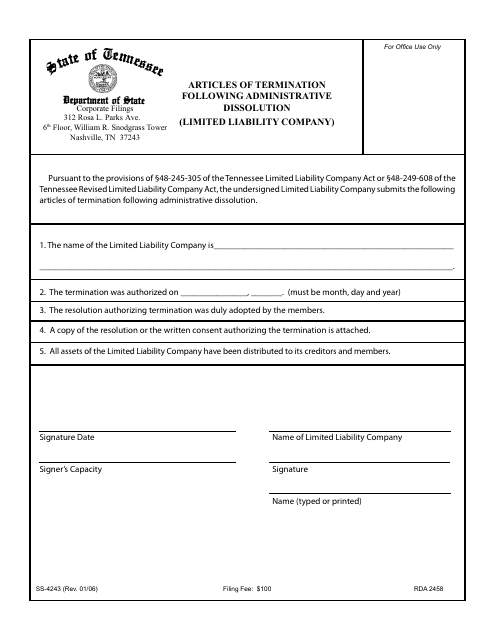

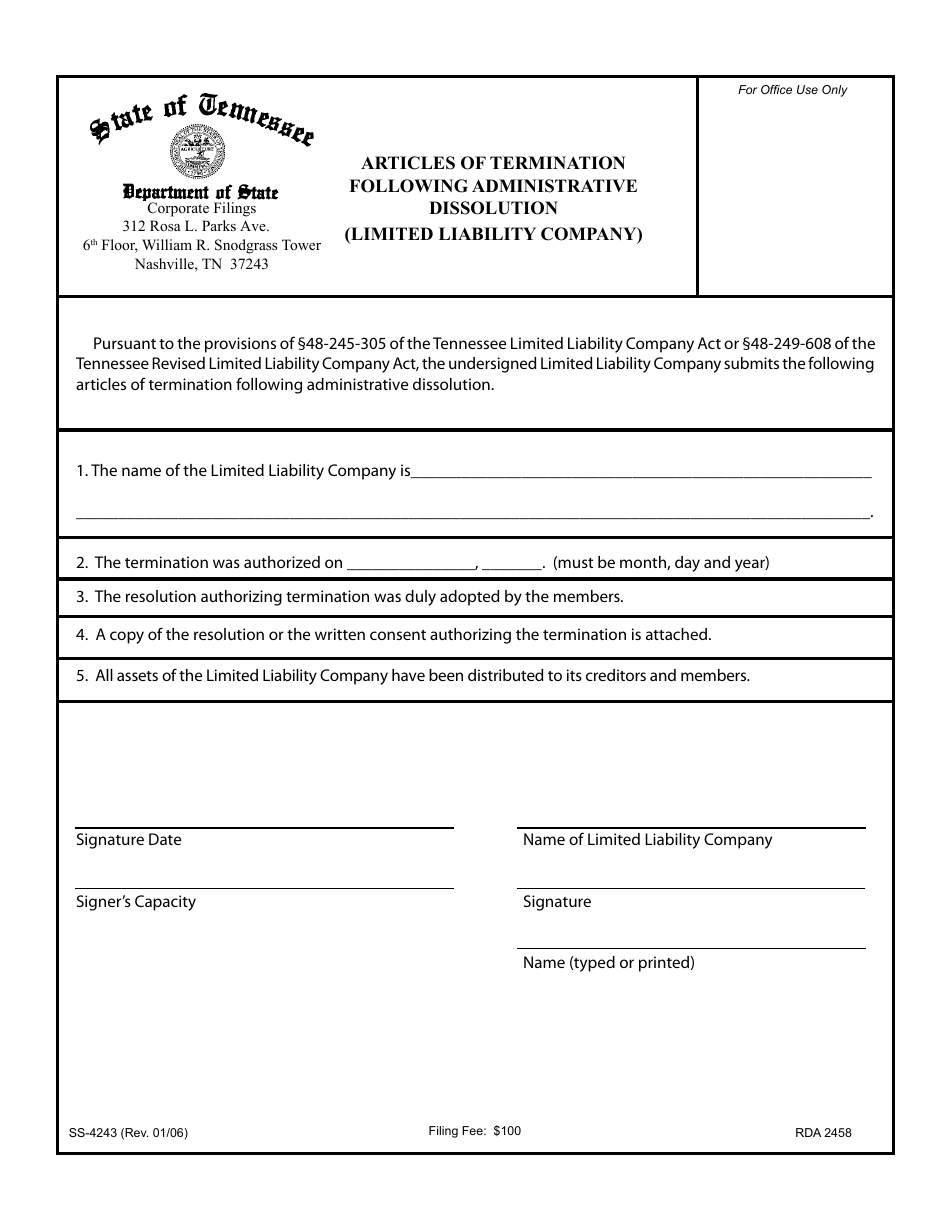

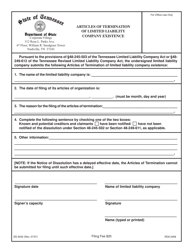

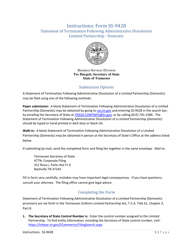

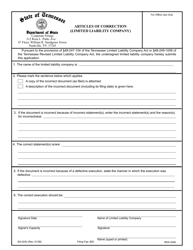

Form SS-4243 Articles of Termination Following Administrative Dissolution (Limited Liability Company) - Tennessee

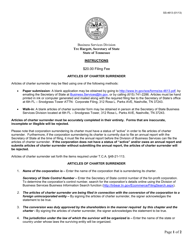

What Is Form SS-4243?

This is a legal form that was released by the Tennessee Secretary of State - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SS-4243?

A: Form SS-4243 is the Articles of Termination Following Administrative Dissolution for limited liability companies (LLCs) in Tennessee.

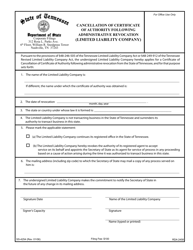

Q: When should Form SS-4243 be filed?

A: Form SS-4243 should be filed when an LLC in Tennessee wants to terminate its existence after being administratively dissolved.

Q: What is administrative dissolution?

A: Administrative dissolution is a process where the state authorities revoke a company's legal status due to failure to comply with certain requirements, such as filing annual reports or paying taxes.

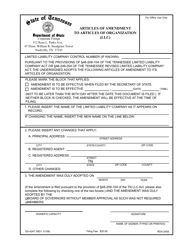

Q: What information is needed on Form SS-4243?

A: Form SS-4243 requires information such as the LLC's name, date of administrative dissolution, reason for termination, and affirmation that all debts and liabilities have been paid.

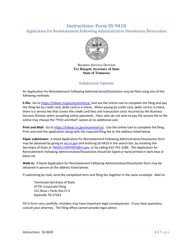

Q: Who can file Form SS-4243?

A: Form SS-4243 can be filed by any person authorized to represent the LLC, such as a member, manager, or authorized agent.

Q: What happens after Form SS-4243 is filed?

A: After Form SS-4243 is filed and approved by the Secretary of State, the LLC's existence is terminated, and it no longer has any legal obligations or rights.

Q: Is there a deadline to file Form SS-4243 after administrative dissolution?

A: Yes, there is a deadline to file Form SS-4243 after administrative dissolution. The form must be filed within two years of the administrative dissolution.

Form Details:

- Released on January 1, 2006;

- The latest edition provided by the Tennessee Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SS-4243 by clicking the link below or browse more documents and templates provided by the Tennessee Secretary of State.