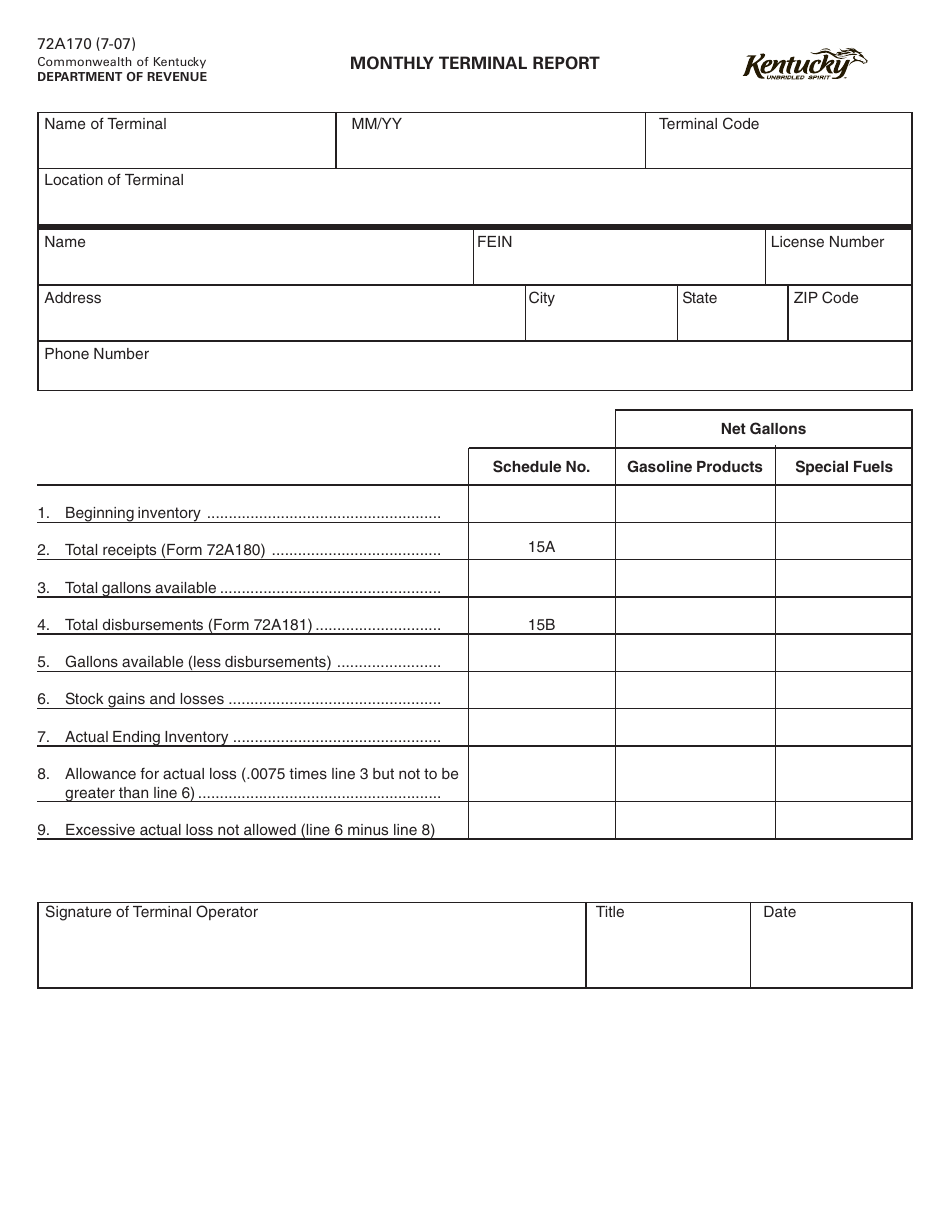

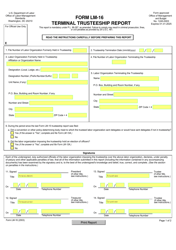

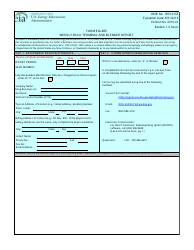

Form 72A170 Monthly Terminal Report - Kentucky

What Is Form 72A170?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A170?

A: Form 72A170 is the Monthly Terminal Report for Kentucky.

Q: Who needs to file Form 72A170?

