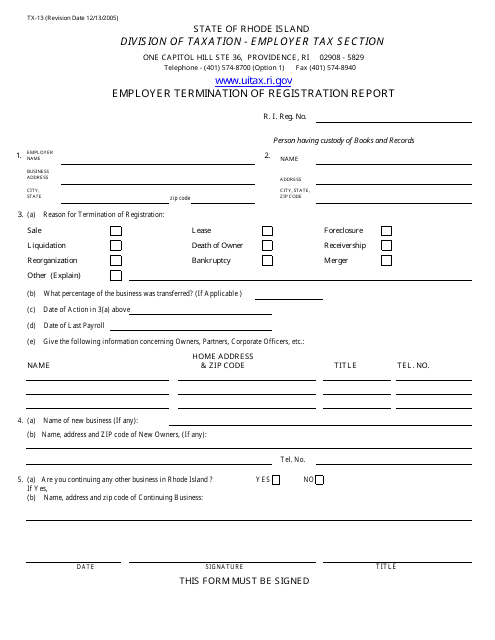

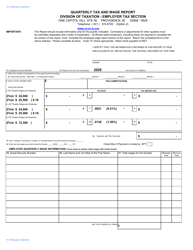

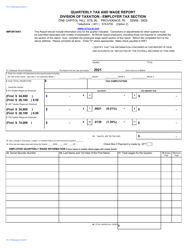

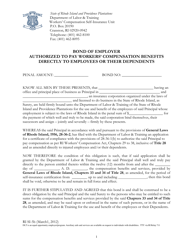

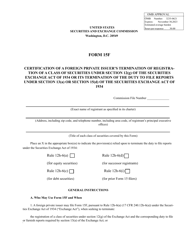

Form TX-13 Employer Termination of Registration Report - Rhode Island

What Is Form TX-13?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

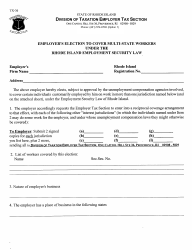

Q: What is Form TX-13?

A: Form TX-13 is the Employer Termination of Registration Report.

Q: What is the purpose of Form TX-13?

A: The purpose of Form TX-13 is to report the termination of an employer's registration in Rhode Island.

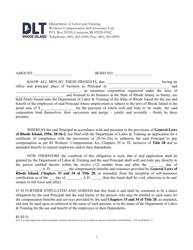

Q: Who needs to file Form TX-13?

A: Employers who have terminated their business in Rhode Island need to file Form TX-13.

Q: Is there a deadline for filing Form TX-13?

A: Yes, Form TX-13 must be filed with the Rhode Island Division of Taxation within 10 days of the termination of the employer's business.

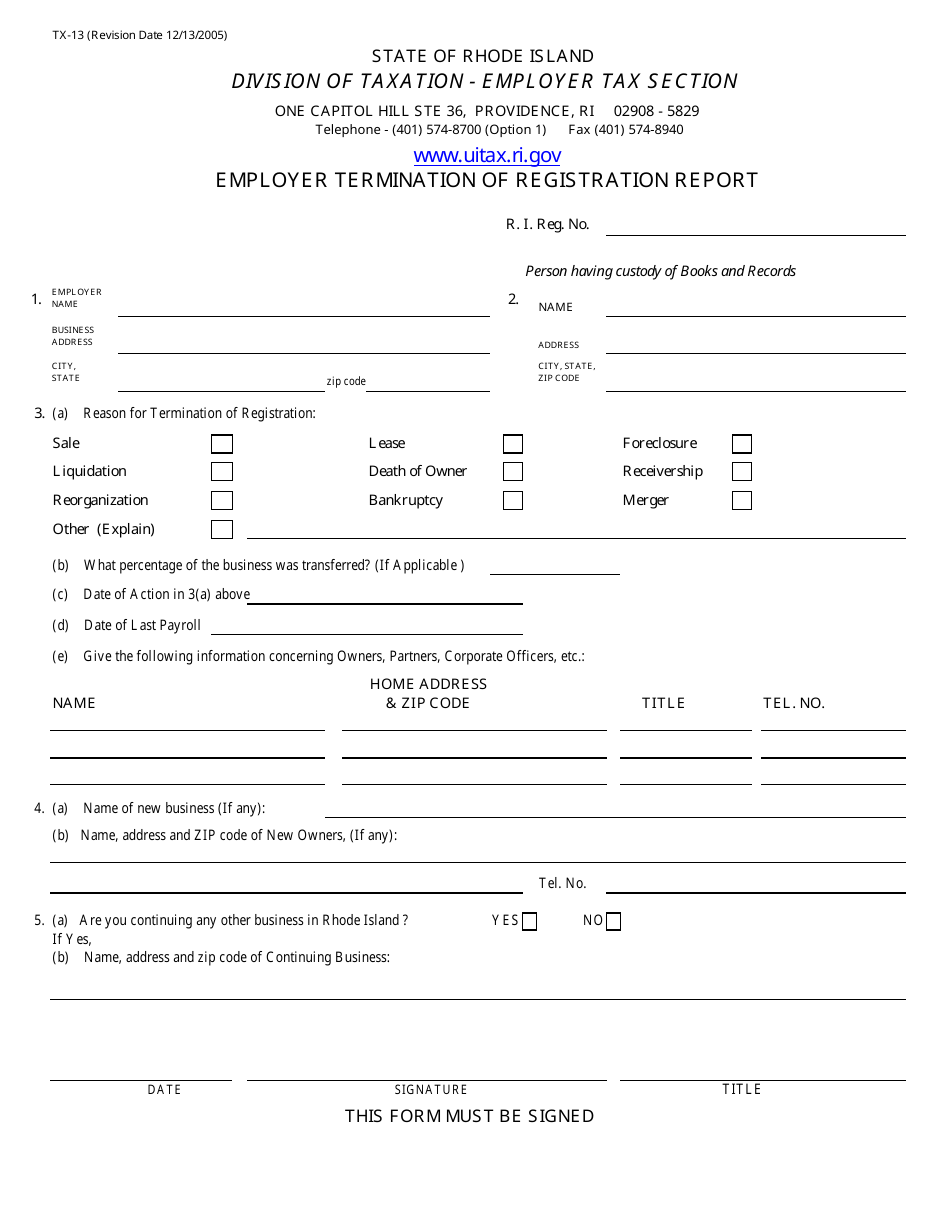

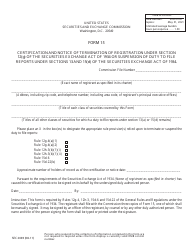

Q: What information is required on Form TX-13?

A: Form TX-13 requires information such as the employer's name, address, federal employer identification number (FEIN), and the date of business termination.

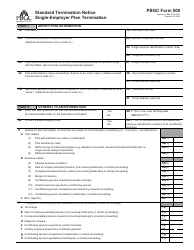

Q: Is there a fee for filing Form TX-13?

A: No, there is no fee for filing Form TX-13.

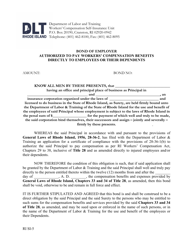

Q: What happens after filing Form TX-13?

A: After filing Form TX-13, the employer's registration will be terminated and they will no longer be responsible for filing state payroll taxes in Rhode Island.

Q: Are there any penalties for not filing Form TX-13?

A: Yes, failure to file Form TX-13 may result in penalties or fines imposed by the Rhode Island Division of Taxation.

Form Details:

- Released on December 13, 2005;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TX-13 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.