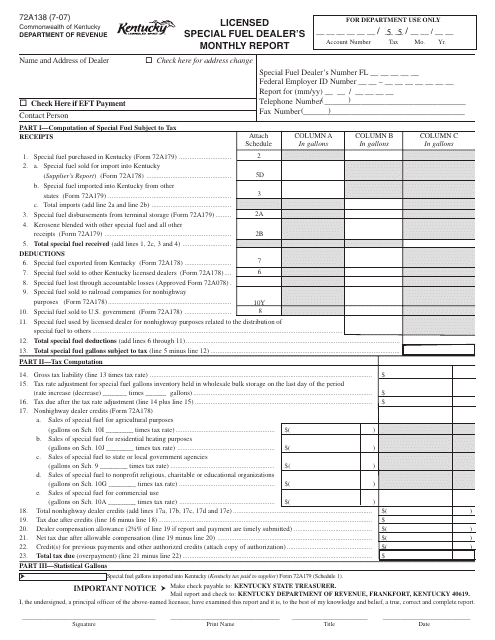

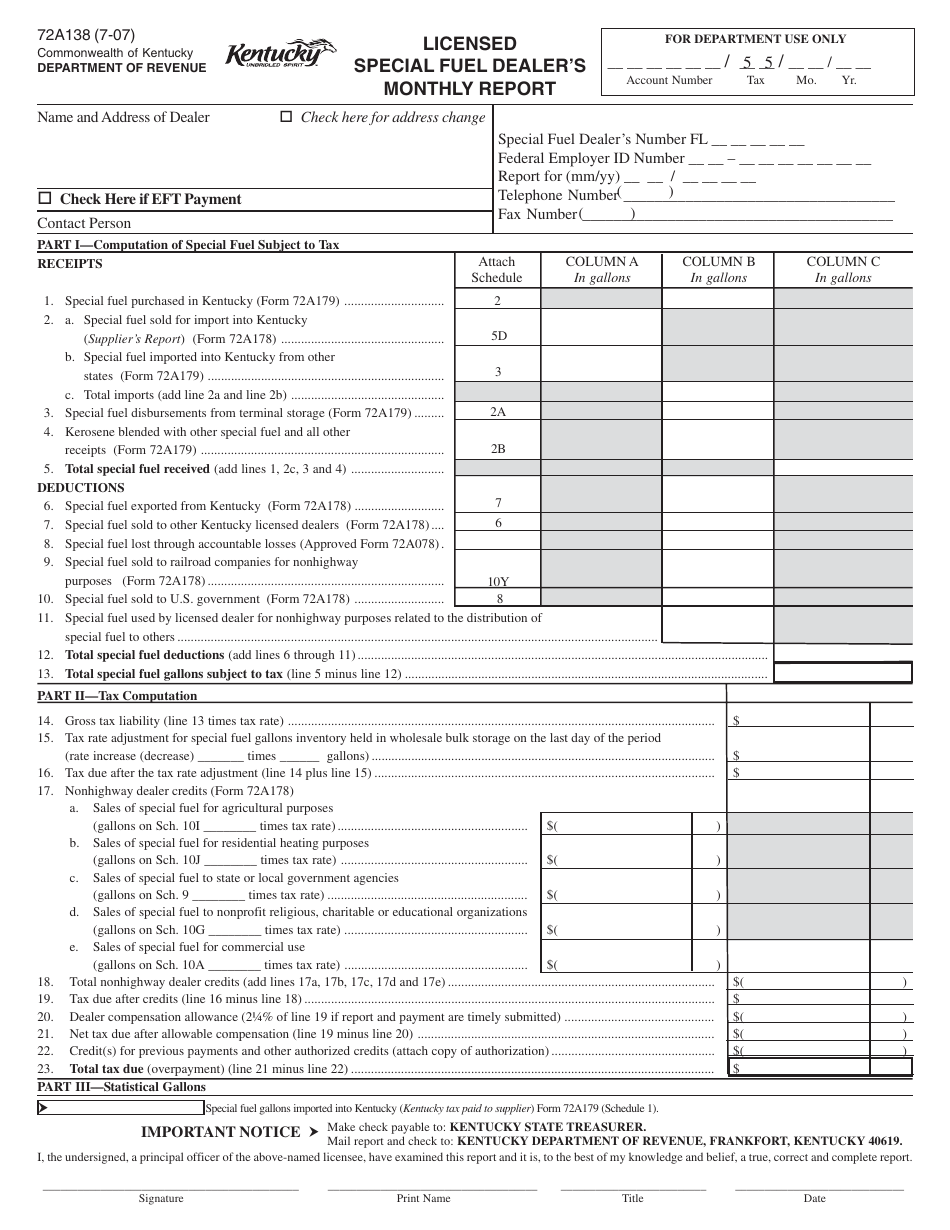

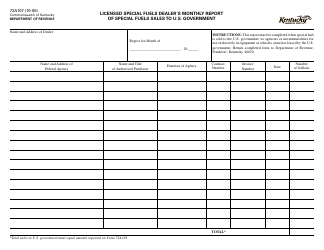

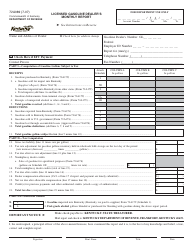

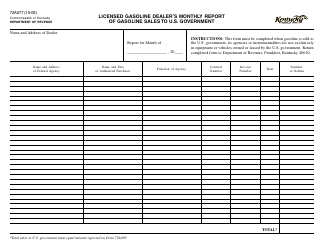

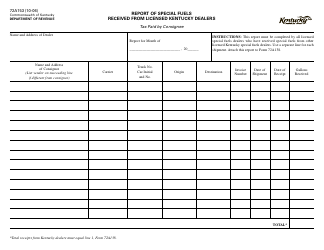

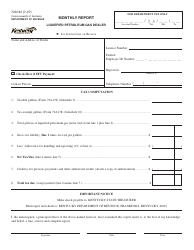

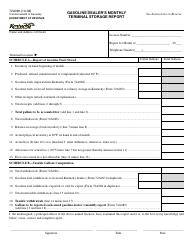

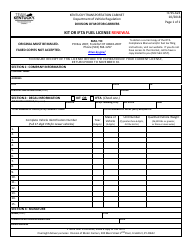

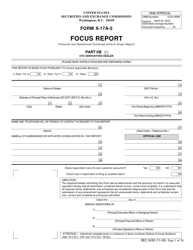

Form 72A138 Licensed Special Fuel Dealer's Monthly Report - Kentucky

What Is Form 72A138?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A138?

A: Form 72A138 is the Licensed Special Fuel Dealer's Monthly Report for Kentucky.

