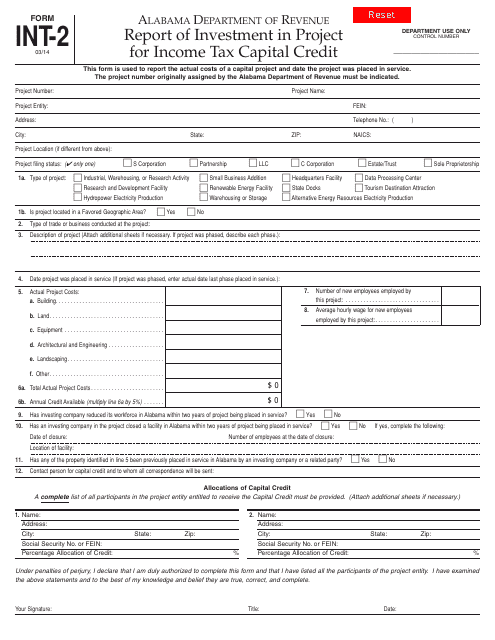

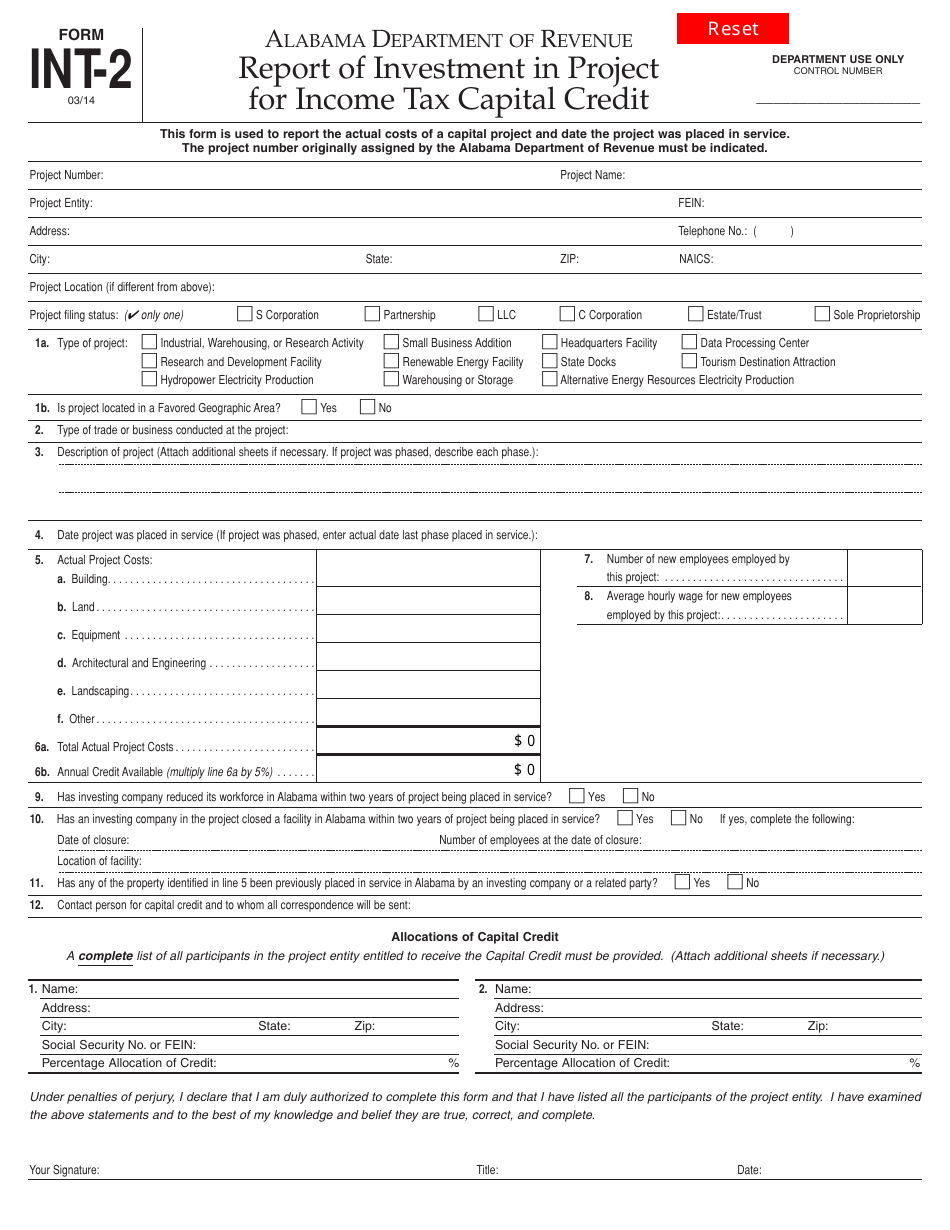

Form INT-2 Report of Investment in Project for Income Tax Capital Credit - Alabama

What Is Form INT-2?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the INT-2 form?

