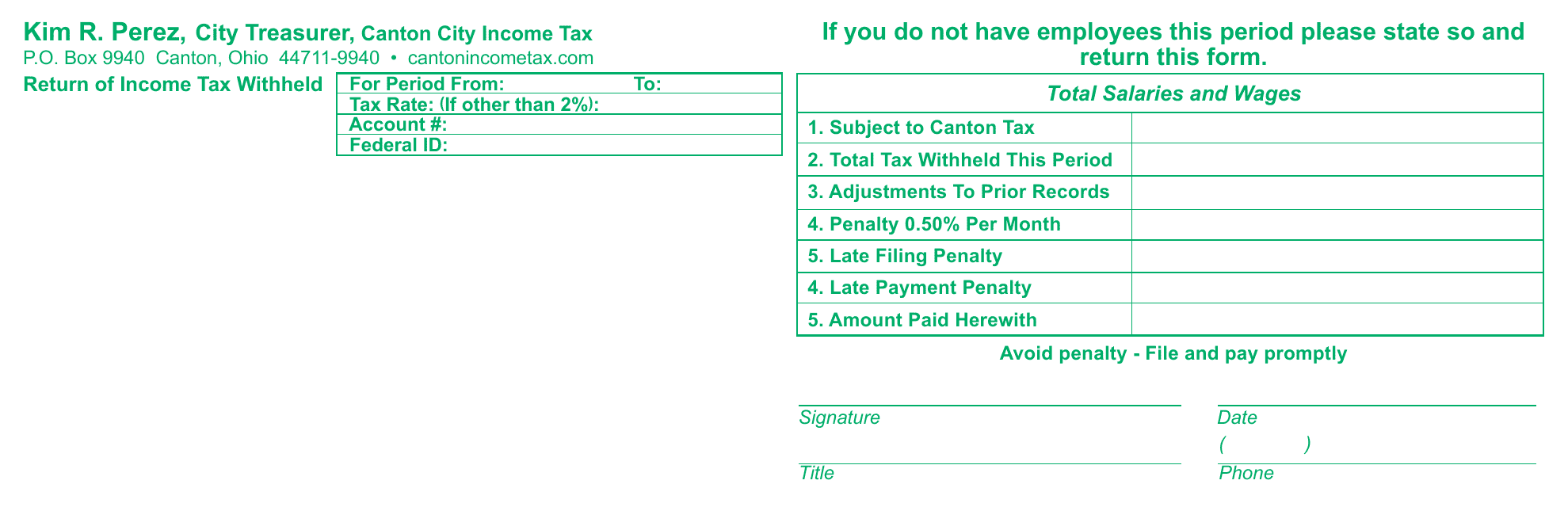

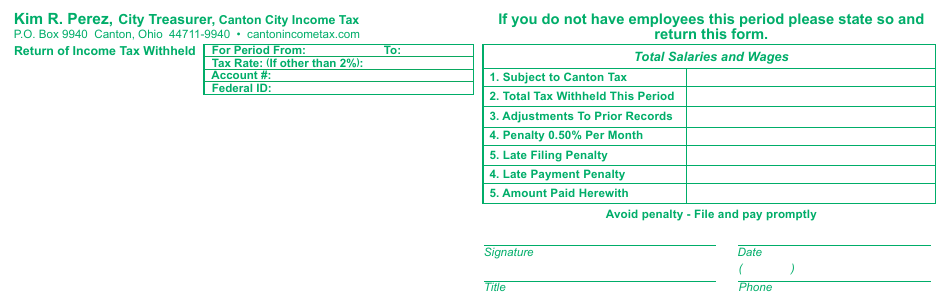

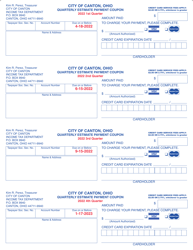

Withholding Coupon - City of Canton, Ohio

Withholding Coupon is a legal document that was released by the Treasury Department - City of Canton, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Canton.

FAQ

Q: What is a withholding coupon?

A: A withholding coupon is a form used to remit withholding taxes to the City of Canton, Ohio.

Q: Who needs to use a withholding coupon?

A: Employers who have employees working in Canton, Ohio and are required to withhold local income taxes need to use a withholding coupon.

Q: Why do employers need to withhold local income taxes?

A: Employers are required to withhold local income taxes to help fund local government services in Canton, Ohio.

Q: How often should employers remit withholding taxes using a withholding coupon?

A: Employers should remit withholding taxes using a withholding coupon on a quarterly basis.

Q: Are there any penalties for not using a withholding coupon or failing to remit withholding taxes on time?

A: Yes, there may be penalties for not using a withholding coupon or failing to remit withholding taxes on time. Employers should ensure timely and accurate remittance to avoid penalties.

Form Details:

- The latest edition currently provided by the Treasury Department - City of Canton, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Treasury Department - City of Canton, Ohio.