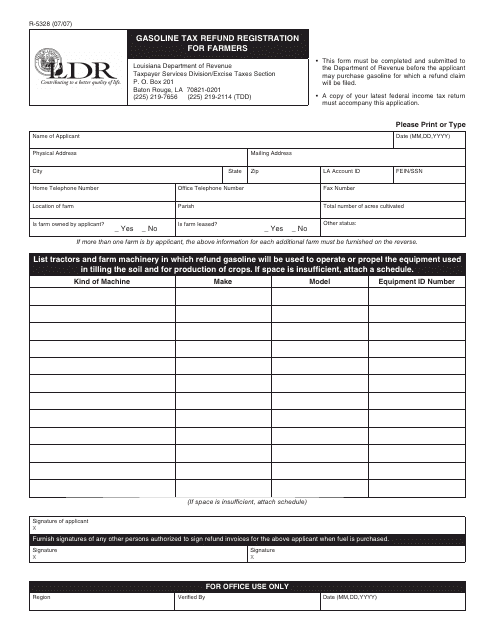

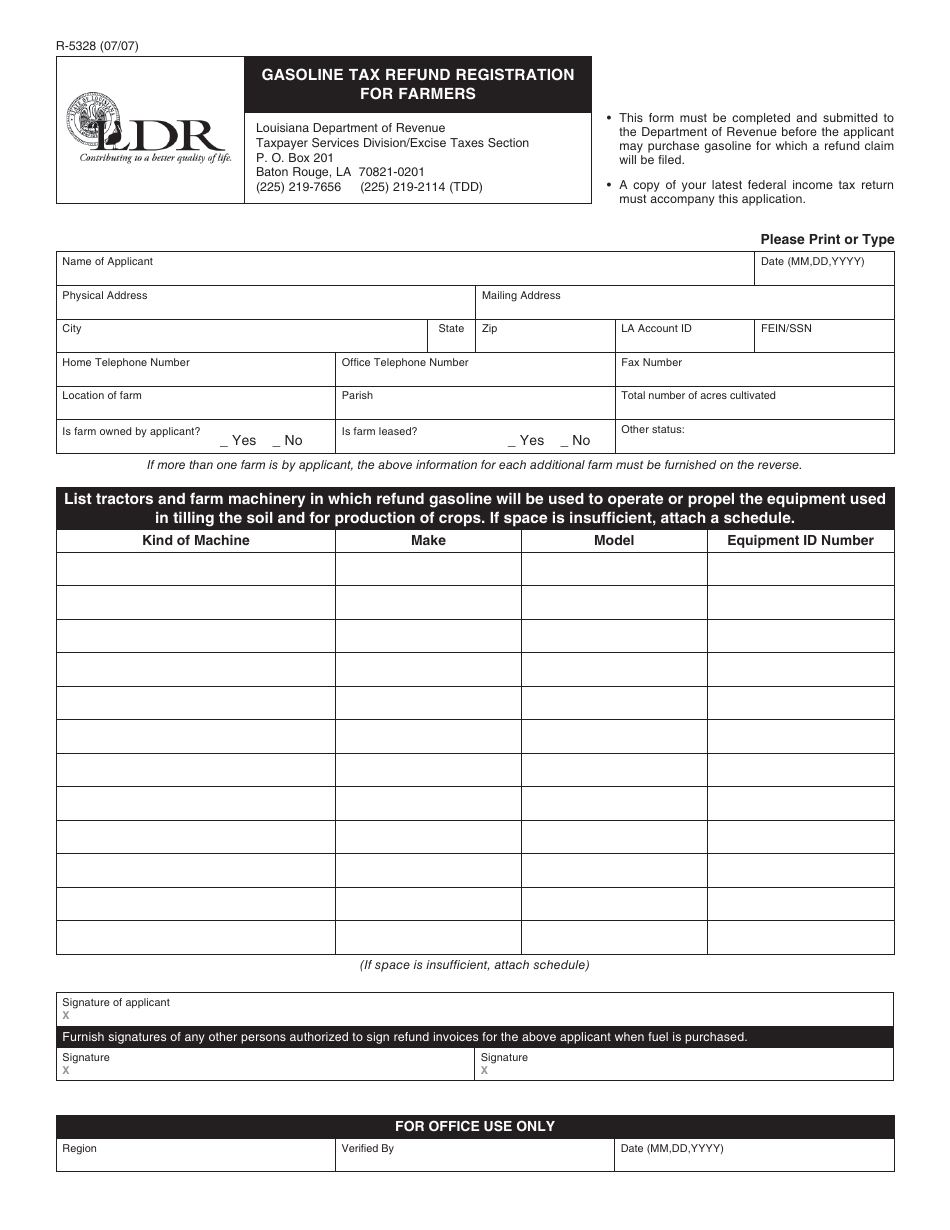

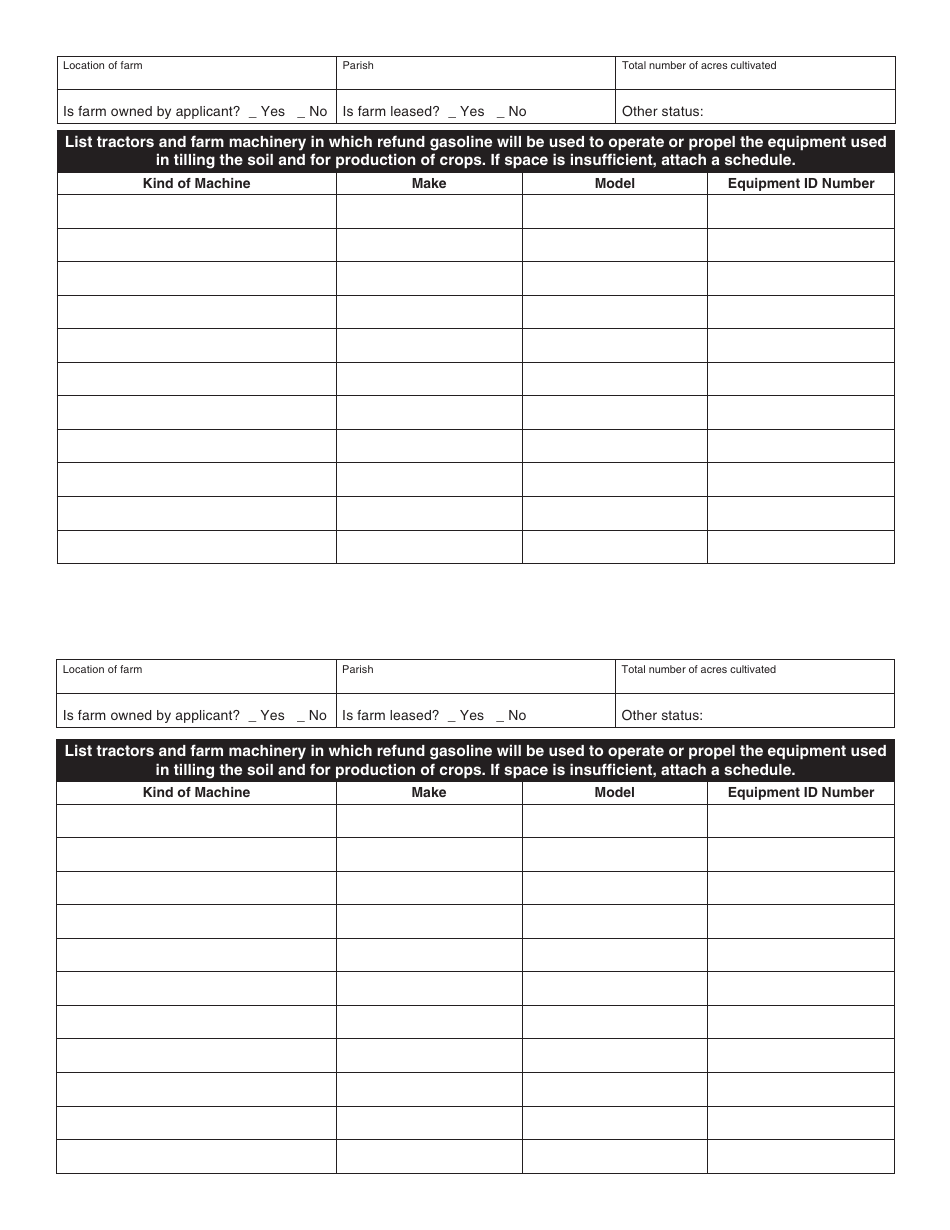

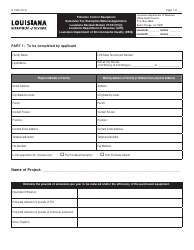

Form R-5328 Gasoline Tax Refund Registration for Farmers - Louisiana

What Is Form R-5328?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-5328?

A: Form R-5328 is the Gasoline Tax Refund Registration for Farmers in Louisiana.

Q: Who is eligible to file Form R-5328?

A: Farmers in Louisiana are eligible to file Form R-5328.

Q: What is the purpose of Form R-5328?

A: The purpose of Form R-5328 is to apply for a gasoline tax refund for fuel used in farming activities.

Q: What information is required on Form R-5328?

A: Form R-5328 requires information such as personal details, farm activities, and fuel consumption.

Q: Is there a deadline for filing Form R-5328?

A: Yes, Form R-5328 must be filed by the last day of the fourth month following the end of the calendar year.

Q: Can I file Form R-5328 electronically?

A: No, Form R-5328 must be filed by mail or in person.

Form Details:

- Released on July 1, 2007;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form R-5328 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.