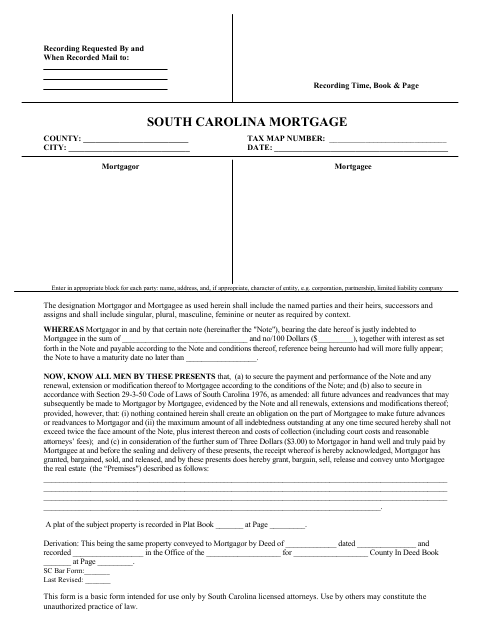

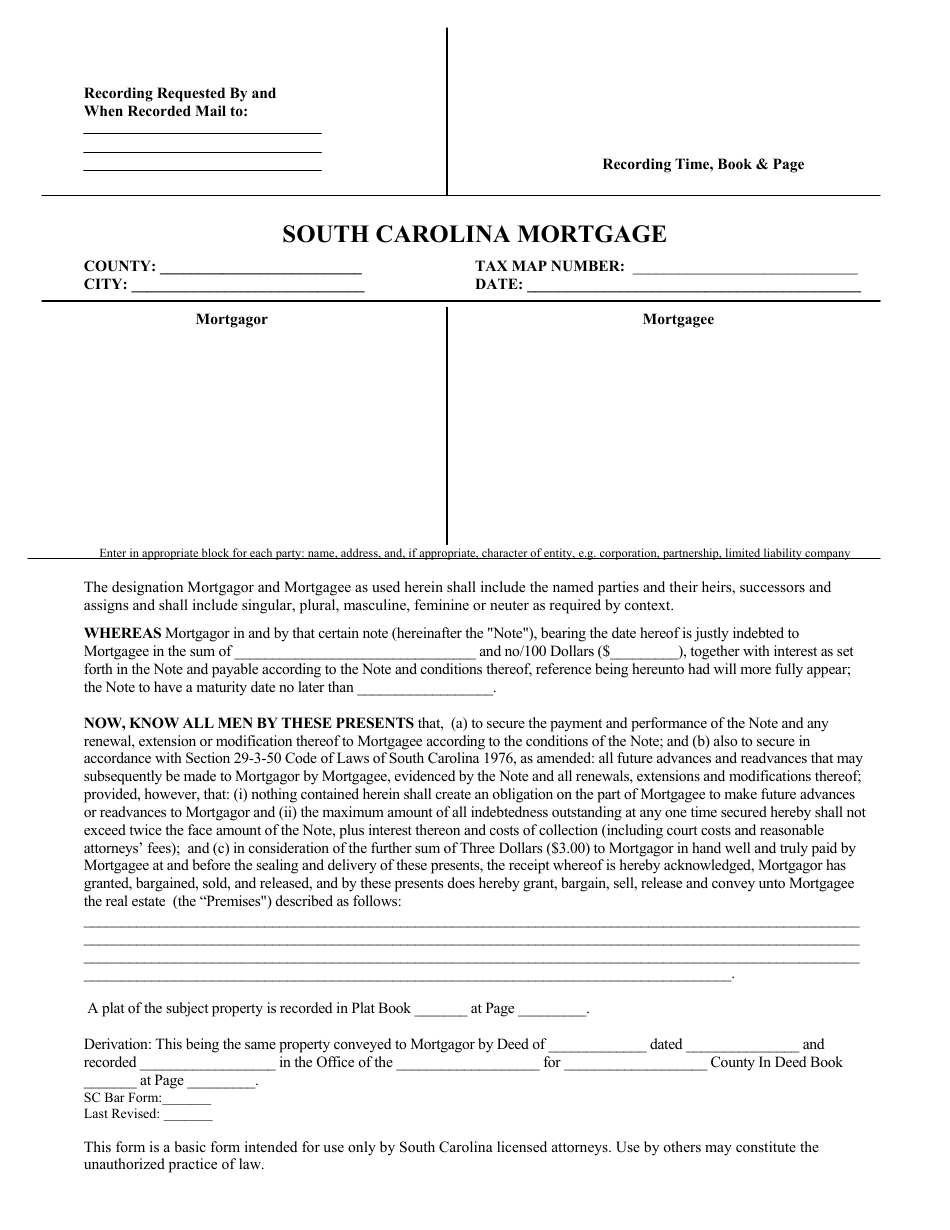

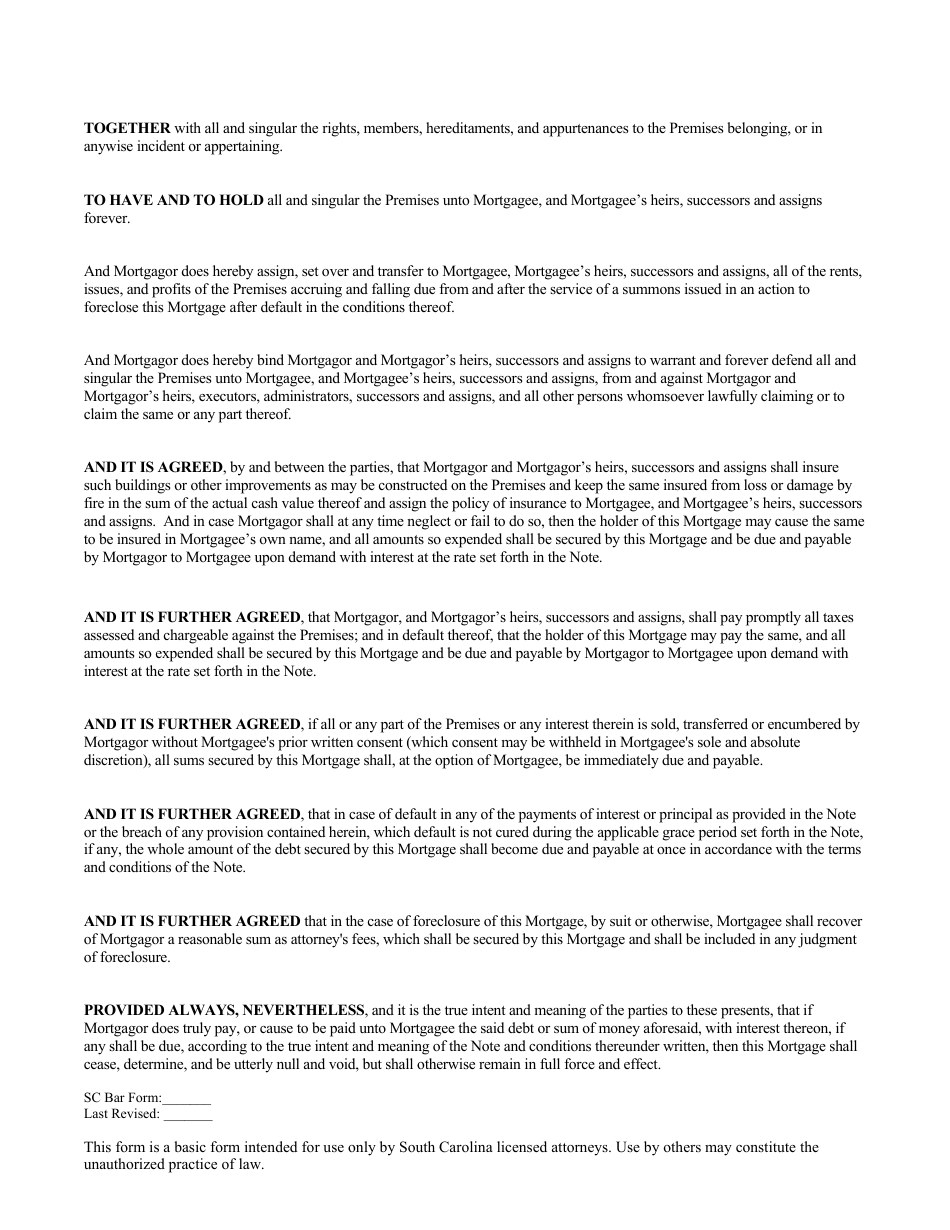

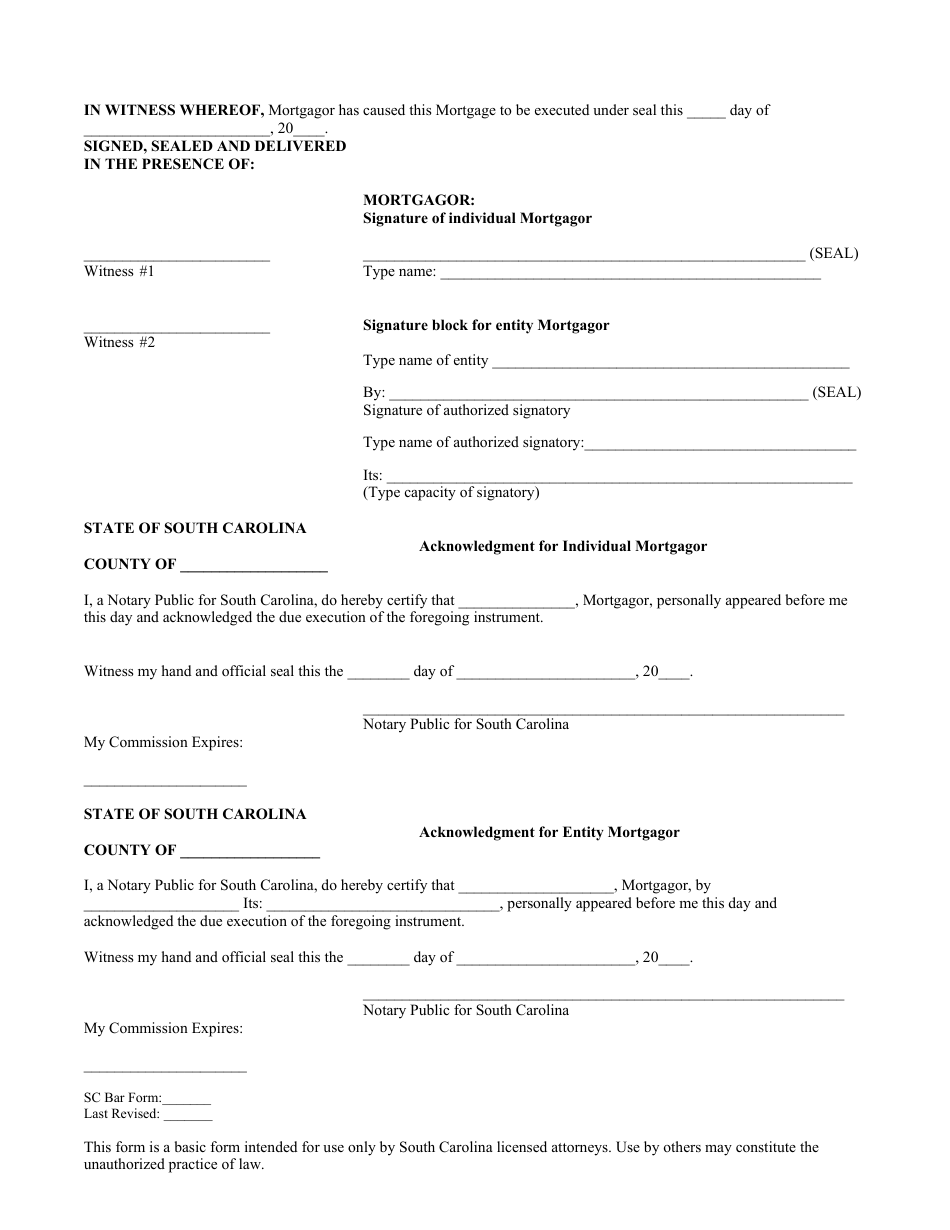

Mortgage Form - South Carolina

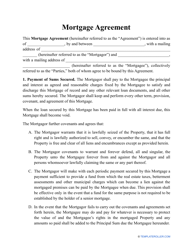

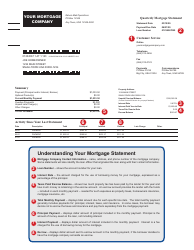

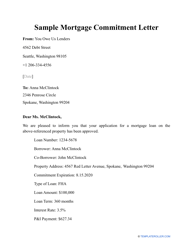

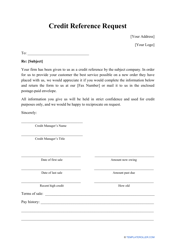

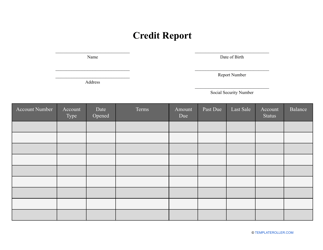

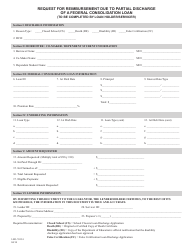

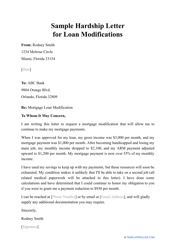

A Mortgage Form in South Carolina is used to document a loan agreement between a borrower and a lender for the purchase of a property. It sets out the terms and conditions of the mortgage, including repayment terms and the rights and responsibilities of both parties.