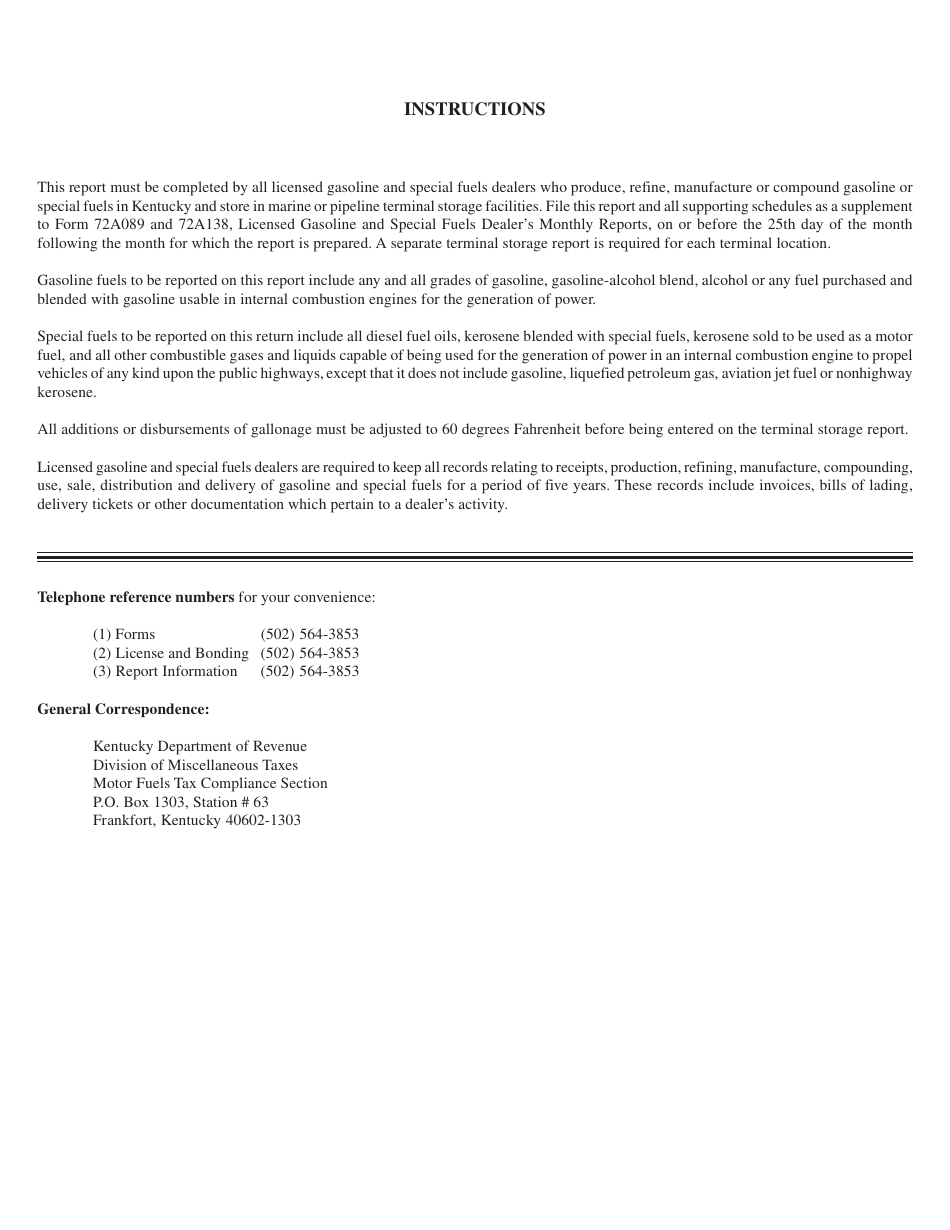

A: This form needs to be filed by terminal operators in Kentucky.

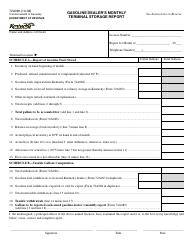

Q: What is the purpose of Form 72A170?

A: The purpose of this form is to report monthly terminal activity in Kentucky.

Q: When is Form 72A170 due?

A: Form 72A170 is due on the 20th day of the following month.

Q: What information is required on Form 72A170?

A: The form requires information such as gross receipts, tax exemptions, and other related details.

Q: How should I file Form 72A170?

A: Form 72A170 can be filed electronically or by mail.

Q: Are there any penalties for not filing Form 72A170?

A: Yes, there are penalties for not filing or late filing of Form 72A170.

Q: What should I do if I have questions about Form 72A170?

A: If you have any questions, you should contact the Kentucky Department of Revenue for assistance.

Form Details:

- Released on July 1, 2007;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A170 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.