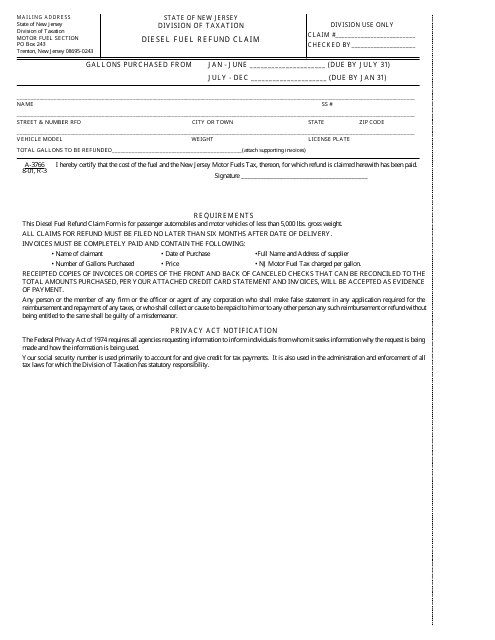

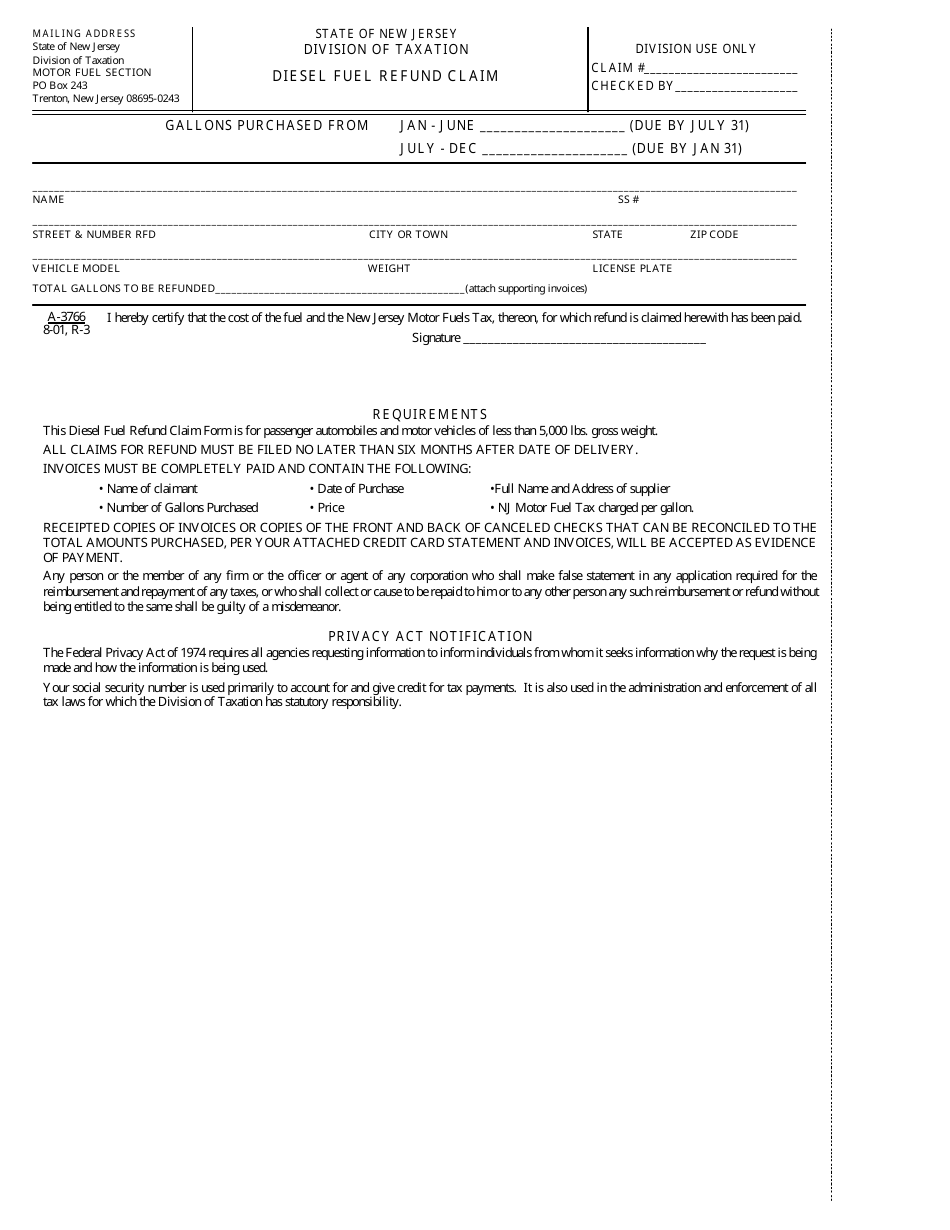

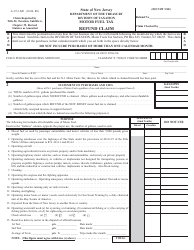

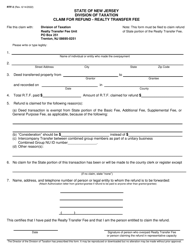

Form A-3766 Diesel Fuel Refund Claim - New Jersey

What Is Form A-3766?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-3766?

A: Form A-3766 is a Diesel Fuel Refund Claim used in the state of New Jersey.

Q: What is the purpose of Form A-3766?

A: The purpose of Form A-3766 is to claim a refund for diesel fueltaxes paid in New Jersey.

Q: Who can use Form A-3766?

A: Form A-3766 can be used by individuals, businesses, and organizations that have paid diesel fuel taxes in New Jersey.

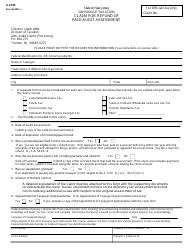

Q: What information is required on Form A-3766?

A: Some of the information required on Form A-3766 includes the claimant's name, address, and identification number, as well as details about the diesel fuel purchases and taxes paid.

Q: Is there a deadline to submit Form A-3766?

A: Yes, Form A-3766 must be filed within 4 years from the due date of the original tax payment.

Q: How long does it take to receive a refund after submitting Form A-3766?

A: The processing time for Form A-3766 varies, but it typically takes several weeks to receive a refund.

Form Details:

- Released on August 1, 2001;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-3766 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.