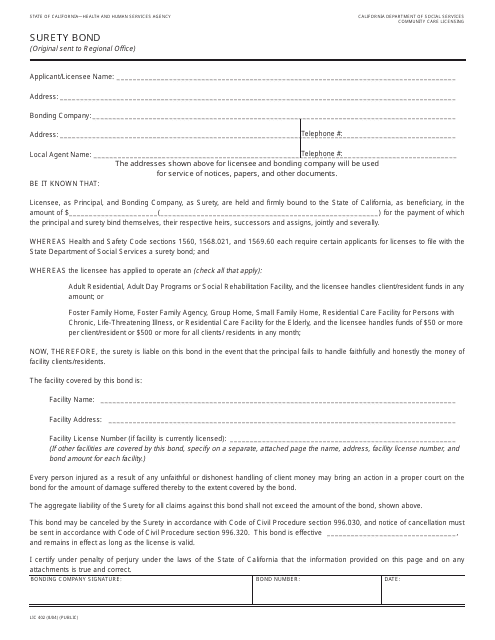

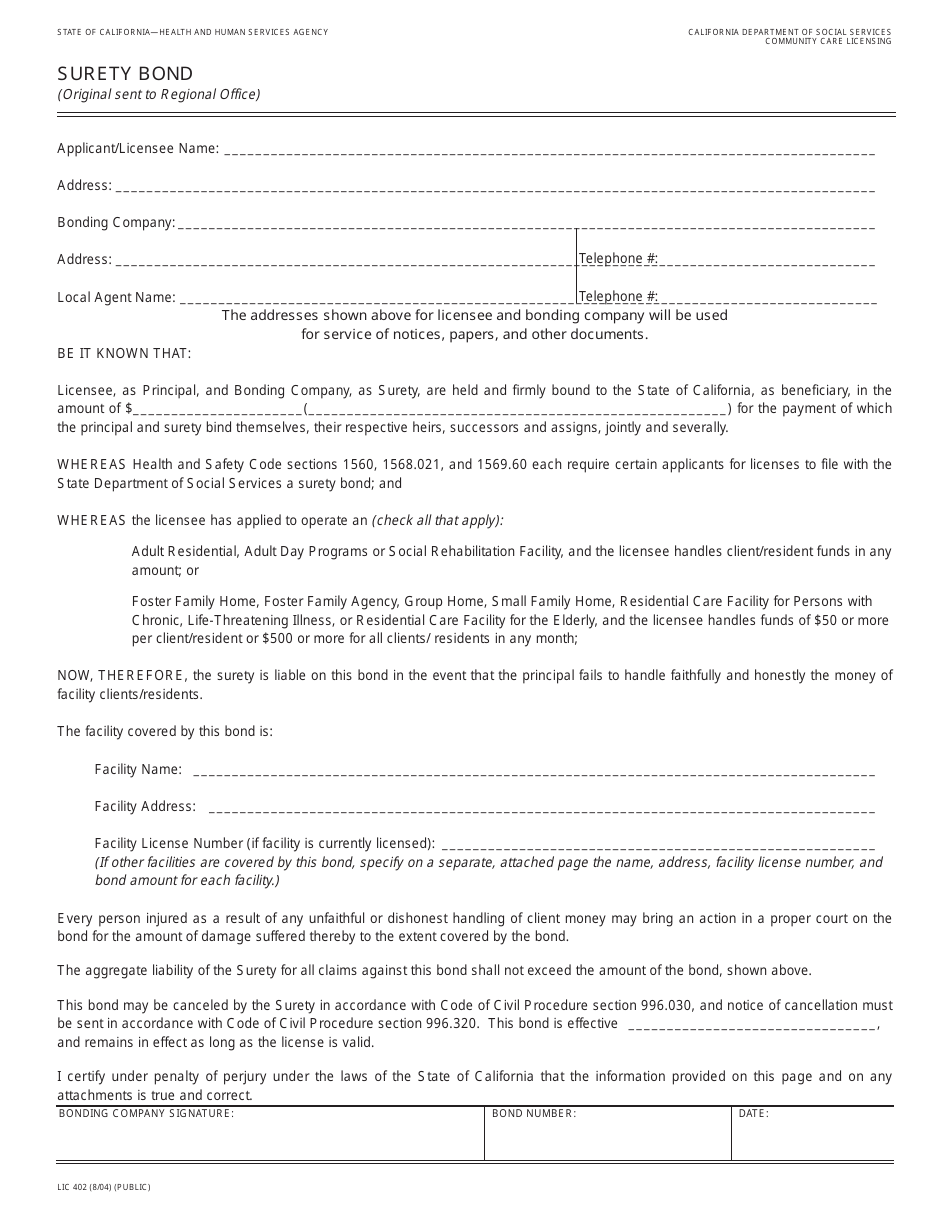

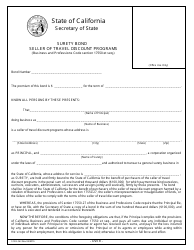

Form LIC-402 Surety Bond - California

What Is Form LIC-402?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a LIC-402 Surety Bond?

A: The LIC-402 Surety Bond is a type of bond required by the state of California for certain businesses.

Q: Who needs a LIC-402 Surety Bond?

A: Certain businesses in California are required to obtain a LIC-402 Surety Bond.

Q: What businesses require a LIC-402 Surety Bond?

A: Auto dismantlers, vehicle verification services, and self-service storage facilities are among the businesses that require a LIC-402 Surety Bond.

Q: Why is a LIC-402 Surety Bond required?

A: The LIC-402 Surety Bond is required to provide financial protection to consumers in case of any fraudulent actions or negligence by the bonded business.

Q: How much does a LIC-402 Surety Bond cost?

A: The cost of a LIC-402 Surety Bond varies depending on various factors such as the type of business and the bond amount required by the state.

Q: How long does it take to get a LIC-402 Surety Bond?

A: The timeframe for obtaining a LIC-402 Surety Bond may vary, but it typically takes a few days to a couple of weeks to get the bond processed and issued.

Q: How long is a LIC-402 Surety Bond valid for?

A: A LIC-402 Surety Bond is typically valid for one year from the date it is issued, but the exact validity period may vary depending on the specific bond requirements set by the state.

Q: What happens if a bonded business fails to fulfill its obligations?

A: If a bonded business fails to fulfill its obligations or engages in fraudulent activities, consumers can file a claim against the LIC-402 Surety Bond to seek compensation for their losses.

Q: Can a bonded business cancel a LIC-402 Surety Bond?

A: A bonded business can typically cancel a LIC-402 Surety Bond by providing a written notice to the bonding company. However, this may result in legal and financial consequences for the business.

Q: Can a LIC-402 Surety Bond be transferred to another business?

A: No, a LIC-402 Surety Bond is not transferrable and is specific to the business entity for which it was issued.

Q: Is a LIC-402 Surety Bond the same as liability insurance?

A: No, a LIC-402 Surety Bond and liability insurance are not the same. A surety bond provides financial protection to consumers, while liability insurance protects the business owner against claims of negligence or damages.

Form Details:

- Released on August 1, 2004;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LIC-402 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.