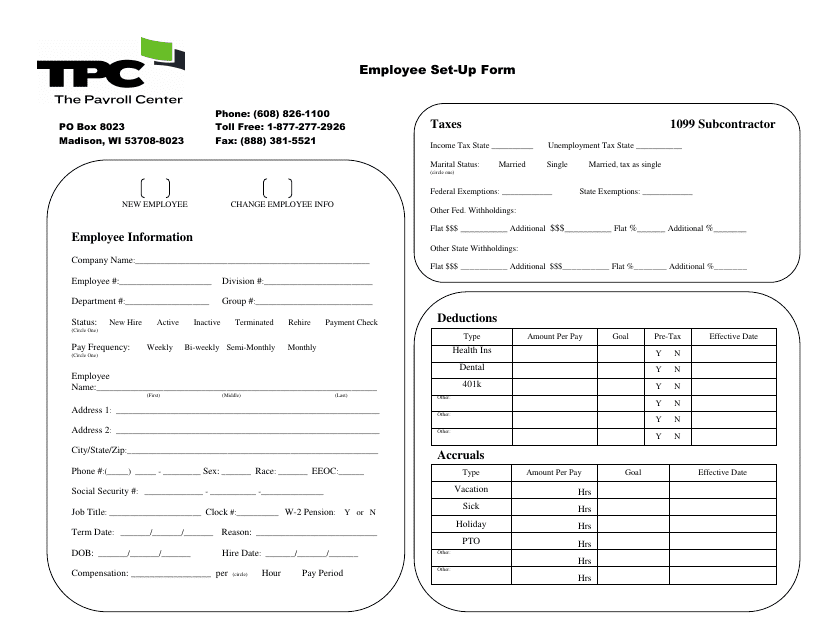

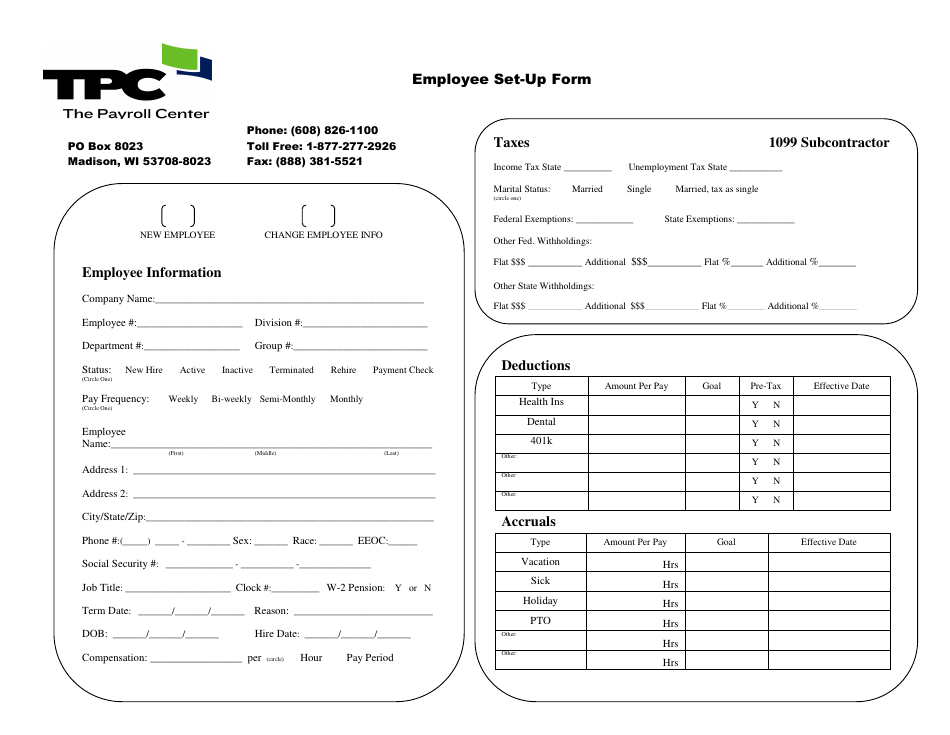

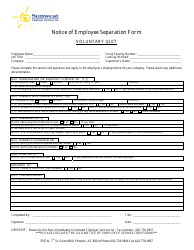

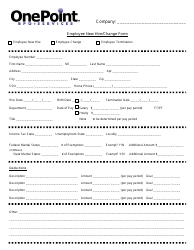

Employee Set-Up Form - the Pavroll Center

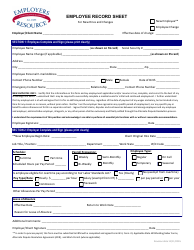

The Employee Set-Up Form is a document used by the Payroll Center to gather information needed to set up an employee's payroll record. It includes details such as personal information, tax withholding information, and banking details for direct deposit.

FAQ

Q: What is the Employee Set-Up Form?

A: The Employee Set-Up Form is a document used by the Payroll Center to collect information for setting up new employees.

Q: Why is the Employee Set-Up Form important?

A: The Employee Set-Up Form is important because it ensures that the Payroll Center has accurate and up-to-date information for new employees.

Q: What information is required on the Employee Set-Up Form?

A: The Employee Set-Up Form typically requires personal information such as name, address, Social Security number, and tax withholding information.

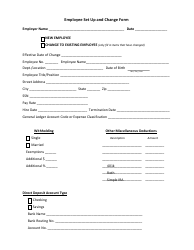

Q: What should I do if I have changes to my information after submitting the Employee Set-Up Form?

A: If you have changes to your information after submitting the Employee Set-Up Form, you should notify the Payroll Center so they can update their records.