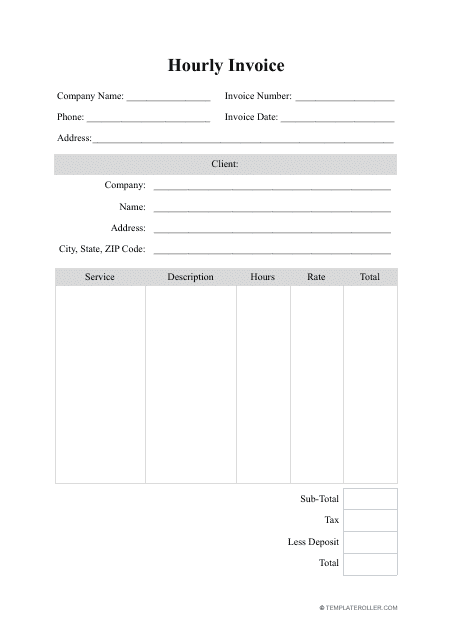

Hourly Invoice Template

An Hourly Invoice Template is a document used for billing clients or customers for services provided on an hourly basis. It helps document the number of hours worked, the rate per hour, and the total amount owed.

The person or company providing the hourly service files the hourly invoice template.

FAQ

Q: What is an hourly invoice template?

A: An hourly invoice template is a pre-designed document that allows you to bill clients for services rendered based on an hourly rate.

Q: Why would I need an hourly invoice template?

A: You would need an hourly invoice template if you provide services on an hourly basis and need a professional way to bill your clients.

Q: Can I customize an hourly invoice template?

A: Yes, most hourly invoice templates can be customized to include your own business logo, contact information, and specific billing details.

Q: How do I use an hourly invoice template?

A: To use an hourly invoice template, simply fill in the required information such as client details, service description, hours worked, and hourly rate to calculate the total amount due.

Q: Is an hourly invoice template legally binding?

A: No, an hourly invoice template is not legally binding. It is a billing document used for record-keeping and payment purposes.

Q: What should be included in an hourly invoice template?

A: An hourly invoice template should include your business name, address, contact information, client details, service description, hours worked, hourly rate, and total amount due.

Q: Can I use an hourly invoice template for other types of billing?

A: Yes, an hourly invoice template can be used for any type of billing where services are provided on an hourly basis.

Q: Do I need to include taxes on an hourly invoice?

A: It depends on your local tax laws. If taxes are applicable to your services, you may need to include them on your hourly invoice.