In South Carolina, the mortgage form is typically filed by the borrower.

FAQ

Q: What is a mortgage form?

A: A mortgage form is a legal document used when purchasing a property which outlines the terms of the loan agreement.

Q: What is the purpose of a mortgage form?

A: The purpose of a mortgage form is to establish the terms of a loan for the purchase of property and create a legal lien on the property.

Q: Who fills out the mortgage form?

A: Both the borrower and the lender will complete sections of the mortgage form.

Q: What information is typically included in a mortgage form?

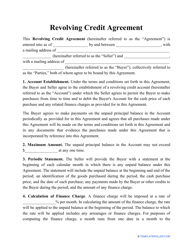

A: A mortgage form typically includes information about the property, the borrower's financial details, the loan amount, interest rate, terms of repayment, and any other specific conditions.

Q: What are the common types of mortgage forms?

A: The common types of mortgage forms include fixed-rate mortgages, adjustable-rate mortgages (ARMs), FHA loans, VA loans, and jumbo loans.

Q: Are mortgage forms different in each state?

A: Mortgage forms may have some variations between states, but the general information and structure remain similar.

Q: Can I customize a mortgage form?

A: Some sections of a mortgage form may be customizable, but it is important to consult with a real estate attorney to ensure compliance with the legal requirements.

Q: What should I do after filling out a mortgage form?

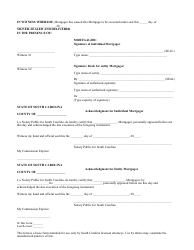

A: After filling out a mortgage form, it should be reviewed by both parties and signed. It is recommended to have an attorney or notary public present to witness the signing.

Q: Do I need to keep a copy of the mortgage form?

A: Yes, it is important to keep a copy of the mortgage form for your records. It serves as evidence of the loan agreement and can be referenced if any disputes arise in the future.