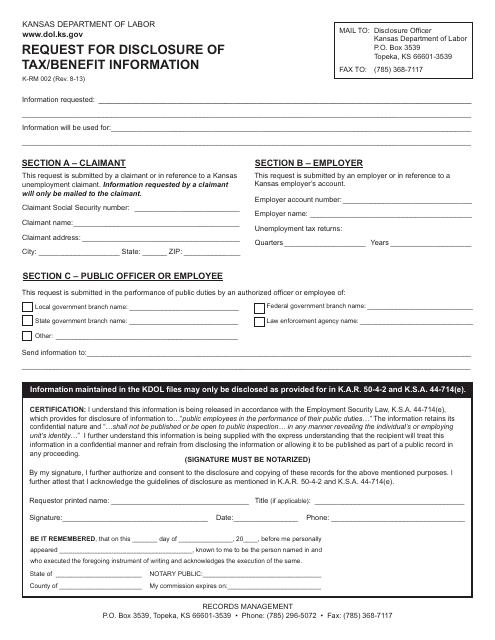

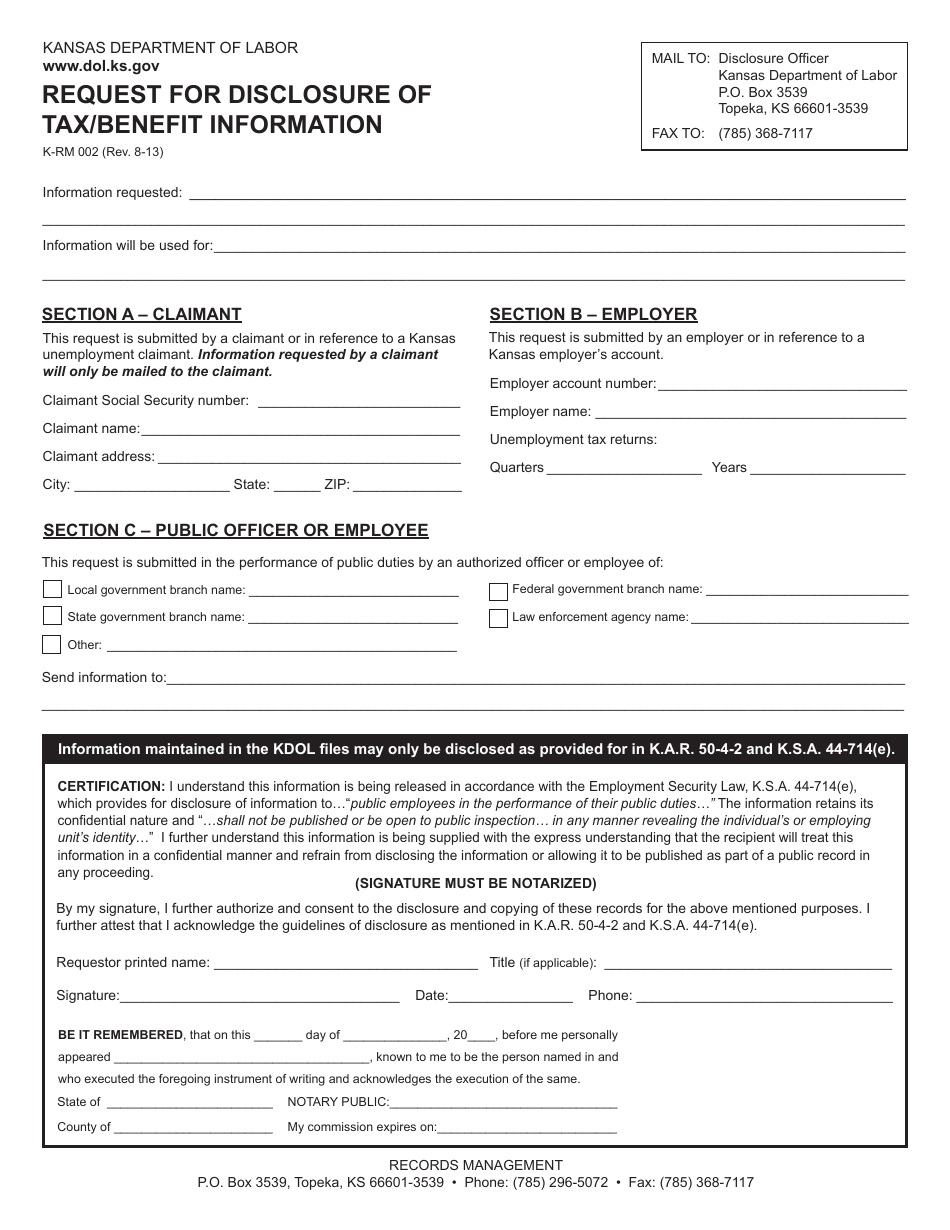

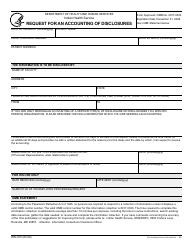

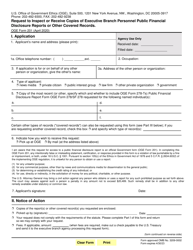

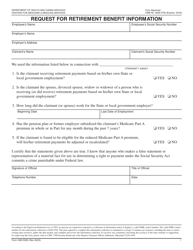

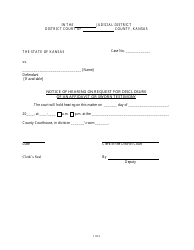

Form K-RM002 Request for Disclosure of Tax / Benefit Information - Kansas

What Is Form K-RM002?

This is a legal form that was released by the Kansas Department of Labor - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-RM002?

A: Form K-RM002 is a request for disclosure of tax/benefit information in the state of Kansas.

Q: What can I use Form K-RM002 for?

A: Form K-RM002 can be used to request disclosure of tax/benefit information in Kansas.

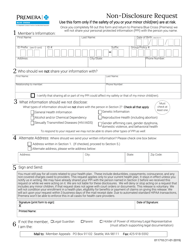

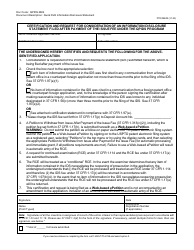

Q: Do I need to include any supporting documents with Form K-RM002?

A: Yes, you may need to include supporting documents to substantiate your request for disclosure of tax/benefit information.

Q: What information will I need to provide on Form K-RM002?

A: You will need to provide your personal information, such as your name, address, social security number, and specific details about the tax/benefit information you are requesting.

Q: Is there a fee for submitting Form K-RM002?

A: There may be a fee associated with submitting Form K-RM002. You should check the instructions on the form or contact the Kansas Department of Revenue for more information.

Q: How long does it typically take to receive a response to a Form K-RM002 request?

A: The processing time for Form K-RM002 requests may vary. It is best to check with the Kansas Department of Revenue for an estimated timeline.

Form Details:

- Released on August 1, 2013;

- The latest edition provided by the Kansas Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-RM002 by clicking the link below or browse more documents and templates provided by the Kansas Department of Labor.