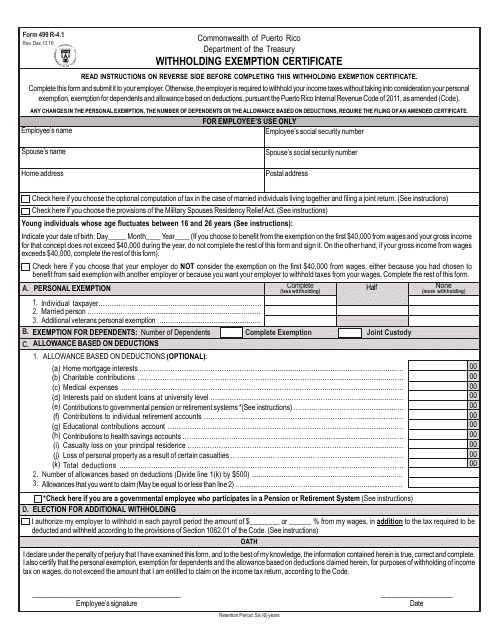

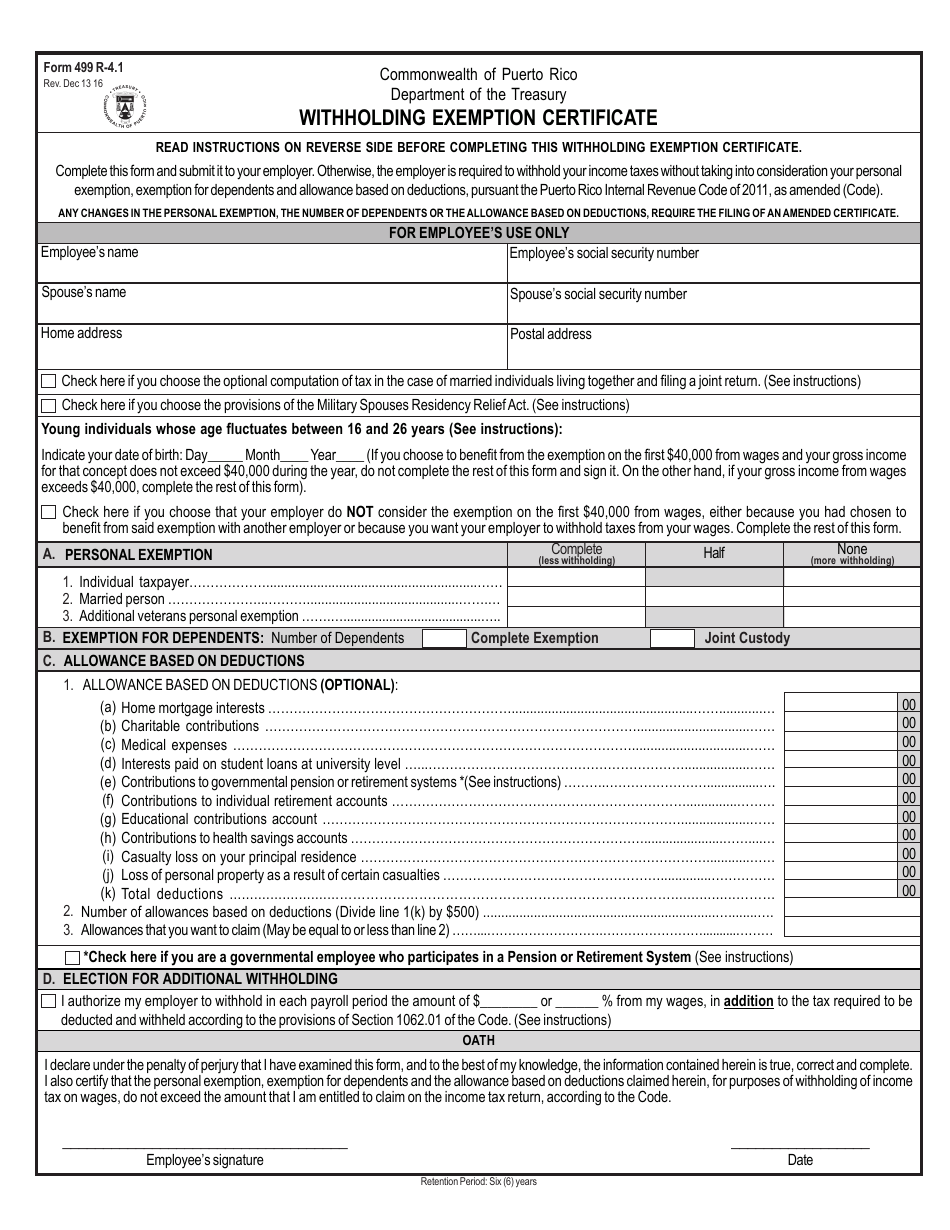

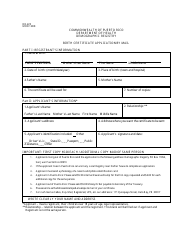

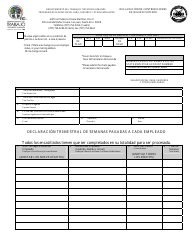

Form 499 r-4.1 Withholding Exemption Certificate - Puerto Rico

What Is Form 499 r-4.1?

This is a legal form that was released by the Puerto Rico Department of Treasury - a government authority operating within Puerto Rico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

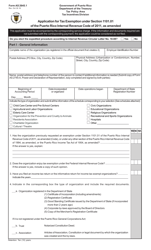

Q: What is Form 499 R-4.1?

A: Form 499 R-4.1 is a Withholding Exemption Certificate for Puerto Rico.

Q: What is the purpose of Form 499 R-4.1?

A: The purpose of Form 499 R-4.1 is to claim exemption from withholding taxes for Puerto Rico residents.

Q: Who should file Form 499 R-4.1?

A: Puerto Rico residents who want to claim exemption from withholding taxes should file Form 499 R-4.1.

Q: How do I fill out Form 499 R-4.1?

A: You need to provide your personal information, declare your exemption status, and sign the form.

Q: Is Form 499 R-4.1 only for Puerto Rico residents?

A: Yes, Form 499 R-4.1 is specifically for residents of Puerto Rico.

Form Details:

- Released on January 13, 2016;

- The latest edition provided by the Puerto Rico Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 499 r-4.1 by clicking the link below or browse more documents and templates provided by the Puerto Rico Department of Treasury.