This version of the form is not currently in use and is provided for reference only. Download this version of

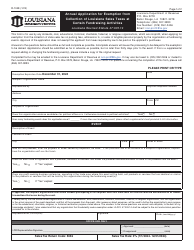

Form R-1377

for the current year.

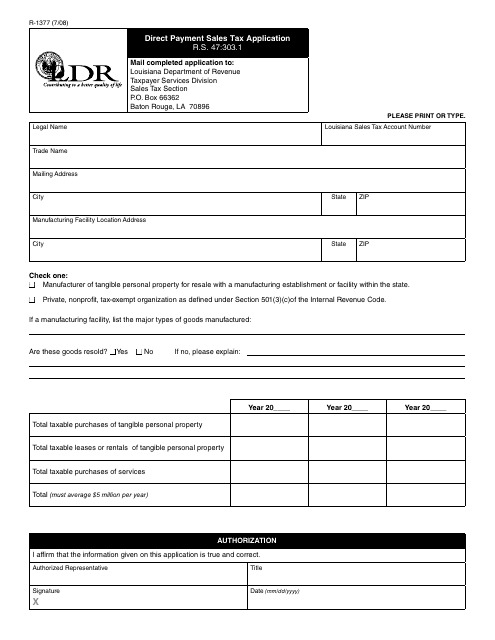

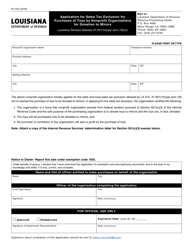

Form R-1377 Direct Payment Sales Tax Application - Louisiana

What Is Form R-1377?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1377?

A: Form R-1377 is the Direct Payment Sales Tax Application for the state of Louisiana.

Q: Who should use Form R-1377?

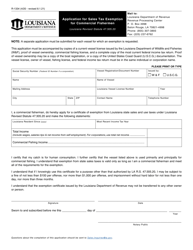

A: Businesses that are registered with the Louisiana Department of Revenue and meet certain criteria can use Form R-1377 to make sales tax payments directly to the state.

Q: What is the purpose of Form R-1377?

A: The purpose of Form R-1377 is to allow eligible businesses to remit sales taxes directly to the state of Louisiana, rather than paying them to vendors.

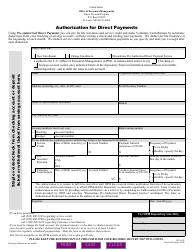

Q: What information do I need to provide on Form R-1377?

A: On Form R-1377, you'll need to provide your business information, tax account number, and the amount of sales tax you're electing to pay directly.

Q: Are there any eligibility requirements for using Form R-1377?

A: Yes, businesses must be registered with the Louisiana Department of Revenue and meet certain criteria set by the department.

Q: What are the benefits of using Form R-1377?

A: Using Form R-1377 allows eligible businesses to have more control over their sales tax payments and provides the convenience of paying directly to the state.

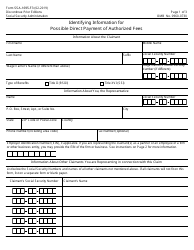

Q: Are there any fees associated with using Form R-1377?

A: No, there are no fees associated with using Form R-1377 to make direct sales tax payments.

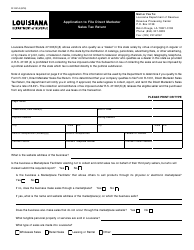

Form Details:

- Released on July 1, 2008;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1377 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.