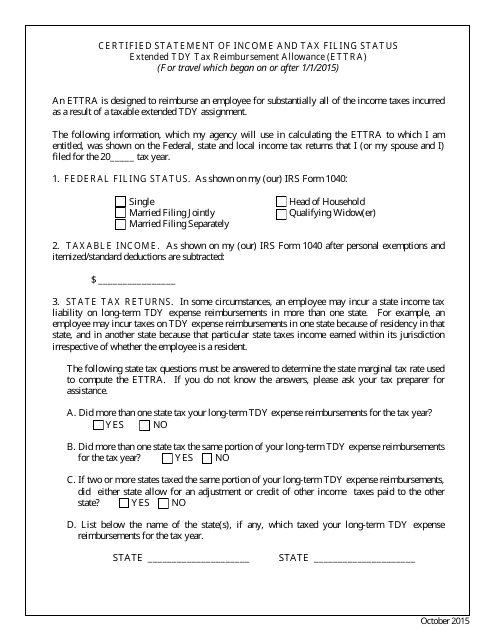

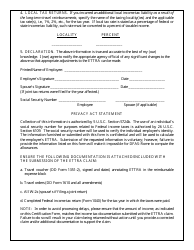

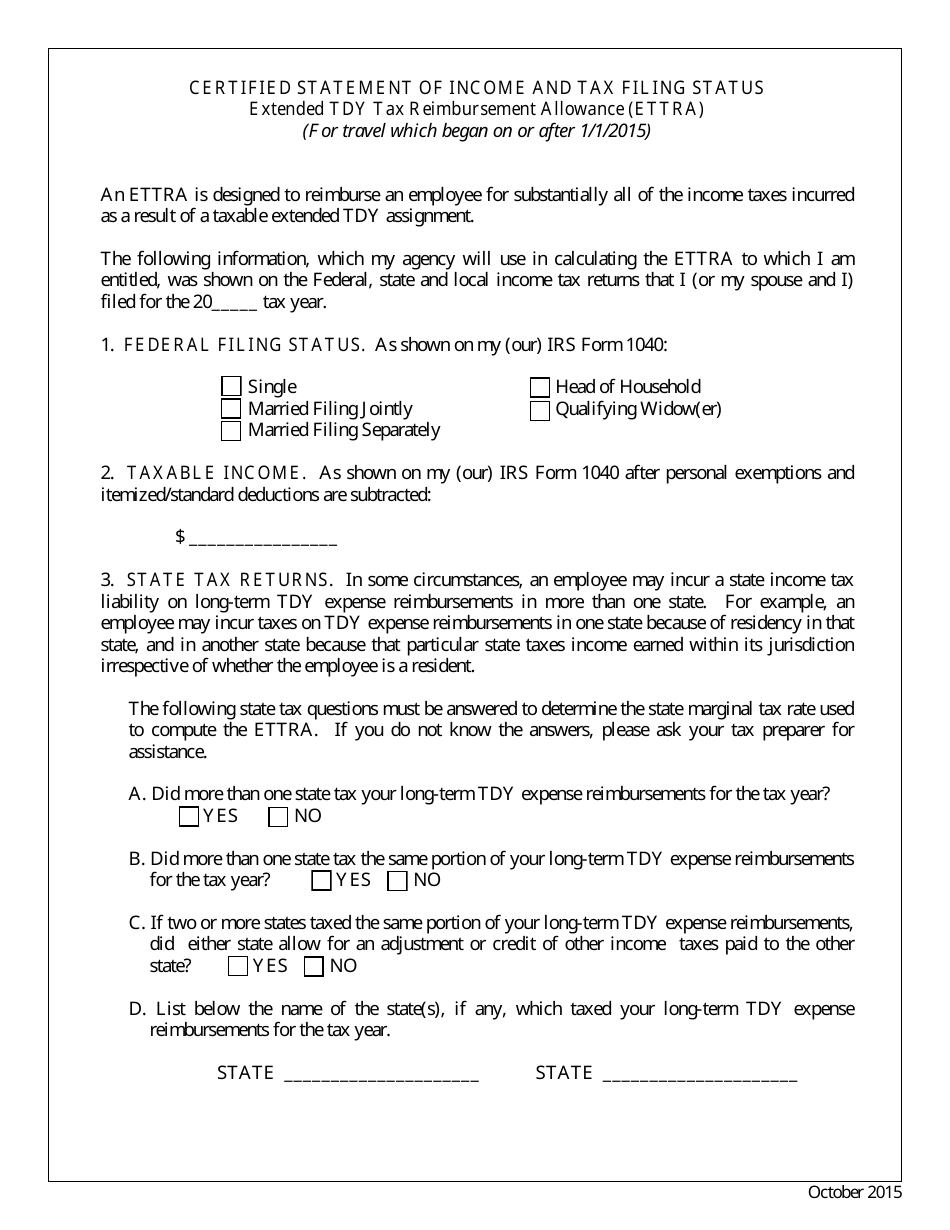

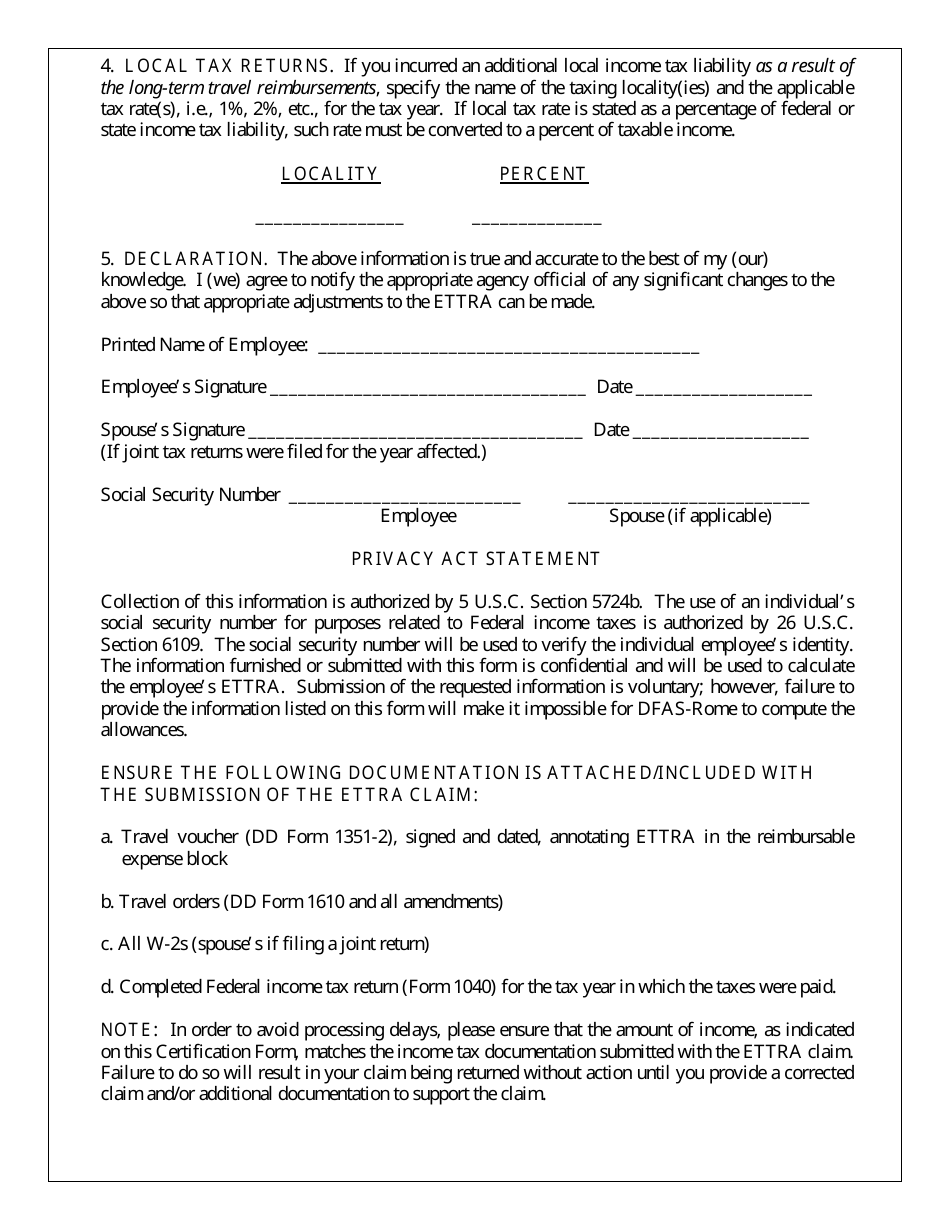

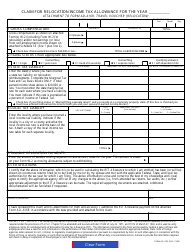

Certified Statement of Income and Tax Filing Status Extended TDY Tax Reimbursement Allowance (Ettra) Form

Certified Statement of Income and Tax Reimbursement Allowance (Ettra) Form is a 2-page legal document that was released by the U.S. Department of Defense - Defense Finance and Accounting Services on October 1, 2015 and used nation-wide.

FAQ

Q: What is the Certified Statement of Income and Tax Filing Status Extended TDY Tax Reimbursement Allowance (Ettra) Form?

A: The Certified Statement of Income and Tax Filing Status Extended TDY Tax Reimbursement Allowance (Ettra) Form is a document related to tax reimbursement for extended temporary duty travel expenses.

Q: Who is eligible to use the Certified Statement of Income and Tax Filing Status Extended TDY Tax Reimbursement Allowance (Ettra) Form?

A: Government employees who have been on extended temporary duty travel may be eligible to use the form.

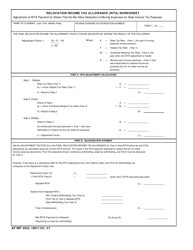

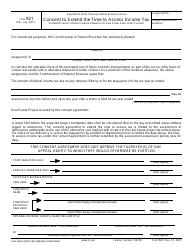

Q: What is the purpose of the Certified Statement of Income and Tax Filing Status Extended TDY Tax Reimbursement Allowance (Ettra) Form?

A: The form is used to claim tax reimbursement for expenses incurred during extended temporary duty travel.

Q: How do I obtain the Certified Statement of Income and Tax Filing Status Extended TDY Tax Reimbursement Allowance (Ettra) Form?

A: You can obtain the form from your employer or the relevant government agency handling your extended temporary duty travel reimbursement.

Q: What information do I need to provide on the Certified Statement of Income and Tax Filing Status Extended TDY Tax Reimbursement Allowance (Ettra) Form?

A: You will need to provide information about your income, tax filing status, and details of your extended temporary duty travel expenses.

Form Details:

- The latest edition currently provided by the U.S. Department of Defense - Defense Finance and Accounting Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.