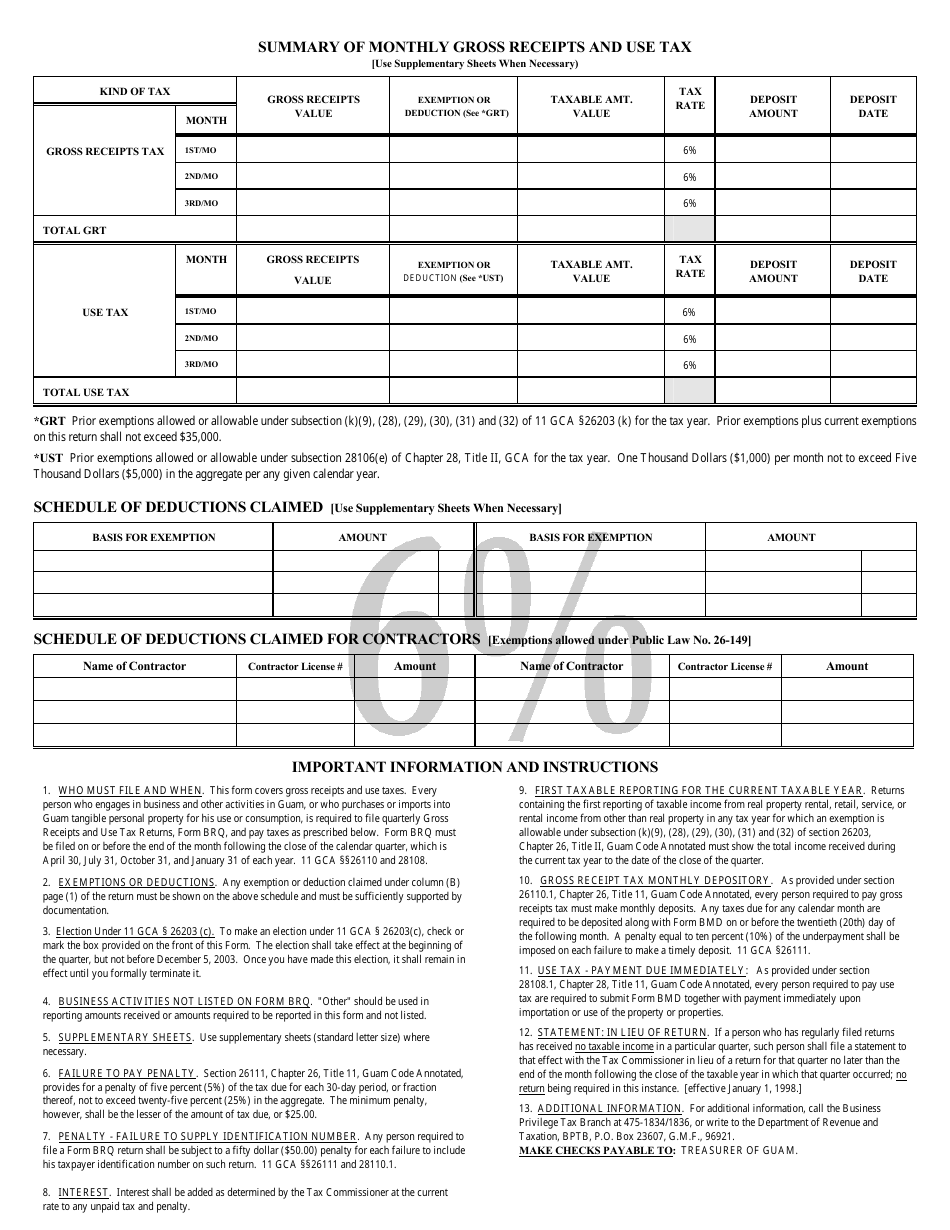

Form brq Quarterly Gross Receipts and Use Tax Return - Guam

What Is Form brq?

This is a legal form that was released by the Guam Department of Revenue and Taxation - a government authority operating within Guam. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form BRQ?

A: Form BRQ is the Quarterly Gross Receipts and Use Tax Return for Guam.

Q: Who needs to file the Form BRQ?

A: Businesses in Guam that have gross receipts and are subject to the Gross Receipts and Use Tax need to file Form BRQ.

Q: What is the purpose of Form BRQ?

A: The purpose of Form BRQ is to report gross receipts and calculate the Gross Receipts and Use Tax liability.

Q: When is Form BRQ due?

A: Form BRQ is due on the 20th day of the month following the end of the quarter.

Q: Are there any penalties for late or incorrect filing of Form BRQ?

A: Yes, late or incorrect filing of Form BRQ may result in penalties and interest charges. It is important to file the form accurately and on time.

Q: What if I have questions or need assistance with Form BRQ?

A: If you have questions or need assistance with Form BRQ, you can contact the Guam Department of Revenue and Taxation for guidance.

Form Details:

- Released on December 1, 2003;

- The latest edition provided by the Guam Department of Revenue and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form brq by clicking the link below or browse more documents and templates provided by the Guam Department of Revenue and Taxation.