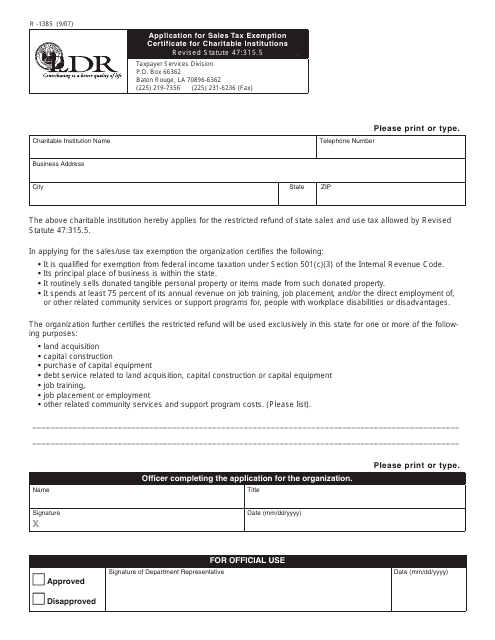

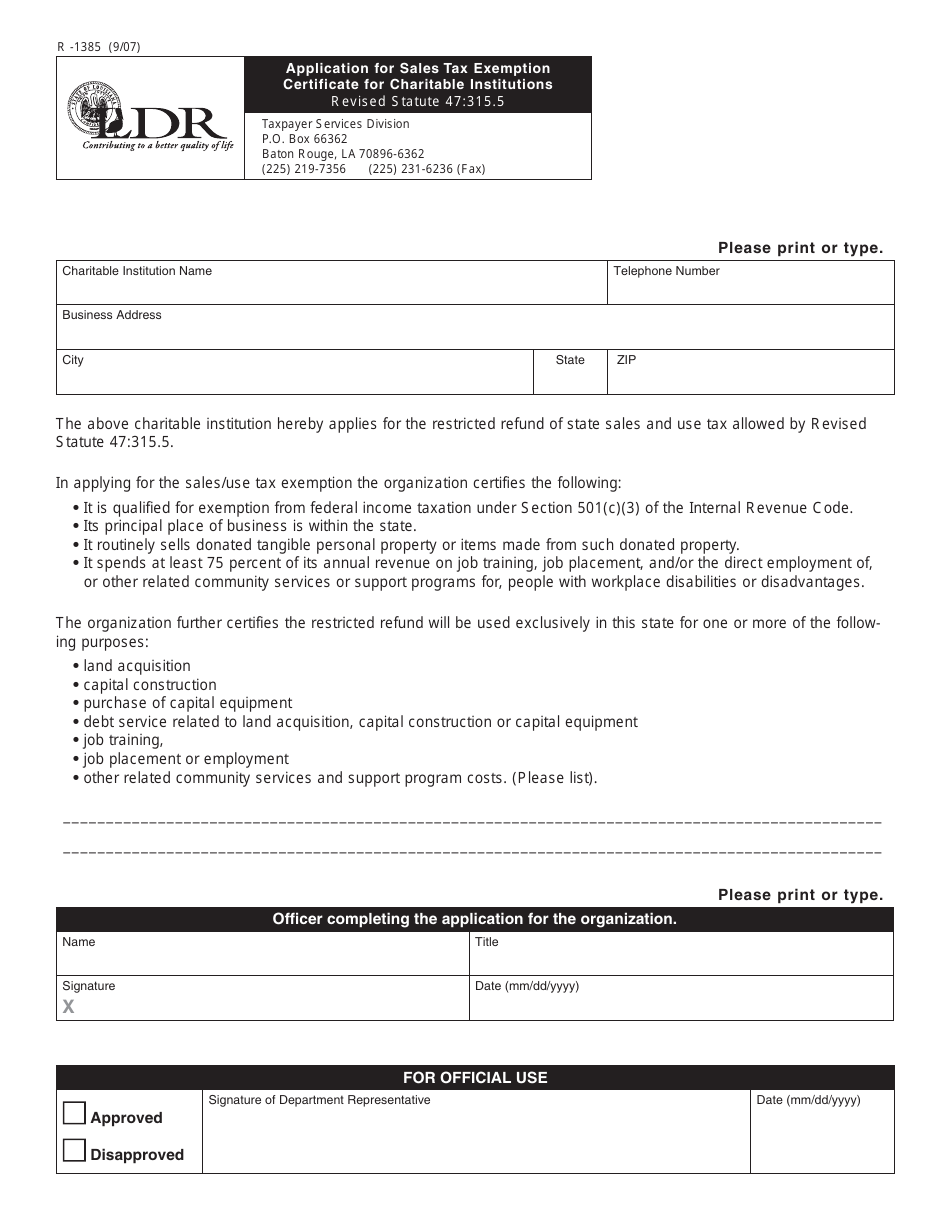

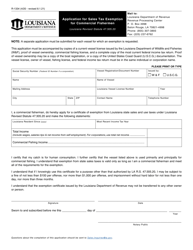

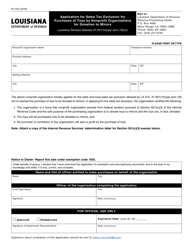

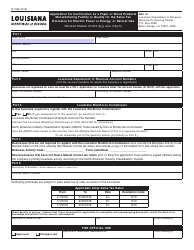

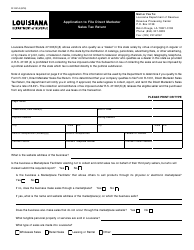

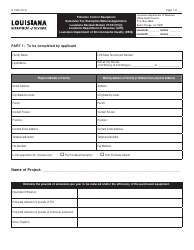

Form R-1385 Application for Sales Tax Exemption Certificate for Charitable Institutions - Louisiana

What Is Form R-1385?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1385?

A: Form R-1385 is an application for a sales tax exemption certificate for charitable institutions in Louisiana.

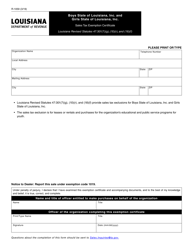

Q: Who needs to fill out Form R-1385?

A: Charitable institutions in Louisiana that want to apply for a sales tax exemption certificate need to fill out Form R-1385.

Q: What is the purpose of Form R-1385?

A: The purpose of Form R-1385 is to apply for a sales tax exemption certificate for charitable institutions in Louisiana.

Q: Is there a fee for submitting Form R-1385?

A: No, there is no fee for submitting Form R-1385.

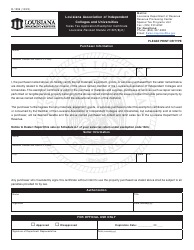

Q: What documentation is required to accompany Form R-1385?

A: You will need to provide supporting documentation such as proof of nonprofit status and financial statements with your Form R-1385 application.

Q: How long does it take to process Form R-1385?

A: The processing time for Form R-1385 can vary, so it is best to contact the Louisiana Department of Revenue for the most accurate information.

Q: What should I do if I have any questions about Form R-1385?

A: If you have any questions about Form R-1385, you should contact the Louisiana Department of Revenue for assistance.

Form Details:

- Released on September 1, 2007;

- The latest edition provided by the Louisiana Department of Revenue;

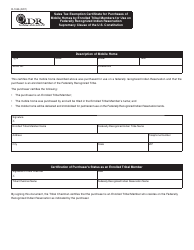

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1385 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.