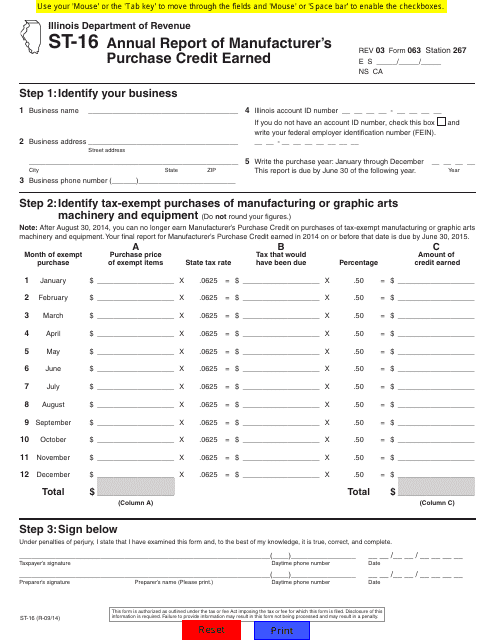

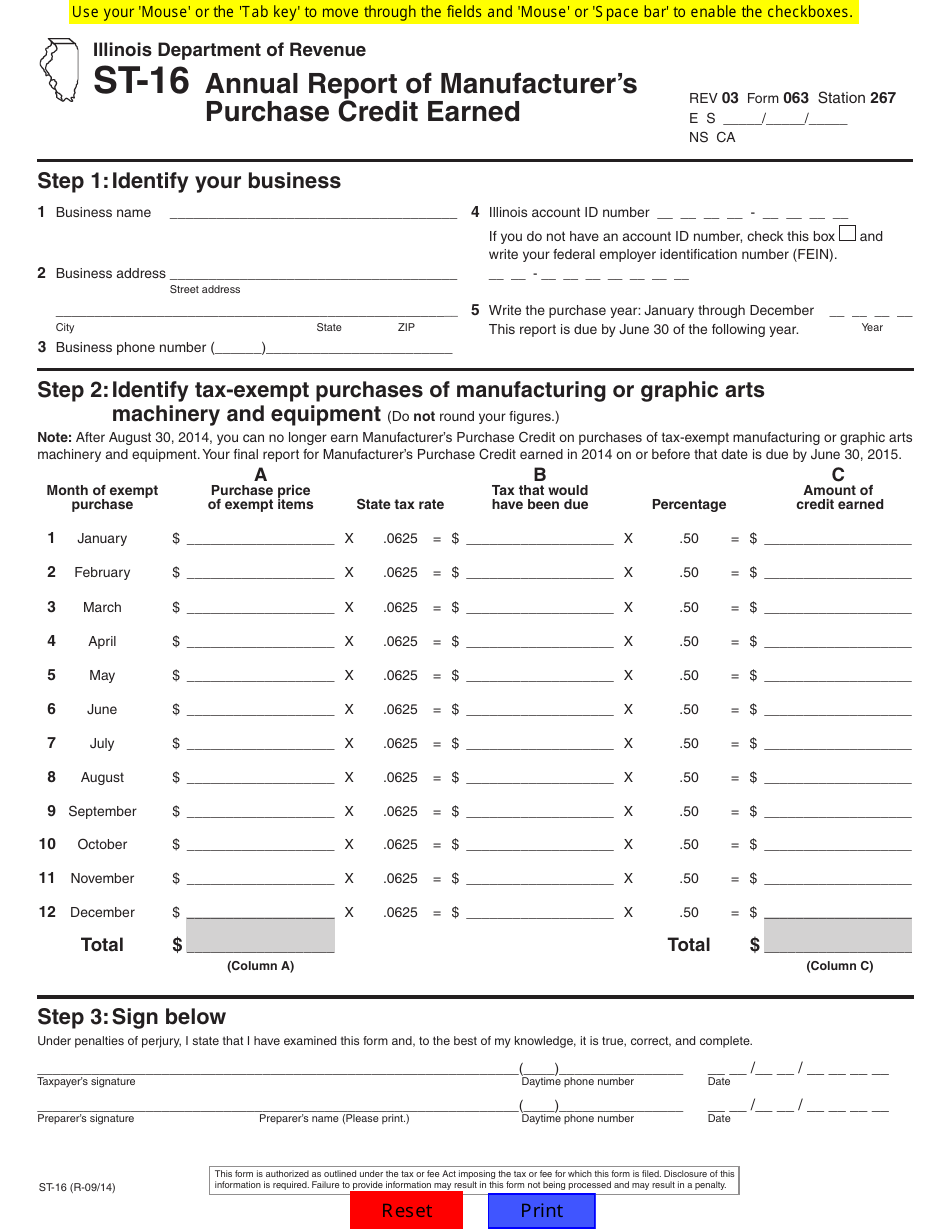

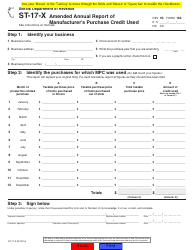

Form ST-16 Annual Report of Manufacturer's Purchase Credit Earned - Illinois

What Is Form ST-16?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-16?

A: Form ST-16 is the Annual Report of Manufacturer's Purchase Credit Earned in Illinois.

Q: Who needs to file Form ST-16?

A: Manufacturers who have earned purchase credits in Illinois need to file Form ST-16.

Q: What is a manufacturer's purchase credit?

A: A manufacturer's purchase credit is a credit earned by manufacturers for sales taxes paid on machinery and equipment purchases in Illinois.

Q: What information is required on Form ST-16?

A: Form ST-16 requires information about the manufacturer's purchase credits earned, used, and remaining balance.

Q: When is Form ST-16 due?

A: Form ST-16 is due on or before the 20th day of the month following the end of the calendar year.

Q: How can Form ST-16 be filed?

A: Form ST-16 can be filed electronically or by mail to the Illinois Department of Revenue.

Form Details:

- Released on September 1, 2014;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-16 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.