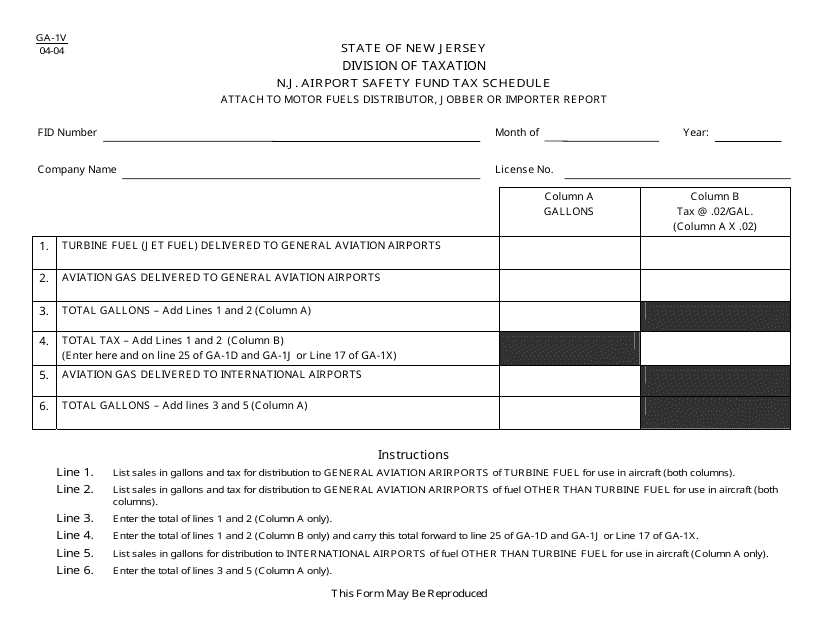

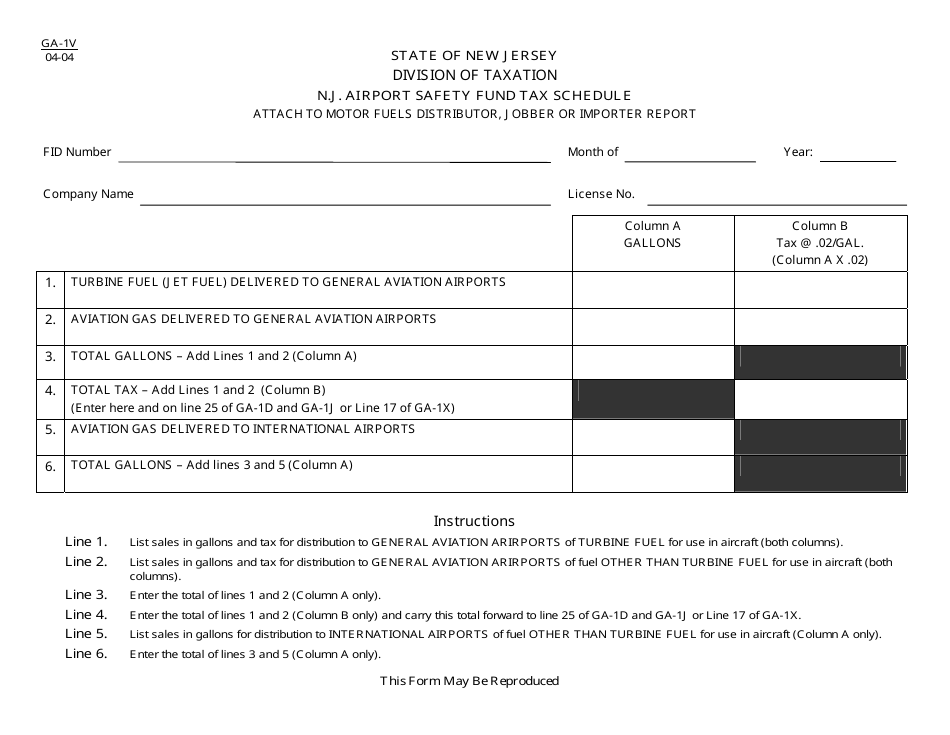

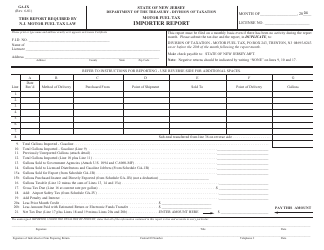

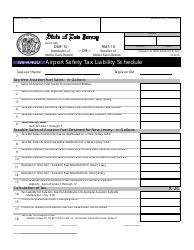

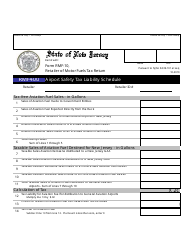

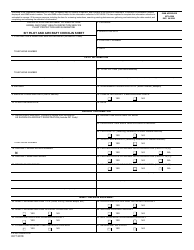

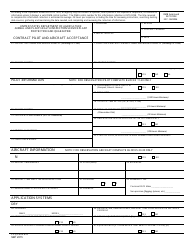

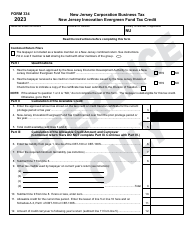

Form GA-1V N.j. Airport Safety Fund Tax Schedule - New Jersey

What Is Form GA-1V?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GA-1V?

A: Form GA-1V is a tax schedule used in New Jersey.

Q: What is the purpose of Form GA-1V?

A: The purpose of Form GA-1V is to report and pay the Airport Safety Fund Tax in New Jersey.

Q: What is the Airport Safety Fund Tax?

A: The Airport Safety Fund Tax is a tax imposed on certain airports and aircraft in New Jersey.

Q: Who needs to file Form GA-1V?

A: Airports and aircraft operators subject to the Airport Safety Fund Tax in New Jersey need to file Form GA-1V.

Q: When is the deadline to file Form GA-1V?

A: The deadline to file Form GA-1V is specified by the New Jersey Division of Taxation and may vary.

Q: Is there a penalty for late filing of Form GA-1V?

A: Yes, there may be penalties for late filing of Form GA-1V in New Jersey.

Q: How do I pay the Airport Safety Fund Tax?

A: The Airport Safety Fund Tax can be paid using electronic funds transfer, check, or money order.

Q: Are there any exemptions or deductions available for the Airport Safety Fund Tax?

A: Exemptions and deductions may be available for the Airport Safety Fund Tax, depending on the specific circumstances.

Q: Who should I contact for more information about Form GA-1V?

A: For more information about Form GA-1V and the Airport Safety Fund Tax, you should contact the New Jersey Division of Taxation.

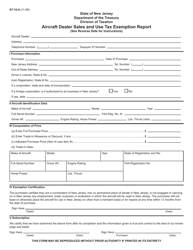

Form Details:

- Released on April 1, 2004;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GA-1V by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.