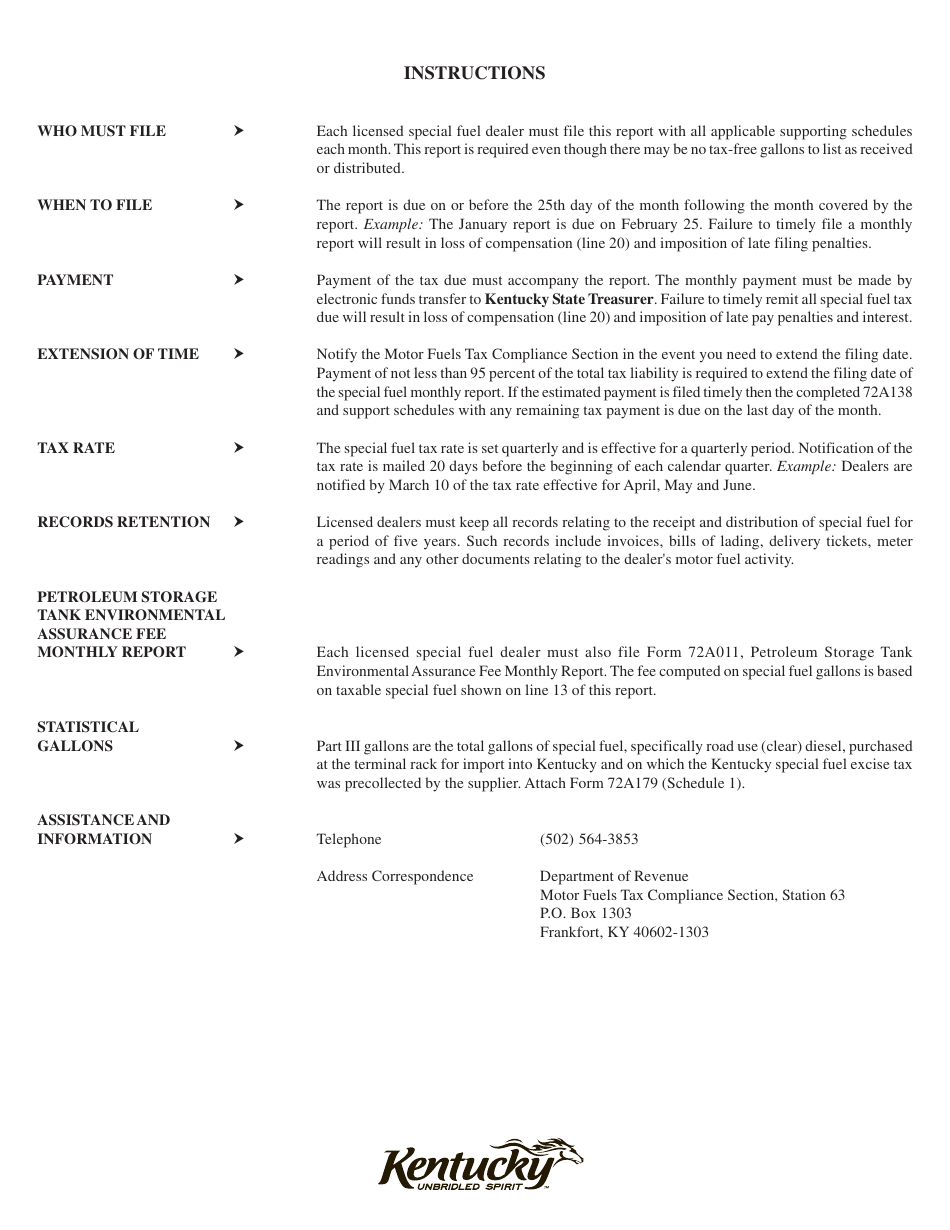

Q: Who needs to file Form 72A138?

A: Licensed Special Fuel Dealers in Kentucky need to file Form 72A138.

Q: What is the purpose of Form 72A138?

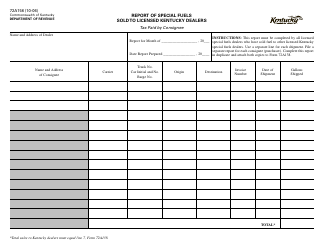

A: The purpose of Form 72A138 is to report monthly sales of special fuel in Kentucky.

Q: What information is required on Form 72A138?

A: Form 72A138 requires information such as gallons of special fuel sold, gallons used in licensed vehicles, and total gallons removed from storage tanks.

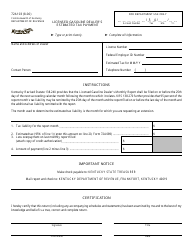

Q: When is Form 72A138 due?

A: Form 72A138 is due on or before the 20th day of the month following the reporting month.

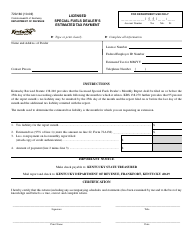

Q: Is there a penalty for late filing of Form 72A138?

A: Yes, there is a penalty for late filing of Form 72A138. The penalty amount is determined based on the number of days the report is late.

Q: What should I do if I need assistance with Form 72A138?

A: If you need assistance with Form 72A138, you can contact the Kentucky Department of Revenue for guidance and support.

Form Details:

- Released on July 1, 2007;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A138 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.