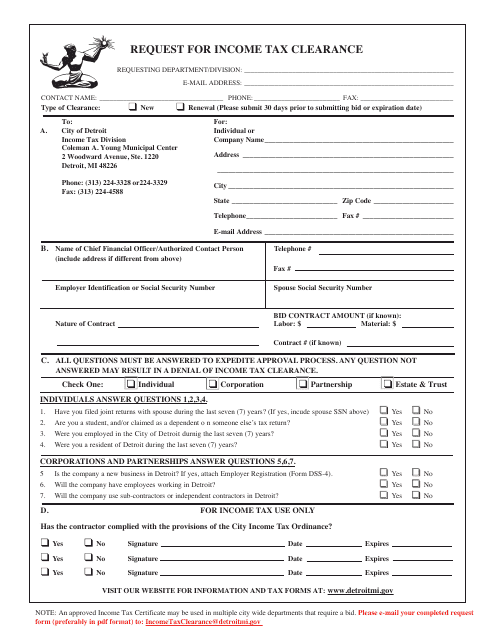

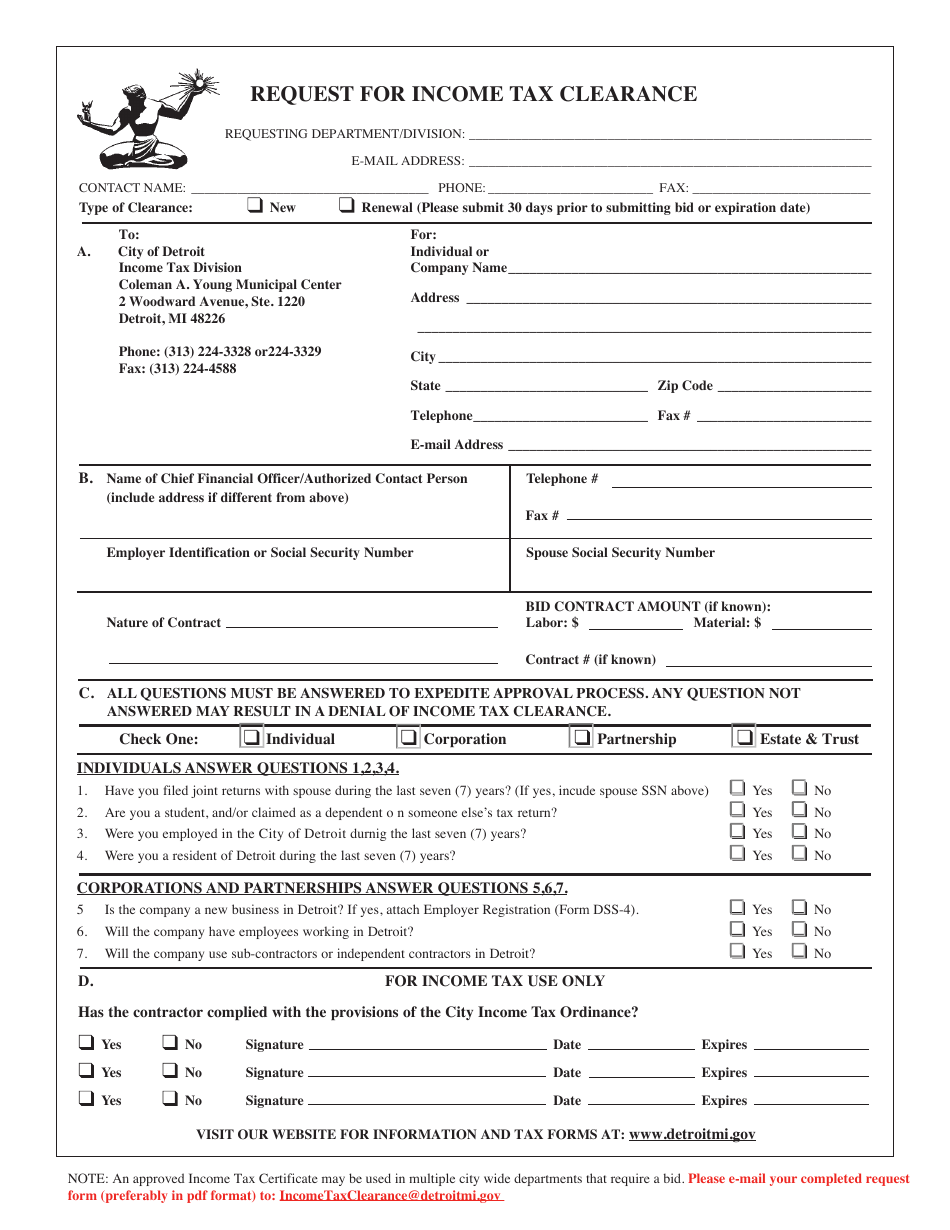

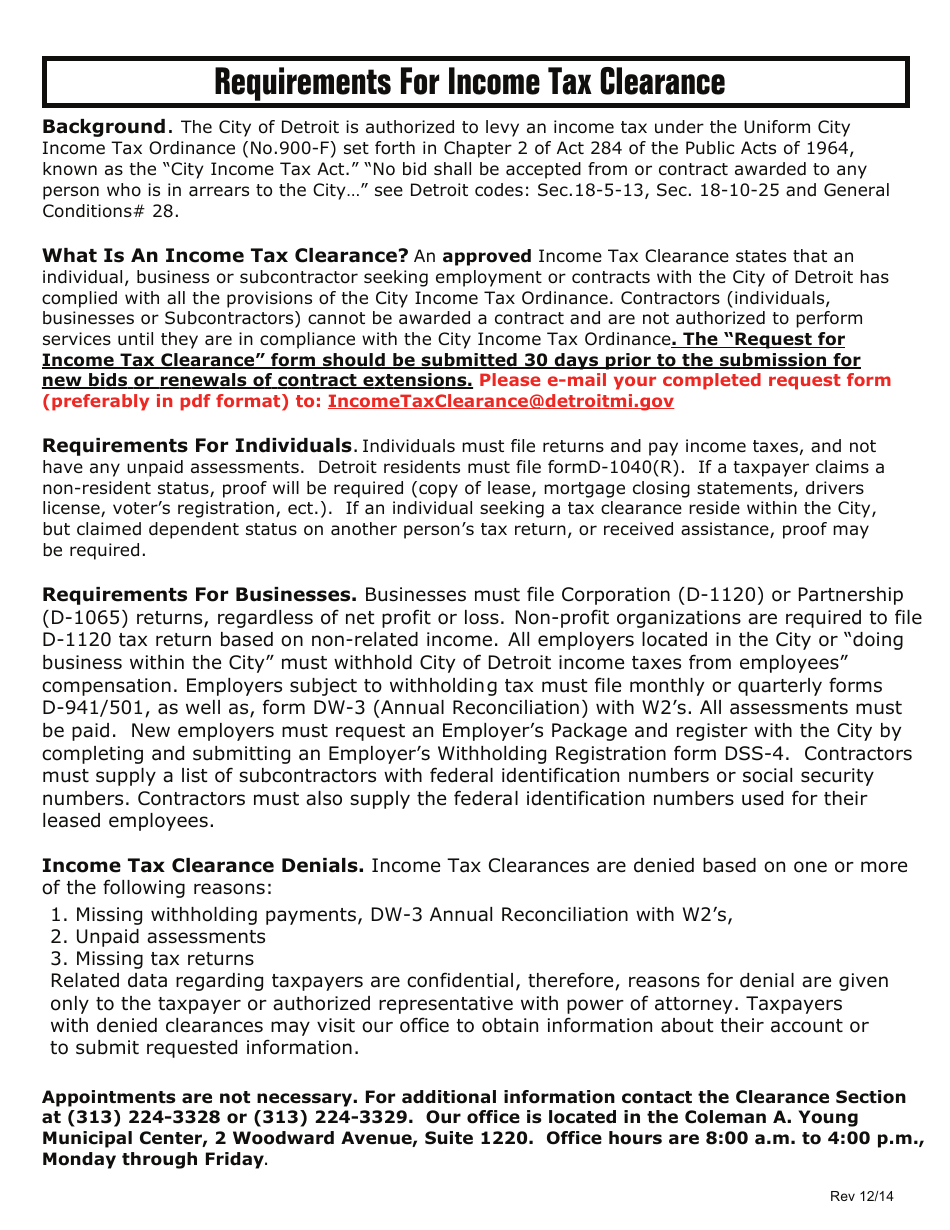

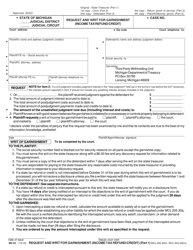

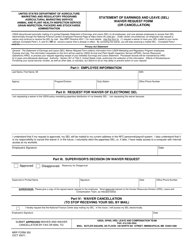

Request for Income Tax Clearance - Detroit, Michigan

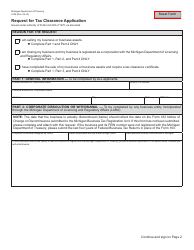

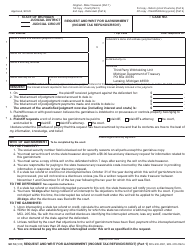

Request for Income Tax Clearance is a legal document that was released by the Michigan Department of Treasury - a government authority operating within Michigan. The form may be used strictly within Detroit.

FAQ

Q: What is an Income Tax Clearance?

A: An Income Tax Clearance is a document that shows that you have paid all your income taxes owed to the city of Detroit, Michigan.

Q: Why do I need an Income Tax Clearance?

A: You may need an Income Tax Clearance when applying for certain licenses, permits, or registrations in Detroit, Michigan.

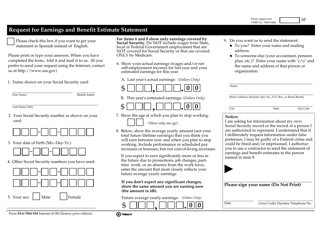

Q: What documents do I need to request an Income Tax Clearance?

A: You will need to provide your Social Security Number, full name, address, and any relevant tax forms or payment information.

Q: Is there a fee for an Income Tax Clearance?

A: Yes, there is a fee associated with requesting an Income Tax Clearance in Detroit, Michigan.

Q: How long does it take to receive an Income Tax Clearance?

A: The processing time for an Income Tax Clearance can vary, but it is typically within a few weeks.

Q: What should I do if I have outstanding tax liabilities?

A: If you have outstanding tax liabilities, you should contact the City of Detroit's Income Tax Division to make arrangements for payment.

Q: Can I request an Income Tax Clearance if I am not a resident of Detroit?

A: No, an Income Tax Clearance is only required for residents of Detroit, Michigan.

Q: What happens if I don't obtain an Income Tax Clearance?

A: If you don't obtain an Income Tax Clearance when required, you may not be able to obtain the licenses, permits, or registrations you need in Detroit, Michigan.

Form Details:

- Released on December 1, 2014;

- The latest edition currently provided by the Michigan Department of Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.