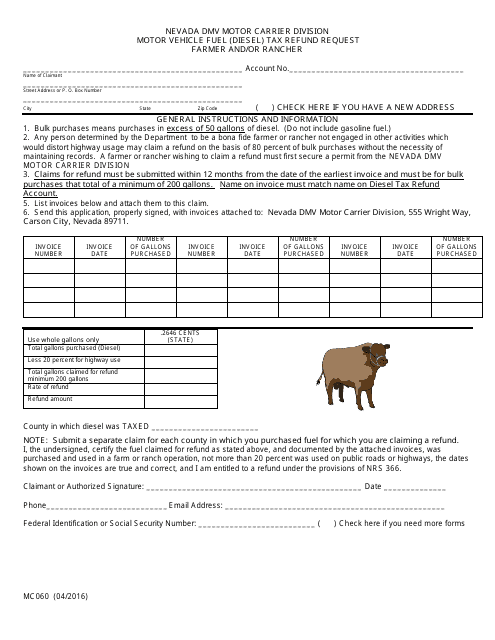

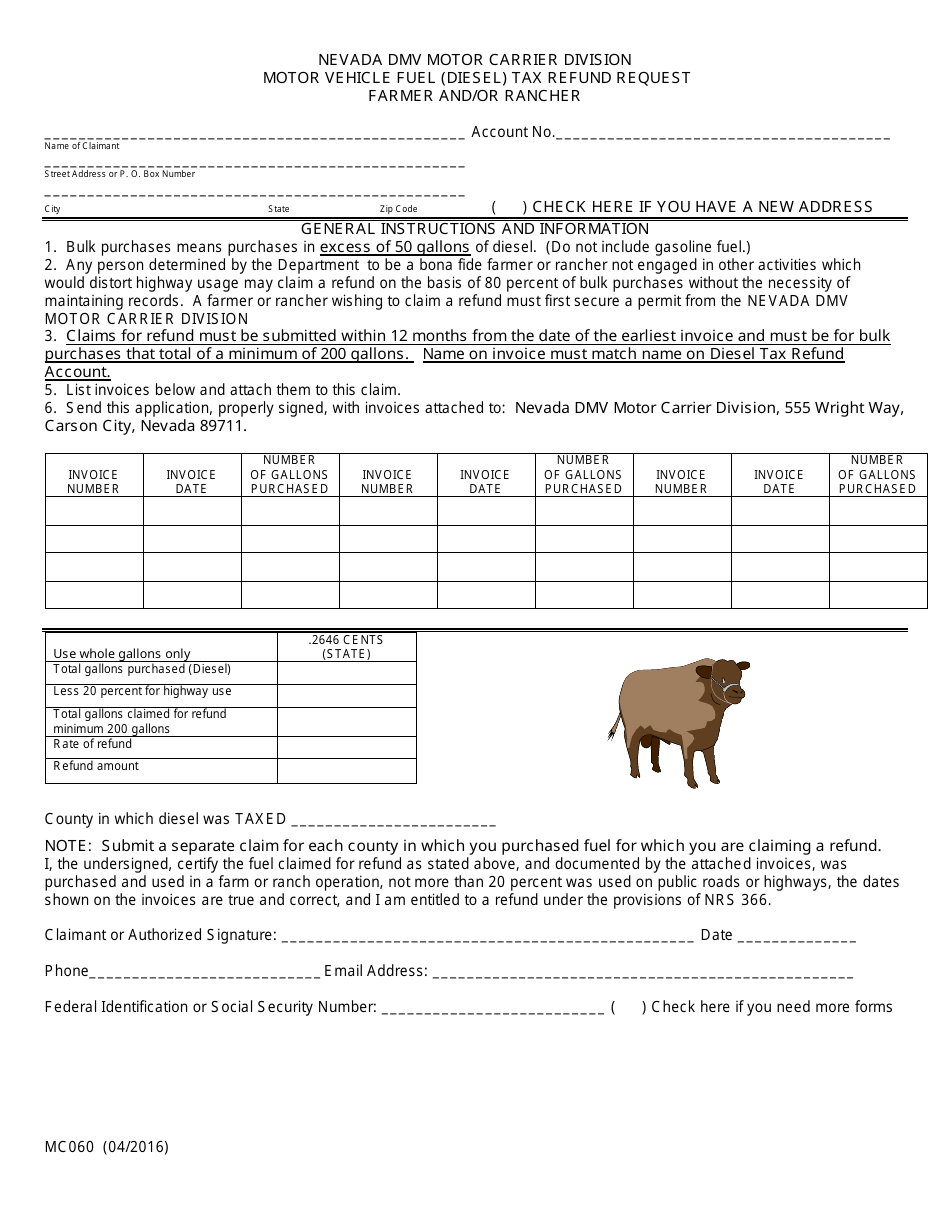

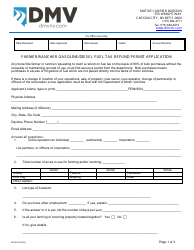

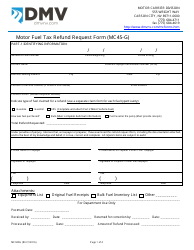

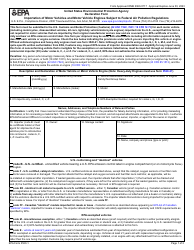

Form MC060 Motor Vehicle Fuel (Diesel) Tax Refund Request - Farmer and / or Rancher - Nevada

What Is Form MC060?

This is a legal form that was released by the Nevada Department of Motor Vehicles - a government authority operating within Nevada. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is MC060 Motor Vehicle Fuel (Diesel) Tax Refund Request?

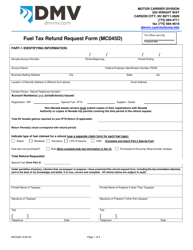

A: MC060 Motor Vehicle Fuel (Diesel) Tax Refund Request is a form used by farmers and/or ranchers in Nevada to request a refund of tax paid on diesel fuel used for agricultural purposes.

Q: Who can use the MC060 form?

A: The MC060 form can be used by farmers and/or ranchers in Nevada who use diesel fuel for agricultural purposes.

Q: What is the purpose of the refund request?

A: The purpose of the refund request is to receive a refund of the tax paid on diesel fuel used for agricultural purposes.

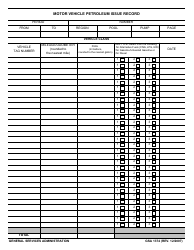

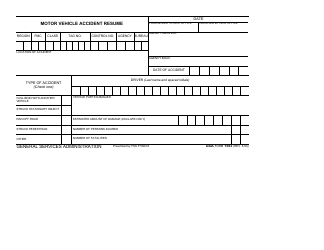

Q: What supporting documents are required for the refund request?

A: Supporting documents such as fuel receipts and/or invoices that show the purchase of diesel fuel for agricultural purposes may be required to accompany the MC060 form.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Nevada Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MC060 by clicking the link below or browse more documents and templates provided by the Nevada Department of Motor Vehicles.