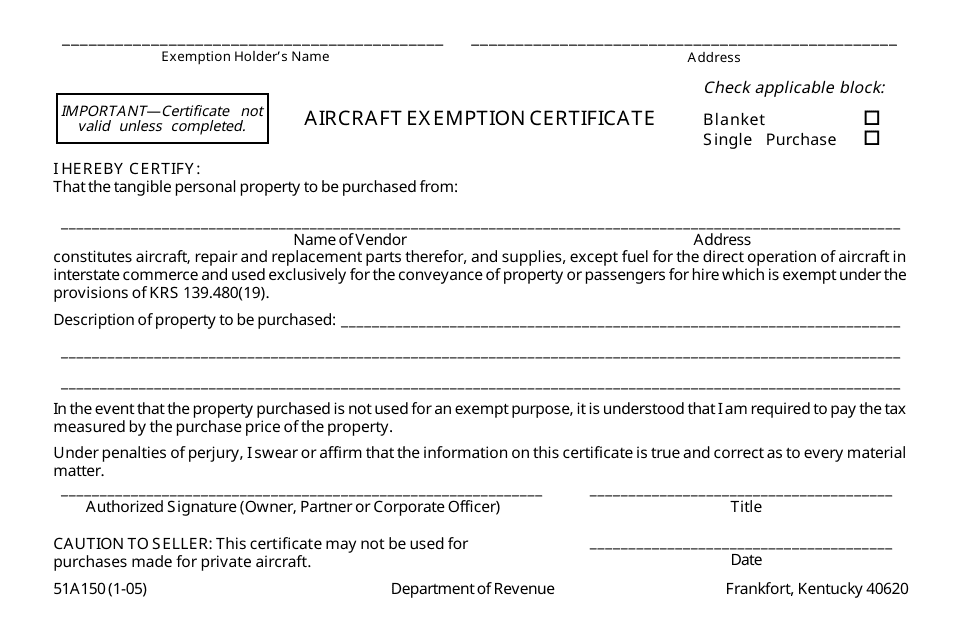

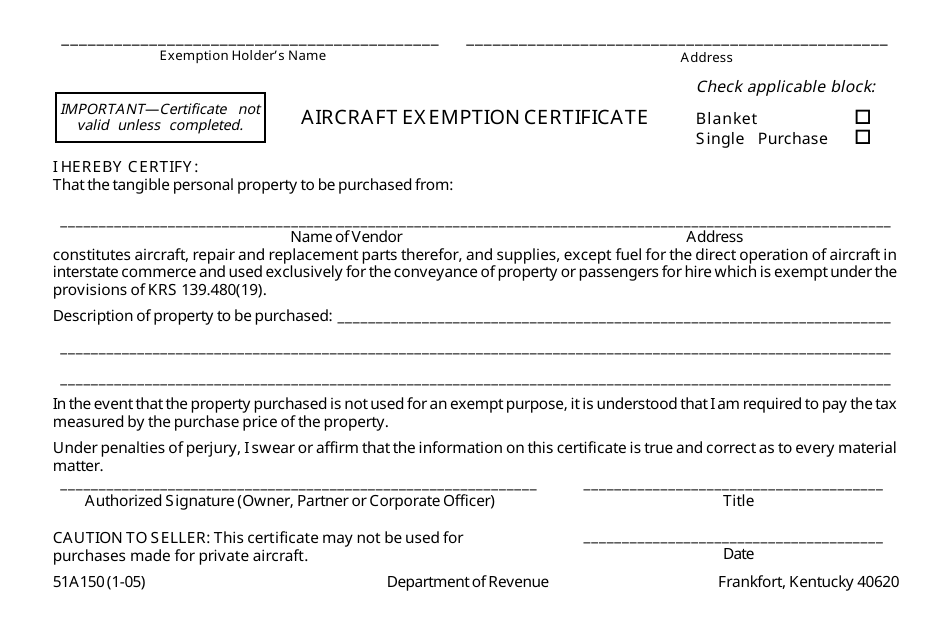

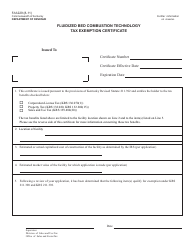

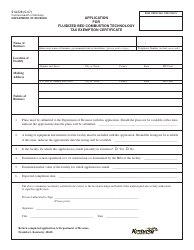

Form 51A150 Aircraft Exemption Certificate - Kentucky

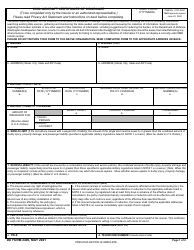

What Is Form 51A150?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

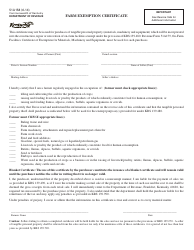

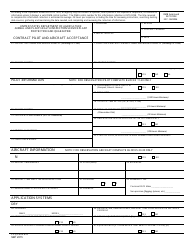

Q: What is Form 51A150 Aircraft Exemption Certificate?

A: Form 51A150 Aircraft Exemption Certificate is a document used in Kentucky to claim a sales tax exemption on aircrafts.

Q: Who can use Form 51A150 Aircraft Exemption Certificate?

A: Individuals or businesses purchasing or leasing aircrafts in Kentucky can use Form 51A150 Aircraft Exemption Certificate.

Q: What is the purpose of Form 51A150 Aircraft Exemption Certificate?

A: The purpose of Form 51A150 Aircraft Exemption Certificate is to claim a sales tax exemption on aircrafts purchased or leased in Kentucky.

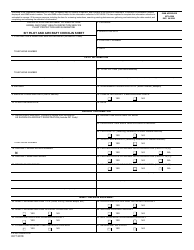

Q: What information is required on Form 51A150 Aircraft Exemption Certificate?

A: Form 51A150 Aircraft Exemption Certificate requires information such as buyer's name and address, seller's name and address, aircraft specifications, and exemption reason.

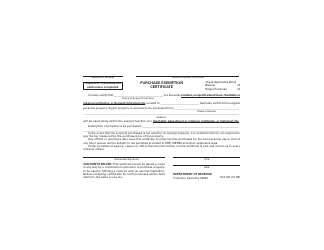

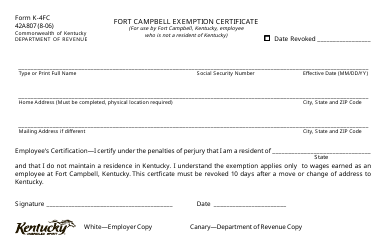

Form Details:

- Released on January 1, 2005;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 51A150 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.