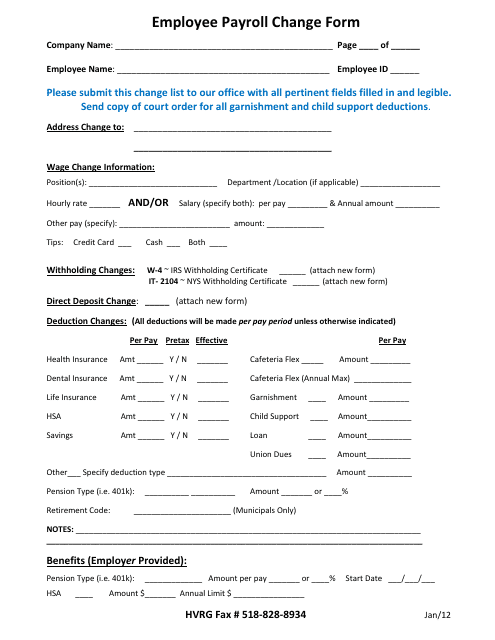

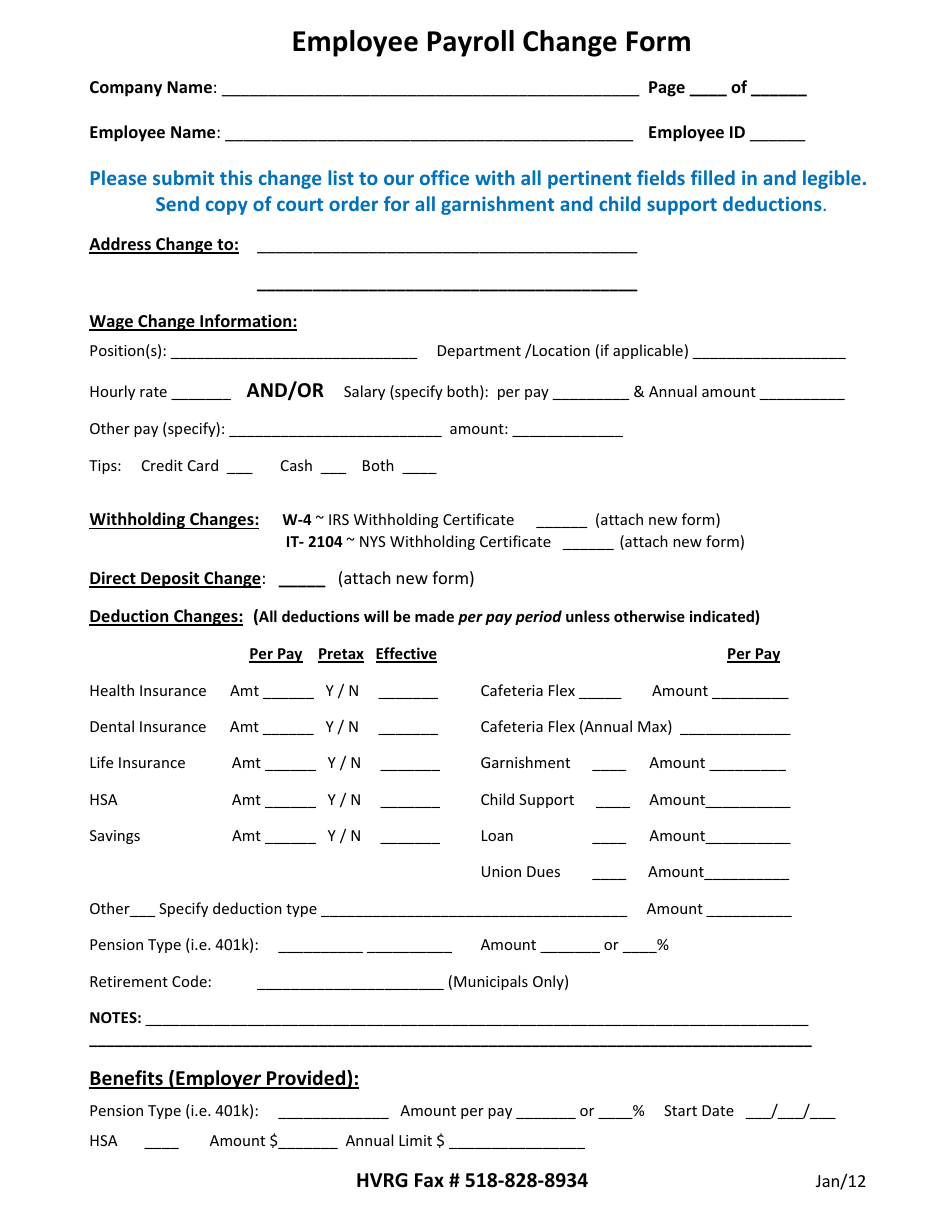

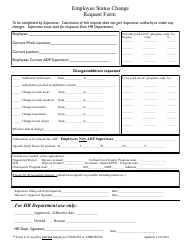

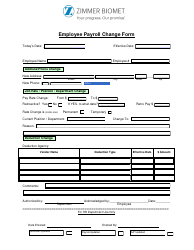

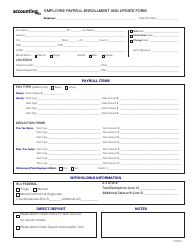

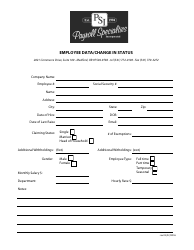

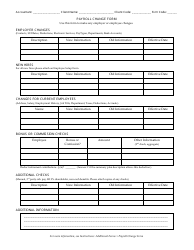

Employee Payroll Change Form - Hvrg

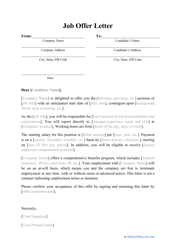

The Employee Payroll Change Form - Hvrg is a document used to make changes to an employee's payroll information, such as changes in salary, tax withholding, or bank account details.

FAQ

Q: What is the Employee Payroll Change Form?

A: The Employee Payroll Change Form is a document used to request changes to an employee's payroll information.

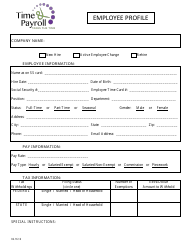

Q: Who needs to fill out the Employee Payroll Change Form?

A: The form should be filled out by an employee or their authorized representative, such as a manager or HR personnel.

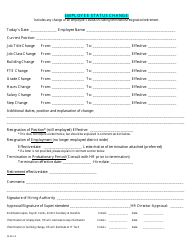

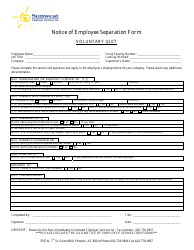

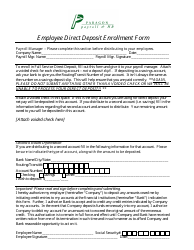

Q: What changes can be requested using the form?

A: The form can be used to request changes to an employee's name, address, tax withholding, direct deposit information, or other payroll-related details.

Q: Is the Employee Payroll Change Form mandatory?

A: The requirement to fill out the form may vary depending on the policies of the employer. It is best to consult with HR or payroll personnel for guidance.

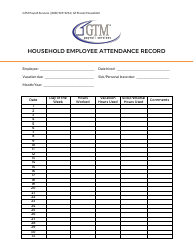

Q: When should I submit the Employee Payroll Change Form?

A: The form should be submitted as soon as there are changes to an employee's payroll information, or according to the specific timeline provided by the employer.

Q: Are there any deadlines for submitting the form?

A: Deadlines for submitting the form may vary depending on the employer's policy. It is important to adhere to any deadlines set by the employer to ensure timely processing of the requested changes.

Q: What documentation do I need to submit along with the form?

A: The required supporting documentation may vary depending on the type of change being requested. Commonly requested documentation includes proof of address change, updated W-4 form for tax withholding changes, or voided check for direct deposit changes. Consult with the employer or the form instructions for specific requirements.