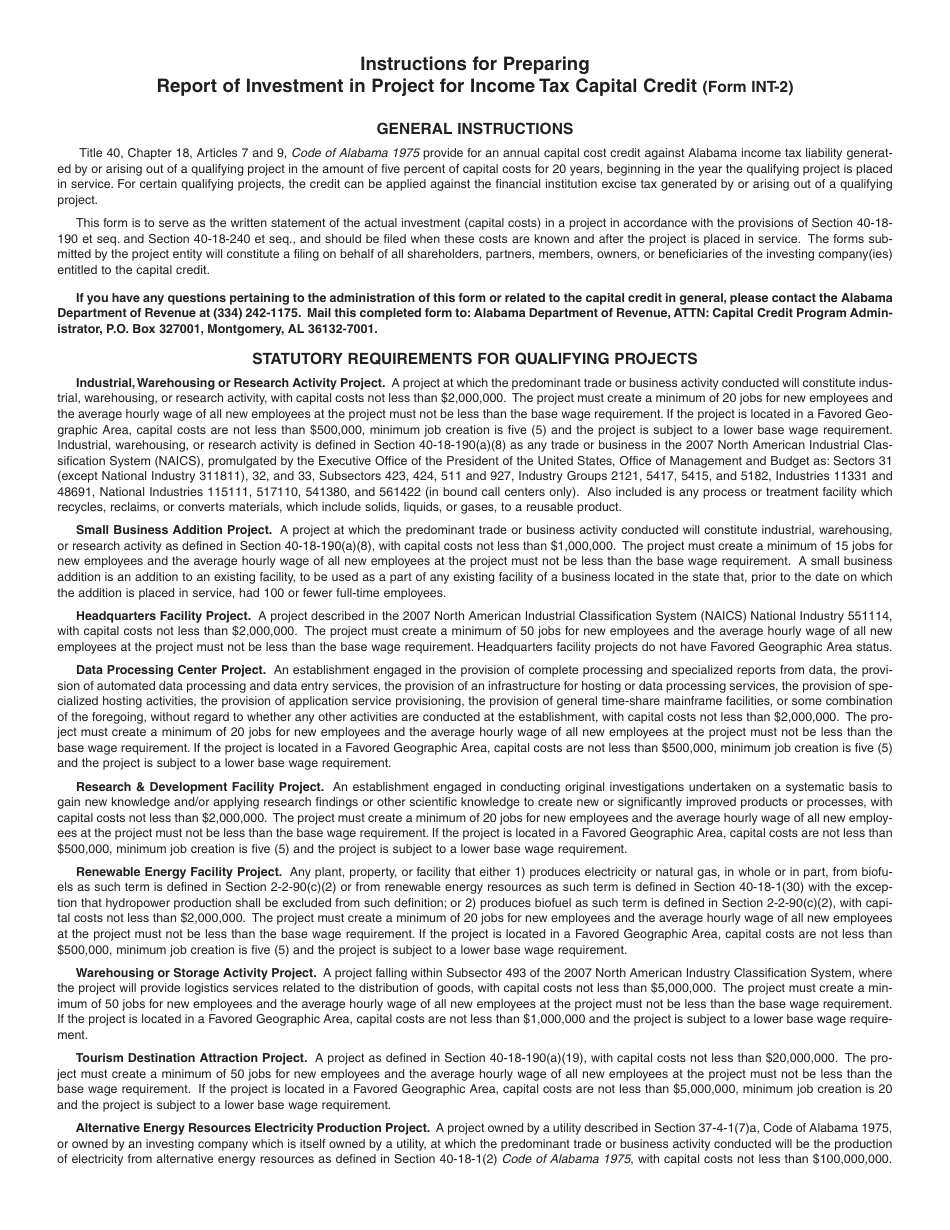

A: The INT-2 form is the Report of Investment in Project for Income Tax Capital Credit in Alabama.

Q: What is the purpose of the INT-2 form?

A: The purpose of the INT-2 form is to report investment in a project for the Income Tax Capital Credit in Alabama.

Q: Who needs to file the INT-2 form?

A: Anyone who has made an investment in a project and is claiming the Income Tax Capital Credit in Alabama needs to file the INT-2 form.

Q: What information is required on the INT-2 form?

A: The INT-2 form requires information about the project, including the location, description, and cost, as well as information about the investor, such as their name, address, and Social Security number.

Q: When is the deadline for filing the INT-2 form?

A: The deadline for filing the INT-2 form is generally the same as the deadline for filing your Alabama income tax return, which is usually April 15th.

Q: Are there any fees associated with filing the INT-2 form?

A: There are no fees associated with filing the INT-2 form.

Form Details:

- Released on March 1, 2014;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form INT-2 by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.