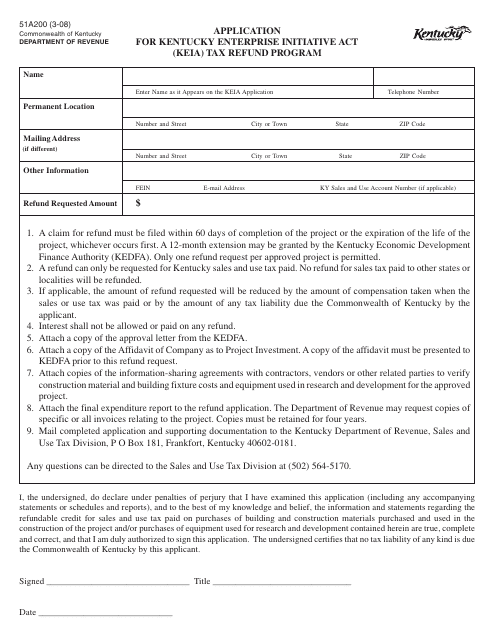

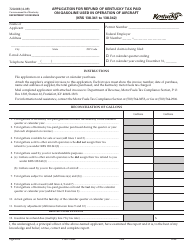

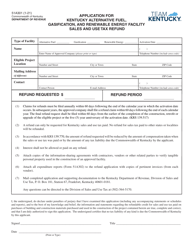

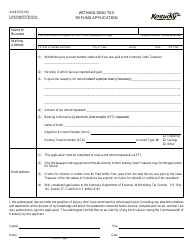

Form 51A200 Application for Kentucky Enterprise Initiative Act (Keia) Tax Refund Program - Kentucky

What Is Form 51A200?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form 51A200?

A: Form 51A200 is an application for the Kentucky Enterprise Initiative Act (Keia) Tax Refund Program.

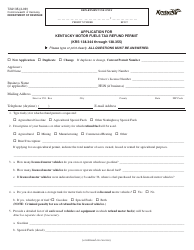

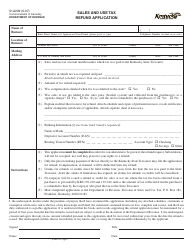

Q: What is the Kentucky Enterprise Initiative Act (Keia) Tax Refund Program?

A: The Kentucky Enterprise Initiative Act (Keia) Tax Refund Program is a program that provides tax incentives to businesses in Kentucky.

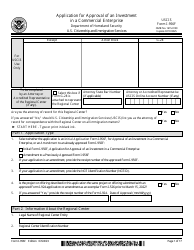

Q: Who is eligible to apply for the Keia Tax Refund Program?

A: Businesses that meet certain criteria, such as being engaged in eligible activities and creating new jobs, are eligible to apply for the Keia Tax Refund Program.

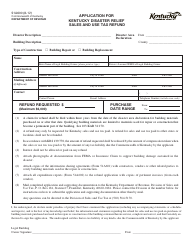

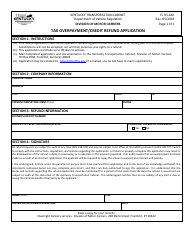

Q: What should I include in my Form 51A200 application?

A: You should include all required information and documentation, such as details about your business, employment information, and any supporting documents requested in the application.

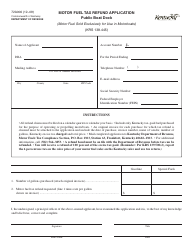

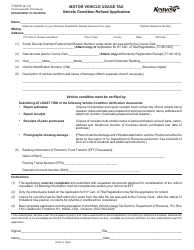

Form Details:

- Released on March 1, 2008;

- The latest edition provided by the Kentucky Department of Revenue;

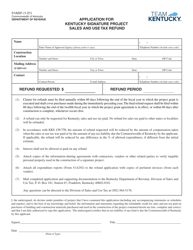

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A200 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.